Score

UPFX

United States|2-5 years|

United States|2-5 years| https://upfxtrade.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Netherlands 5.17

Netherlands 5.17Surpassed 33.00% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Ultimate Pinnacle Limited

UPFX

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

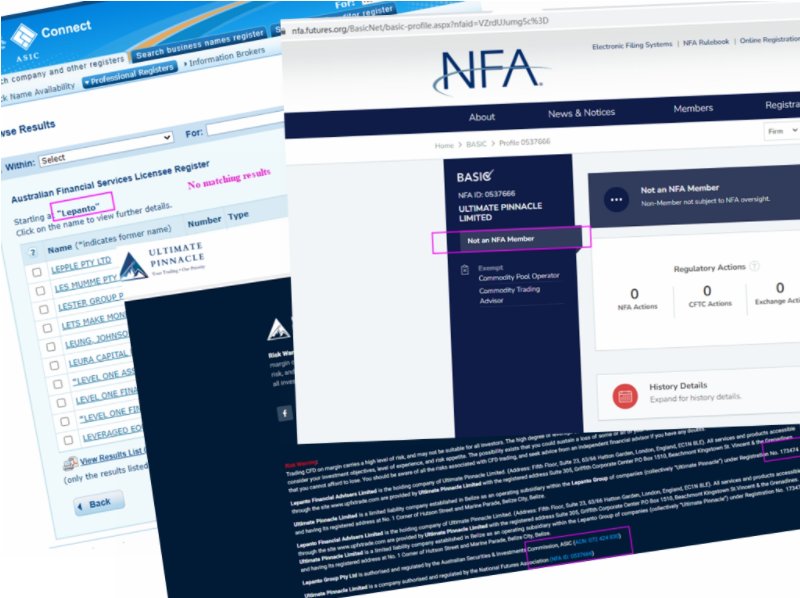

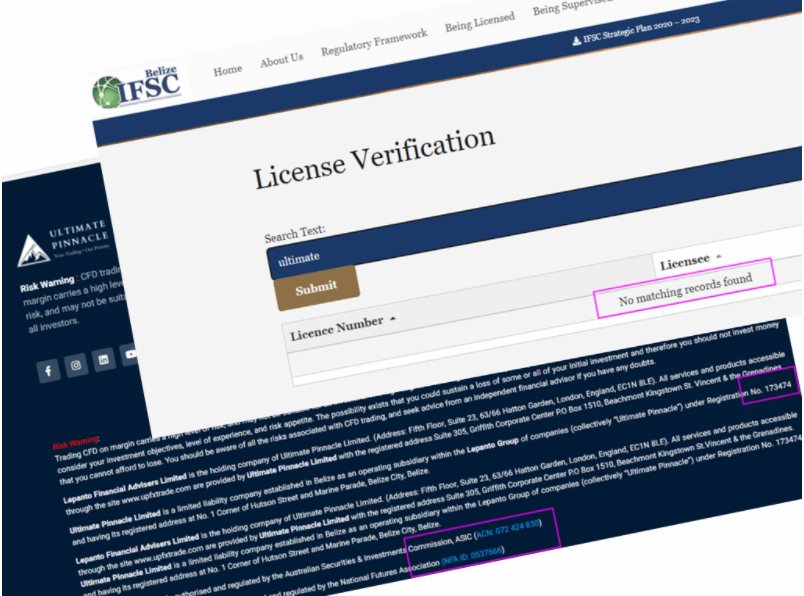

- This broker exceeds the business scope regulated by Australia ASIC(license number: 224485)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | $100 |

| Minimum Spread | from 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | (6+) VISA Neteller Skrill USDT |

| Withdrawal Method | (6+) USDT Skrill VISA MASTER |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | $ 5,000 |

| Minimum Spread | from 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | (6+) USDT MASTER VISA Neteller |

| Withdrawal Method | (6+) VISA MASTER Neteller USDT |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | $ 1,000 |

| Minimum Spread | from 0.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | (6+) VISA Neteller Skrill USDT |

| Withdrawal Method | (6+) USDT Skrill VISA MASTER |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $100 |

| Minimum Spread | from 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | (6+) USDT MASTER VISA Neteller |

| Withdrawal Method | (6+) VISA MASTER Neteller USDT |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed UPFX also viewed..

XM

HFM

GO MARKETS

STARTRADER

UPFX · Company Summary

| Broker Name | UPFX |

| Company Name | Ultimate Pinnacle Limited |

| Registered Country | Belize |

| Regulation | No regulation |

| Year of Establishment | N/A |

| Account Types | Standard, Swap-free, Pro, ECN |

| Minimum Deposit | $100 |

| Trading Instruments | Forex, commodities, indices, cryptocurrencies, shares |

| Spreads | Variable |

| Maximum Trading Leverage | Up to 1:1000 |

| Scalping Allowed | Yes |

| Hedging Allowed | Yes |

| Social Trading | Yes |

| Funding Methods | USDT, VISA, MasterCard, UnionPay, Neteller, Skrill |

| Withdrawal Options | USDT, VISA, MasterCard, UnionPay, Neteller, Skrill |

| Trading Platforms | MT5 Trading Platform |

| Mobile Trading | Yes |

| Educational Resources | Yes |

| Customer Support | Contact Form |

Please note that the provided information is based on general knowledge and may not reflect the most up-to-date details. It's always recommended to visit UPFX's official website or contact their customer support for the most accurate and current information regarding their services, regulations, trading conditions, and any other relevant details.

General Information

UPFX is a forex trading platform that is registered in Belize under the company name Ultimate Pinnacle Limited. UPFX offers a range of trading instruments, including major currency pairs (such as EUR/USD, GBP/USD), minor currency pairs, and other financial instruments like commodities, indices, shares and cryptocurrencies. UPFX appears to offer multiple account types, such as Golden, Ultimate, Pro, and ECN. These account types may vary in terms of features, trading conditions, and minimum deposit requirements. Each account type may cater to different trading needs and preferences, providing varying benefits and services. The specific details regarding each account type, including their features, advantages, and requirements, would need to be obtained from UPFX directly.

UPFX offers a maximum trading leverage of up to 1:1000. This means that traders using UPFX may have the option to trade with leverage of up to 500 times the amount of their invested capital. However, it's important to note that high leverage levels can amplify both potential profits and losses, so careful risk management is crucial.

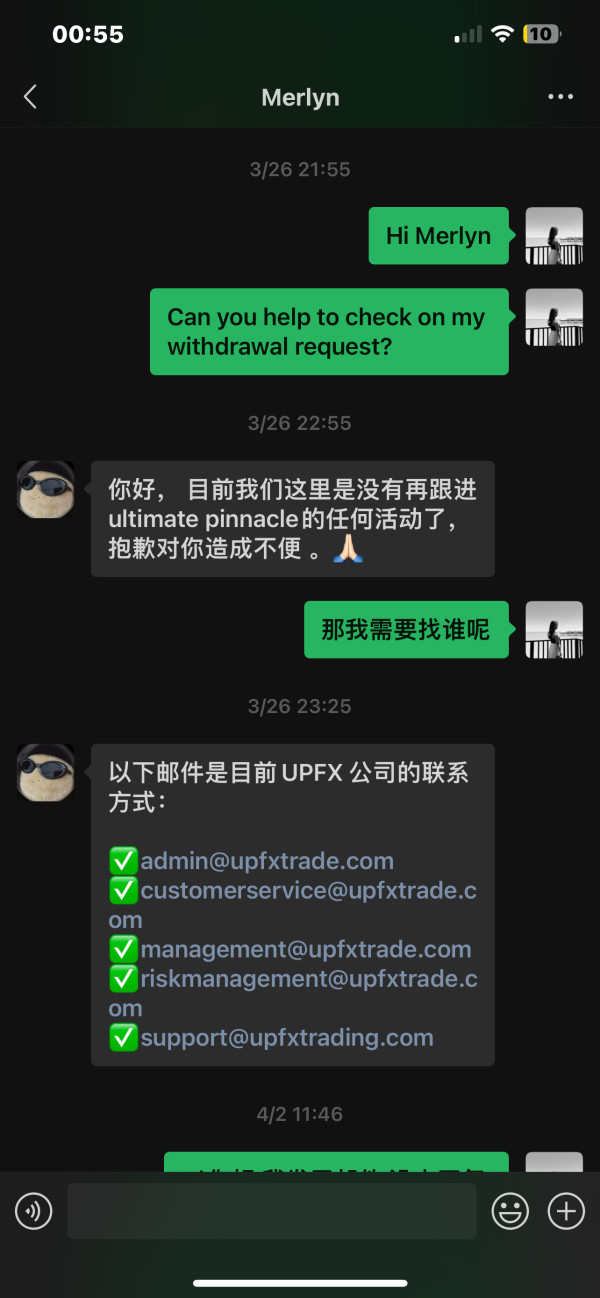

Lastly, UPFX provides customer support services to assist traders with their inquiries, account-related issues, and technical support. The specific channels of customer support (such as email, phone) and their availability hours would need to be confirmed by visiting UPFX's website or contacting their support team directly.

Is UPFX legit or a scam?

UPFX (Ultimate Pinnacle Limited) is not regulated. Please note that this lack of regulation can carry additional risks, as regulated brokers are typically subject to oversight and required to adhere to certain standards and safeguards to protect traders' interests. When considering a forex broker, it is generally recommended to choose a regulated broker that operates under the supervision of a reputable financial authority.

Pros and Cons

UPFX offers multiple account types and a wide range of trading instruments, including forex and more. It provides high maximum trading leverage, various trading accounts, social trading supported. However, the lack of regulation raises concerns about potential risks and the absence of investor protection. Additionally, limited information on trading conditions and fees, as well as a lack of educational resources and transparency about the company's background, are aspects that should be taken into account. The availability and quality of customer support channels are also uncertain.

| Pros | Cons |

| Diverse range of trading instruments | Lack of regulation |

| High maximum trading leverage up to 1:1000 | Limited information available |

| Multiple account types to choose from | Potential higher risk without regulation |

| Availability of ECN account | Limited customer support information |

| Social trading allowed | Potential challenges with fund protection |

| MT5 trading platform supported | Trading platform limited to MT5 |

| 24/7 customer support | Uncertainty regarding company reputation |

| Potential limitations on withdrawal options | |

| Lack of educational resources | |

| High minimum deposit for ECN account |

Market Instruments

UPFX offers traders a comprehensive suite of trading opportunities encompassing various financial markets. With UPFX, clients gain access to an extensive range of trading instruments, including but not limited to the dynamic world of Forex currency pairs, the diverse realm of commodities such as gold, silver, and oil, the volatility of global indices representing major markets worldwide, the emerging sector of cryptocurrencies like Bitcoin and Ethereum, and even the enticing prospects of trading shares in renowned companies across international stock exchanges. This wide array of offerings allows traders to explore and capitalize on multiple markets, diversify their portfolios, and potentially seize opportunities in different asset classes, all within a single trading platform.

Account Types

UPFX presents traders with a diverse selection of trading accounts tailored to suit individual preferences and trading styles. With four distinct account types—Standard, Swap-free, ECN and Pro—UPFX ensures there is an option for traders at every level of experience.

The Standard account, with a minimum deposit requirement of $100, offers a gateway for aspiring traders to enter the markets and explore their potential.

| Pros | Cons |

| 1. Low minimum deposit requirement ($100) | 1. Limited features and benefits compared to other account types |

| 2. Accessible for beginner traders | 2. Potentially higher spreads compared to other account types |

For those seeking a swap-free trading experience in accordance with their religious beliefs or for other reasons, UPFX offers a Swap-free account option. With a minimum deposit requirement of $100, this account type eliminates any interest charges on overnight positions, ensuring compliance with Sharia principles.

| 1. Interest-free trading for religious or | 1. Potentially wider spreads compared to Standard account |

| cultural reasons | 2. Limited availability for certain trading instruments |

| 2. Suitable for traders who prefer |

For traders with a more professional approach, the Pro account demands a minimum deposit of $1000, granting access to advanced tools and features designed to support sophisticated trading strategies.

| Pros | Cons |

| 1. Lower spreads compared to Standard | 1. Higher minimum deposit requirement ($1,000) |

| and Swap-free accounts | 2. Requires more trading experience and expertise |

| 2. Access to additional features and | |

| trading tools |

For traders seeking direct market access and enhanced trading conditions, UPFX offers the ECN (Electronic Communication Network) account. With a minimum deposit requirement of $5000, this account type offers traders access to a deep pool of liquidity, potentially tighter spreads.

| Pros | Cons |

| 1. Tight spreads and potential for lower trading costs | 1. Higher minimum deposit requirement ($5,000) |

| 2. Direct market access and potentially faster trade execution | 2. Requires advanced trading knowledge and experience |

| 3. Ability to trade with raw market spreads |

Regardless of the chosen account type, UPFX provides a range of leverage options to amplify trading potential. The specific leverage ratios may vary depending on the selected account, from 1:400 to 1:1000, allowing traders to adjust their risk exposure according to their individual trading strategies and preferences.

All four types of trading accounts support social trading, enabling traders to connect and share insights with a community of like-minded individuals.

Furthermore, traders can rest assured knowing that assistance is readily available whenever needed, ensuring a smooth and seamless trading experience with 24/7 account and technical support services.

How to open an account?

Opening an account with UPFX is a straightforward process. Here are the steps typically involved:

1. Visit the UPFX Website. Go to the official UPFX website to begin the account opening process. Look for the “Open An Account” button on the homepage.

2. Complete the Registration Form. Fill out the registration form with accurate personal information, including your full name, email address, country of residence, and preferred account currency. Provide any additional details or documentation required by UPFX.

3. Submit Identity Verification Documents. As part of the account opening process, UPFX may require you to verify your identity and address. This typically involves providing scanned copies or photos of identification documents like a passport or driver's license, as well as proof of address such as a utility bill or bank statement.

4. Fund Your Account. Once your account has been approved and verified, you can proceed to fund your account. Choose from the available deposit methods offered by UPFX, which may include bank transfers, credit/debit cards, or online payment systems. Follow the instructions provided by UPFX to make your initial deposit, ensuring it meets the minimum deposit requirement for your chosen account type.

5. Verify and Activate Your Account. After funding your account, UPFX will typically verify your deposit and account information. This process may take a short time. Once your account has been verified and activated, you will receive a confirmation email with login details and instructions on how to access the trading platform. Upon receiving the email, you can log in to your UPFX trading account using the provided credentials. It is essential to review and familiarize yourself with the platform's features, trading tools, and available resources. You can then proceed to customize your trading environment according to your preferences.

Leverage

UPFX offers a range of leverage options across their different account types, providing traders with flexibility and potentially enhancing their trading capabilities. The leverage ratios offered by UPFX typically range from 1:400 to 1:1000, representing a generous offering that allows traders to amplify their trading positions in the market.

By utilizing leverage, traders can control larger positions with a smaller amount of capital. For example, with a leverage ratio of 1:400, a trader can control a position worth $40,000 by only having $100 of their own capital in the trading account. This potential for higher leverage ratios may attract traders seeking to maximize their exposure and potential returns in the markets.

It is important to note that while leverage can magnify profits, it can also amplify losses. Traders should exercise caution and employ effective risk management strategies when trading with leverage. It is advisable to thoroughly understand the concept of leverage and its implications before utilizing it in trading activities.

Spreads & Commissions

Spreads and commissions vary depending on what trading accounts you are holding. The spreads in the standard account start from 2 pips, no commissions charged. With more account balance, traders can enjoy tighter spreads. The standard pro accounts charges a commission of $7 per lot with its spread from 0.0 pips.

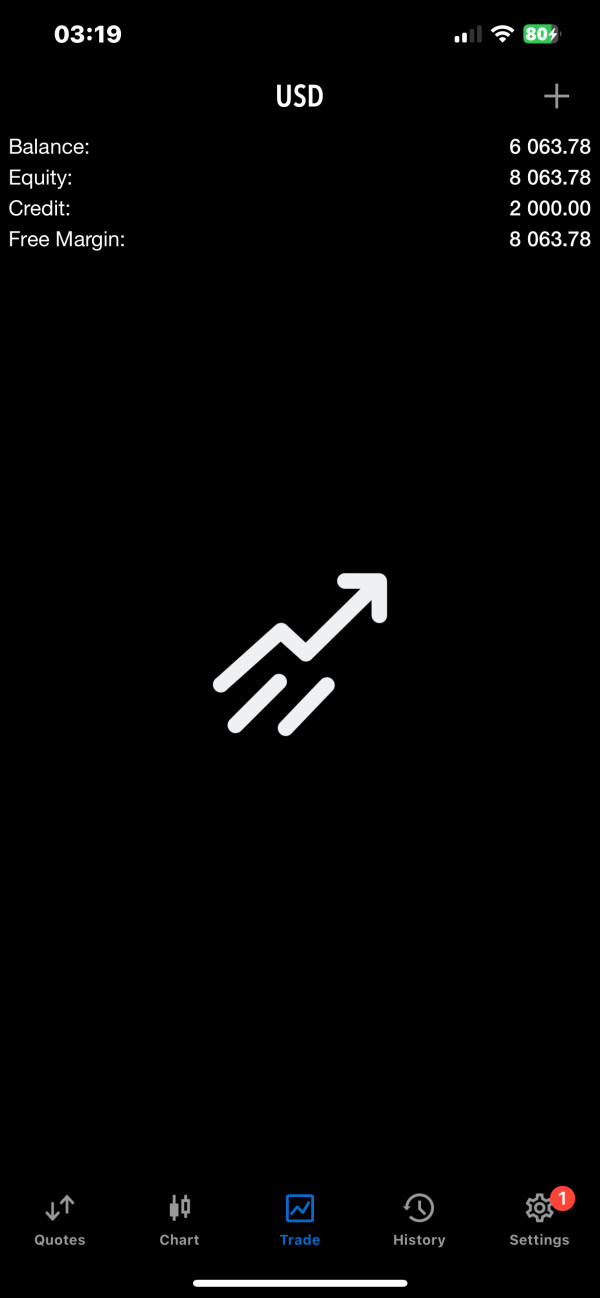

Trading Platform Available

UPFX provides traders with the popular MetaTrader 5 (MT5) trading platform, along with the convenience of the MT5 web-terminal. The MT5 platform is a versatile and feature-rich trading software that offers advanced tools and functionality for executing trades in the financial markets.

With the MT5 platform, traders can access a wide range of trading instruments, including Forex currency pairs, commodities, indices, cryptocurrencies, and shares. The platform provides real-time price quotes, interactive charts, technical analysis tools, and a customizable interface to suit individual trading preferences.

The MT5 platform also offers various order types, including market orders, limit orders, stop orders, and more, allowing traders to implement their preferred trading strategies. Additionally, the platform supports automated trading through the use of expert advisors (EAs), enabling traders to implement algorithmic trading strategies and utilize custom indicators.

In addition to the MT5 desktop platform, UPFX provides the MT5 web-terminal, a browser-based version of the platform. The web-terminal allows traders to access their trading accounts and trade directly from a web browser without requiring any software downloads or installations. This offers flexibility and convenience as traders can access their accounts and trade from any device with an internet connection.

Social Trading

Indeed, UPFX supports a Social Trading community, providing traders with the opportunity to engage and collaborate with other traders within their platform. Social Trading is a popular feature that allows traders to observe, follow, and even copy the trading strategies of experienced traders.

By participating in the Social Trading community, UPFX clients can benefit from the collective wisdom and expertise of successful traders. They can access information about trading strategies, market insights, and performance metrics of other traders within the community. This feature creates an environment where traders can learn from each other, share ideas, and potentially enhance their trading skills.

Additionally, Social Trading can be particularly advantageous for novice traders who may lack experience or confidence in making independent trading decisions. By observing and replicating the trades of established traders, they can gain exposure to different trading approaches and potentially achieve more consistent results.

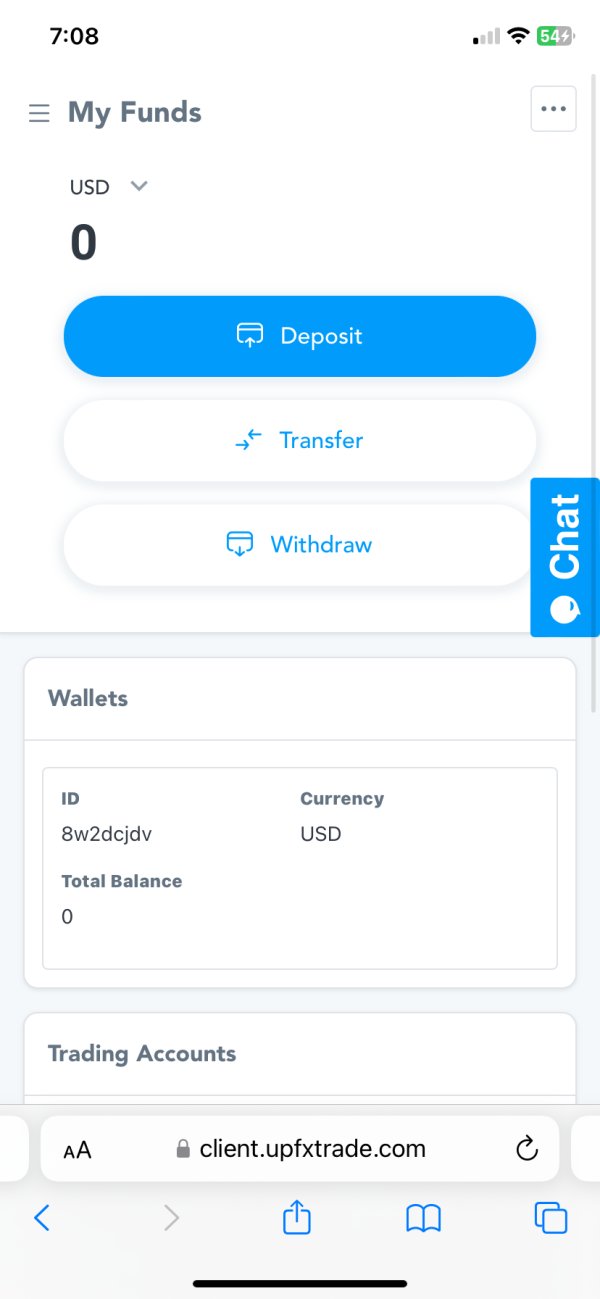

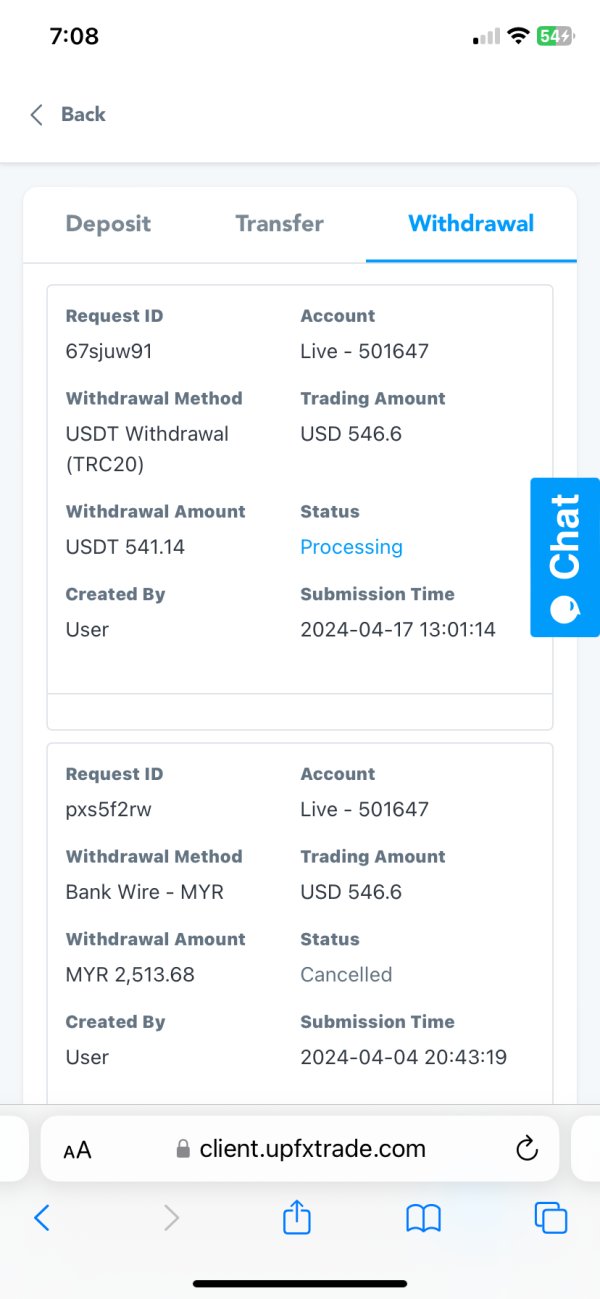

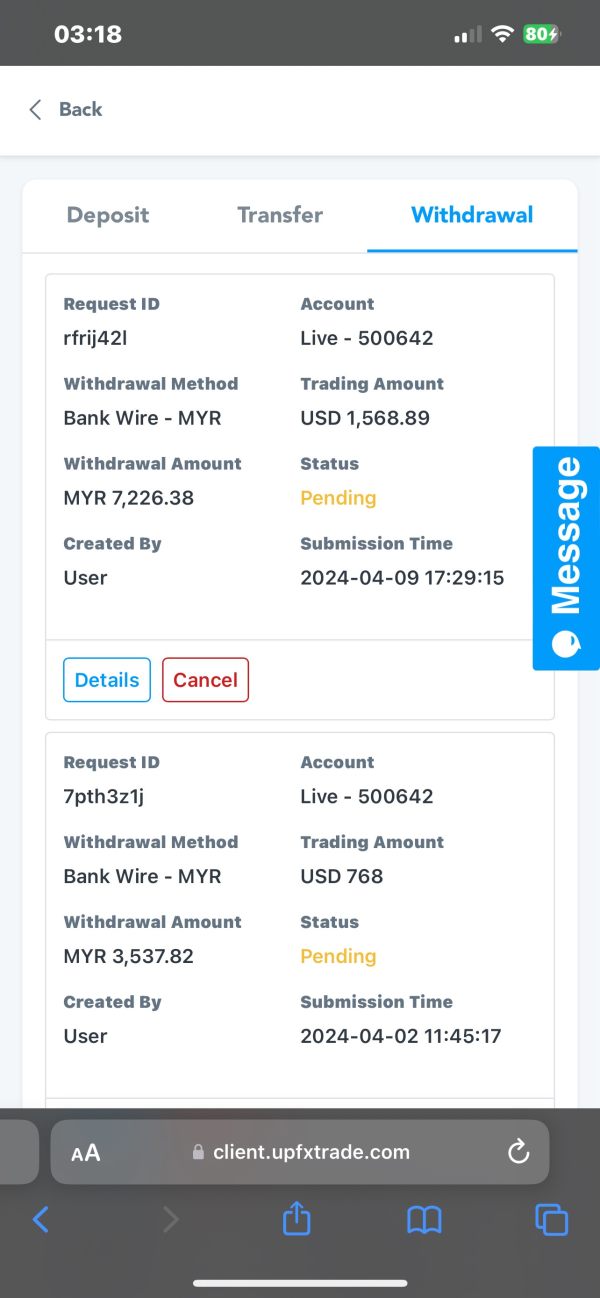

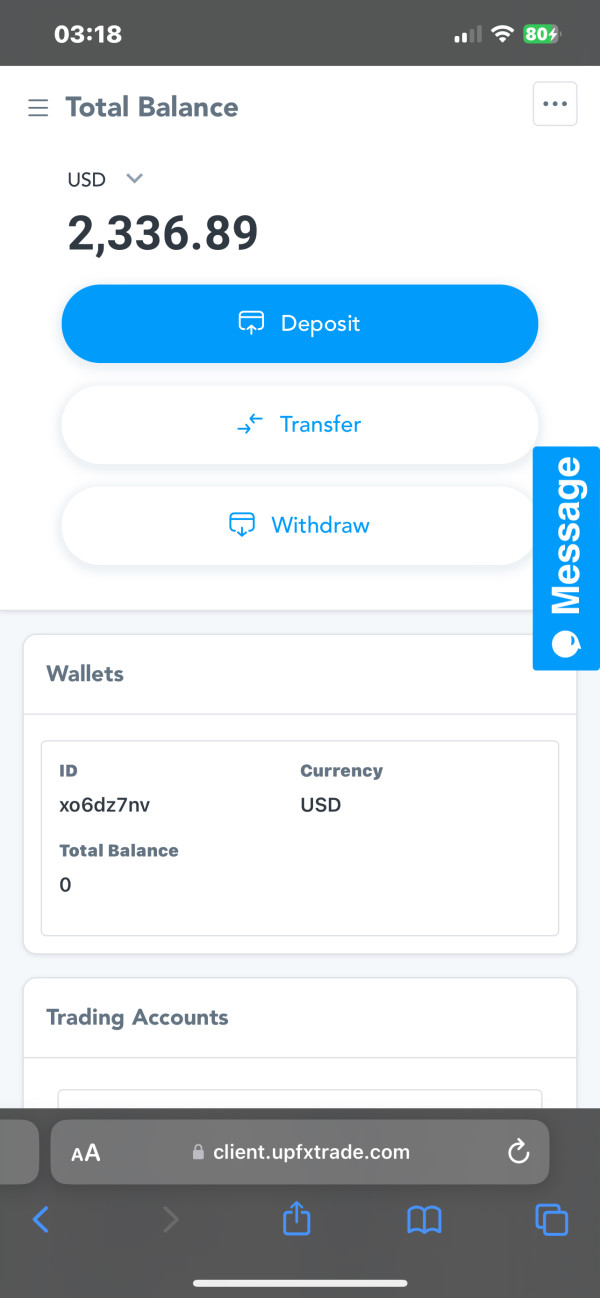

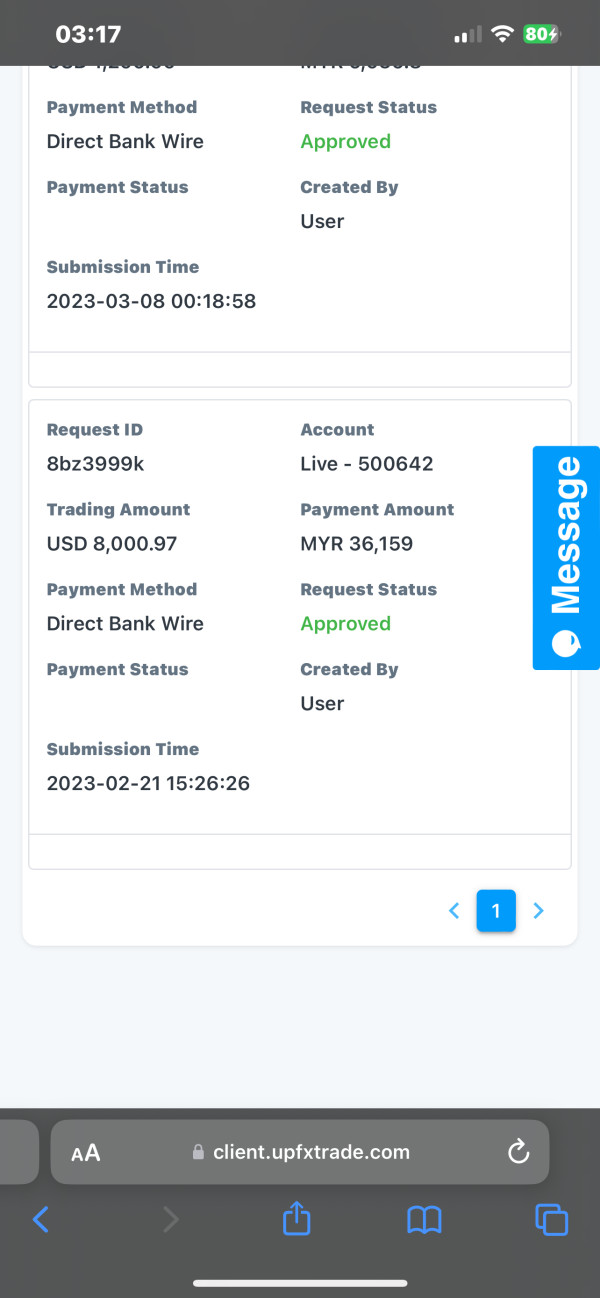

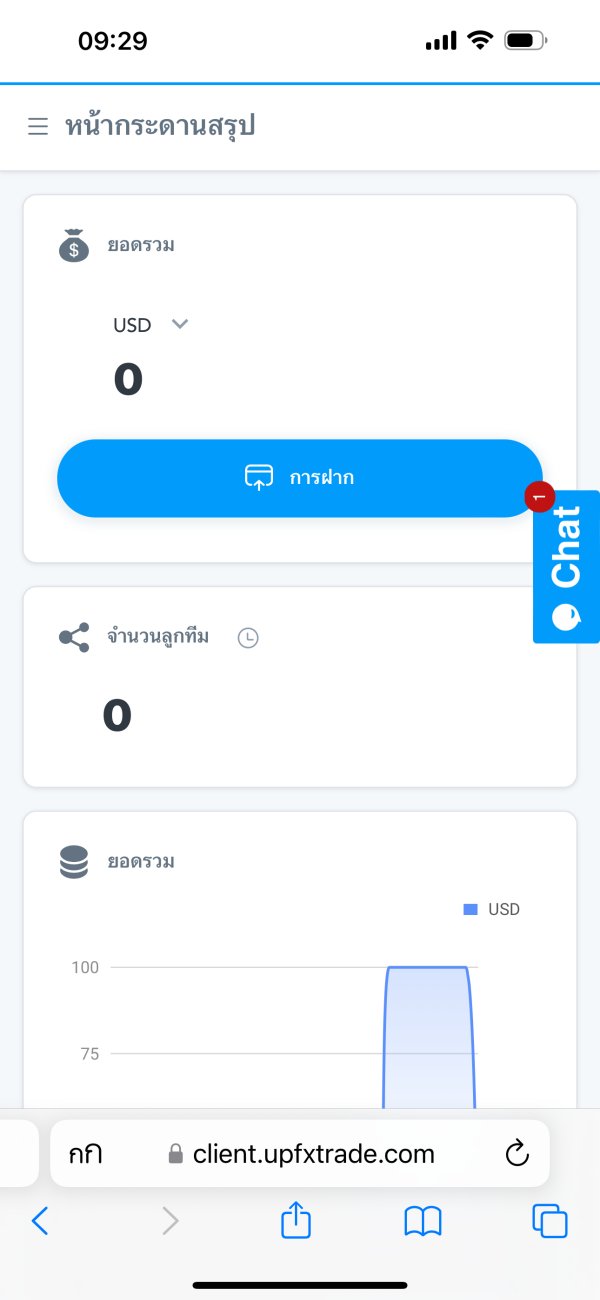

Deposit & Withdrawal

UPFX offers a range of payment methods to facilitate deposits and withdrawals for its clients. Some of the supported payment methods include USDT (Tether), VISA, MasterCard, Skrill, Neteller, and Union Pay.While the specific minimum deposit requirements and processing times for each payment method are not specified, it is important to note that the minimum deposit to open a Standard account with UPFX is $100. The actual minimum deposit for each payment method may vary, and it is advisable to refer to UPFX's official website or contact their customer support for accurate and up-to-date information regarding minimum deposit requirements and processing times associated with each payment method.

Customer Support

It seems that the available information suggests that UPFX claims to offer 24/7 customer support; however, the current website display only shows a contact form, and the FAQ section appears to be empty or non-functional. This limited information raises some concerns about the accessibility and availability of customer support services.

As customer support is a crucial aspect of any brokerage service, it's essential to have reliable and accessible support channels in place to address any inquiries, concerns, or issues that traders may encounter. Confirming the availability and effectiveness of UPFX's customer support is an important step in evaluating the overall quality of their services.

Educational Resources

As part of their offerings, UPFX provides access to basic educational content, which may include an economic calendar and economic news.

An economic calendar is a valuable tool for traders as it displays key economic events, announcements, and data releases that can impact the financial markets. By staying informed about upcoming economic events, traders can anticipate potential market volatility and make more informed trading decisions. The economic calendar offered by UPFX can assist traders in tracking important events such as central bank announcements, economic indicators, and geopolitical developments.

In addition to the economic calendar, UPFX may also provide access to economic news updates. These updates often cover market analysis, commentary, and insights into significant market-moving events. Economic news can help traders stay up to date with the latest developments and gain a better understanding of the factors influencing the financial markets.

| Pros | Cons |

| Access to an economic calendar | Limited depth of educational content |

| Availability of economic news updates | Lack of comprehensive educational courses |

| Possible reliance on external sources for educational content | |

| Educational resources may not be tailored to individual trader needs | |

| Educational resources should be used as supplementary information, not as financial advice |

Conclusion

On the positive side, UPFX offers a range of trading instruments, including Forex, commodities, indices, cryptocurrencies, and shares, providing traders with diverse investment opportunities. The availability of different account types, such as Standard, Swap-free, Pro, and ECN, caters to various trading preferences and experience levels. The leverage options, reaching up to 1:500, can be advantageous for traders seeking higher exposure to the markets. Additionally, UPFX supports the widely used MetaTrader 5 (MT5) trading platform, which offers advanced tools and functionality for efficient trading. The inclusion of a Social Trading community allows traders to engage with and learn from other experienced traders, enhancing their trading knowledge and strategies.

However, there are some drawbacks to consider. UPFX's lack of regulation, as it is registered in Belize with no specified regulatory authority, may raise concerns about the level of investor protection. The limited availability of specific information, such as non-trading fees and educational resources, can make it challenging to assess the complete offering. Furthermore, the absence of a comprehensive FAQ section on the website may result in a lack of easily accessible self-help resources for traders.

FAQs

Q: How do I open an account with UPFX?

A: Visit our website, click “Open Account,” follow the registration process, provide required information, and submit necessary documents.

Q: What trading instruments does UPFX offer?

A: UPFX offers Forex, commodities, indices, cryptocurrencies, and shares for trading.

Q: What are the minimum deposit requirements?

A: Standard and Swap-free accounts require a minimum deposit of $100, Pro account $1,000. ECN account requires $5,000.

Q: Which trading platform does UPFX support?

A: UPFX supports the MetaTrader 5 (MT5) trading platform.

Q: How can I contact UPFX's customer support?

A: You can reach this broker via the contact form on our website.

News

Review 24

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now