Score

SPX Markets

Hong Kong|2-5 years|

Hong Kong|2-5 years| https://www.spxmarkets.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongAccount Information

Users who viewed SPX Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

spxmarkets.com

Server Location

Ireland

Website Domain Name

spxmarkets.com

Server IP

52.215.67.40

Company Summary

Note: SPX Markets official site - https://www.spxmarkets.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| SPX Markets Review Summary in 7 Points | |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex currency pairs, indices, stocks, commodities, cryptocurrencies |

| Leverage | Up to 1:200 |

| Spread | 0.6 pips |

| Minimum Deposit | EUR 1000 |

| Customer Support | Email, address, phone |

What is SPX Markets?

SPX Markets, an international brokerage headquartered in the United Kingdom, provides market instruments including forex currency pairs, indices, stocks, commodities and cryptocurrencies to its customers. However, the broker operates without any valid regulations from any regulatory authorities which raises concerns about its liability and dependability. Furthermore, the non-functional website heightens the question, significantly increasing the associated investment risks within the platform.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. At the end of the article, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Tight spreads | • Unregulated |

| • Multiple account types | • Website unavailable |

| • Lack of transparency | |

| • Reports of withdrawal issues | |

| • High minimum deposit |

Pros:

Tight spreads: SPX Markets offers competitive spreads, starting from as low as 0.6 pips, which can enhance profitability for traders by minimizing transaction costs and improving trading efficiency.

Multiple account types: SPX Markets provides 4 account types for different trading needs and preferences, offering flexibility and customization for clients' trading strategies.

Cons:

Unregulated: The lack of regulation raises concerns about investor protection and oversight, potentially exposing clients to higher risks due to the absence of regulatory safeguards and accountability measures.

Website unavailable: Inaccessibility to the website hampers clients' ability to access trading platforms, account information, and essential resources, leading to disruptions in trading activities and communication with the broker.

Lack of transparency: Limited transparency regarding trading conditions, fees, and policies undermines clients' trust and confidence in the broker, creating uncertainty and ambiguity in their trading experience.

Reports of withdrawal issues: Instances of withdrawal difficulties reported by clients raise concerns about the reliability and efficiency of SPX Markets' withdrawal processes, causing frustration and distrust among clients.

High minimum deposit: SPX Markets imposes a relatively high minimum deposit requirement at EUR 1000 from its Bronze account, which poses a barrier to entry for some traders, limiting accessibility and deterring those with smaller investment capital from opening accounts and accessing the broker's services.

Is SPX Markets Safe or Scam?

When considering the safety of a brokerage like SPX Markets or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: Currently, this broker is running without any legitimate regulatory supervision, fostering doubts about its legitimacy and trustworthiness. This worry is heightened by the broker's inaccessible website. It's vital to engage in comprehensive research when involving oneself with any financial entity, particularly when clear cautionary indicators like these are evident.

User feedback: Three reports about being unable to withdraw exposed on WikiFX, which severely questions the company's reliability on daily operation. This serves as a serious warning for anyone considering their services and urges utmost caution.

Security measures: So far we cannot find any security measures info on Internet for this broker.

In the end, choosing whether or not to engage in trading with SPX Markets is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

SPX Markets offers a comprehensive selection of market instruments spanning forex currency pairs, indices, stocks, commodities, and cryptocurrencies, providing traders and investors with diverse opportunities for portfolio diversification and strategic investment.

With access to a wide range of forex currency pairs, including major, minor, and exotic pairs, traders can capitalize on global economic trends and currency fluctuations.

The availability of popular indices allows investors to track the performance of key market sectors and regions, while stocks offer opportunities to invest in individual companies across various industries.

Additionally, SPX Markets provides access to commodities such as gold, oil, and agricultural products, allowing investors to hedge against inflation and geopolitical uncertainties.

For those interested in emerging digital assets, the inclusion of cryptocurrencies offers exposure to this dynamic and rapidly evolving market.

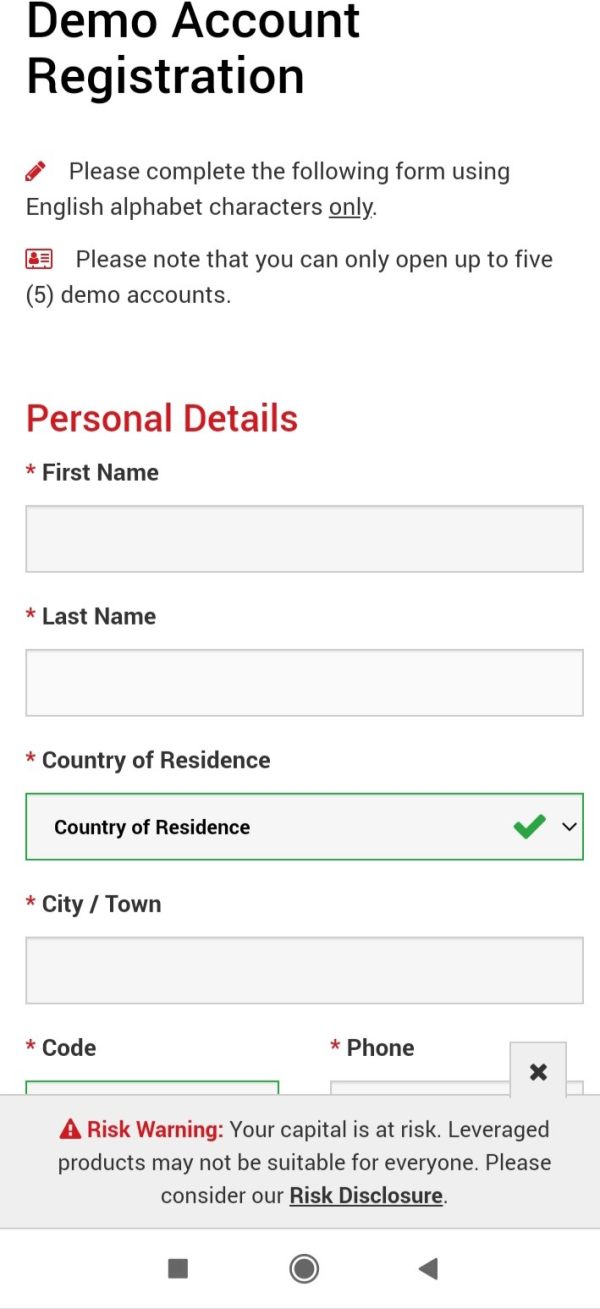

Account Types

SPX Markets provides a range of account types tailored to meet the varying needs and investment preferences of traders and investors.

The Platinum account, with a minimum deposit requirement of €25,000, offers access to premium features and services, including personalized support and advanced trading tools.

For investors seeking a mid-tier option, the Gold account requires a minimum deposit of €10,000 and provides a balance of competitive features and affordability.

Those looking for more accessible entry points can opt for the Silver account, which necessitates a minimum deposit of €2,500, or the Bronze account, requiring a minimum deposit of €1,000.

Despite the differences in minimum deposit requirements, SPX Markets minimum deposit is quite high comparing to most forex brokers, you should take this into account before committing any actual trading with this broker.

Leverage

SPX Markets extends leverage options of up to 1:200, enabling traders to amplify their trading positions and potentially enhance their returns. With leverage, traders can control larger positions in the market with a smaller initial investment, thus magnifying profit opportunities. However, it's crucial for traders to understand the risks associated with leverage, as it also amplifies potential losses.

Spread & Commission

SPX Markets boasts competitive spreads starting from as low as 0.6 pips, providing traders with cost-effective access to the financial markets. A narrow spread minimizes the difference between the buying and selling prices of an asset, allowing traders to enter and exit positions with reduced transaction costs.

While commission information is not readily available, we recommend you to seek clarification from the broker directly to get better understanding of your trading cost structure.

Deposit & Withdrawal

SPX Markets offers a diverse array of payment methods for its clients. Whether depositing funds to kickstart trading or withdrawing profits, clients can choose from a variety of options including VISA, MasterCard, Maestro, Diners Club, JBC, Skrill, Ukash, Neteller, and SWIFT.

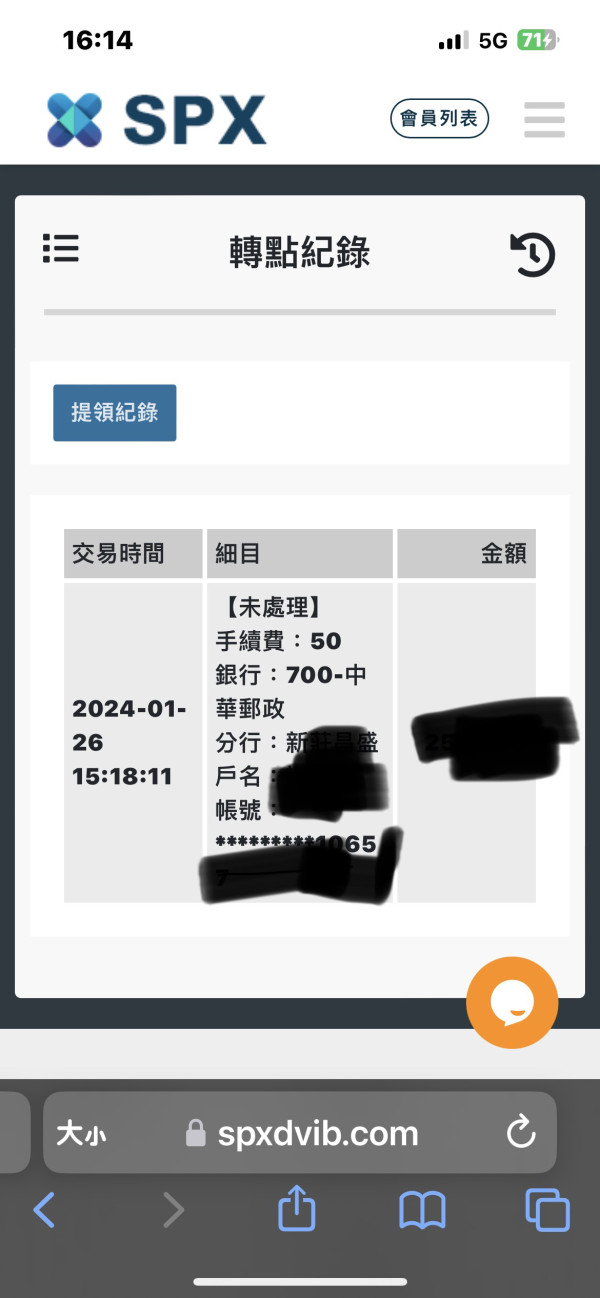

User Exposure on WikiFX

On WikiFX, there are three reports regarding withdrawal issues, whichraises serious concerns and serves as a cautionary signal to traders. We strongly recommend that traders carry out a comprehensive review of all relevant details before making a decision. Our platform is designed to serve as a crucial resource in your trading journey. If you ever encounter any fraudulent brokers or have personally experienced such malpractices, we strongly urge you to report it in our “Exposure” section. Your contributions are invaluable in helping us achieve our mission, and our expert team will make every effort to respond to your concerns promptly.

Customer Service

SPX Markets provides customer support via email, offering assistance for inquiries and concerns. Additionally, clients can reach out through phone communication for more immediate assistance. The company's physical address serves as a point of contact for further queries or correspondence.

Tel: +442045428087.

Email: support@spxmarkets.com.

Traders should consider this potential limitation when evaluating the broker's overall support framework and their own communication preferences.

Address: 1 Canada Square, Canary Wharf, London E14 5AA.

Conclusion

In conclusion, SPX Markets, a brokerage firm based in the United Kingdom, offers online trading services including forex currency pairs, indices, stocks, commodities and cryptocurrencies to global traders. However, its unregulated status and ongoing website inaccessibility issues raise significant concerns. Furthermore, its unavailable website and negative reports further dampens the firm's credibility. Therefore, we encourage you to consider other brokers who prioritize transparency, adhere to regulations and deliver professional services.

Frequently Asked Questions (FAQs)

| Q 1: | Is SPX Markets regulated? |

| A 1: | No. The broker is currently under no valid regulation. |

| Q 2: | Is SPX Markets a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its unavailable website and negative reports from clients. |

| Q 3: | Whats the minimum deposit does SPX Markets require? |

| A 3: | SPX Markets requested a minimum deposit of EUR 1000. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

柱4355

Taiwan

I want to withdraw money, but I am not allowed to do so because my registered bank account number is incorrect. How could it be wrong that I used a copied account? They also refused to let me withdraw the money on the grounds that I had not registered it with customer service for participating in the event. Another person kept persuading me to deposit more money, and said that if I didn’t use it, I would be compensated for the technical fees, which totaled more than 370,000.

Exposure

02-14

康9848

Taiwan

I can't withdraw NT$10,000, I have to deposit NT$60,000 before I can withdraw the money. Shocked.

Exposure

01-26

FX7640896282

Argentina

I deposited $30 and started transactions. But all the investment disappeared suddenly and no one replied me.

Exposure

2021-09-03

柠檬28651

New Zealand

SPX Markets is a scam brokerage firm that appears to be legitimate but actually intends to defraud investors of their money. The first few trades are profitable, but this is just the result of their hateful manipulation to make you let your guard down and invest more and more money and... get scammed!

Neutral

2023-03-22