Score

CKB

Australia|2-5 years|

Australia|2-5 years| https://www.ckbinternational.com/en/index.html

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

CKB Markets Co., Limited

CKB

Australia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

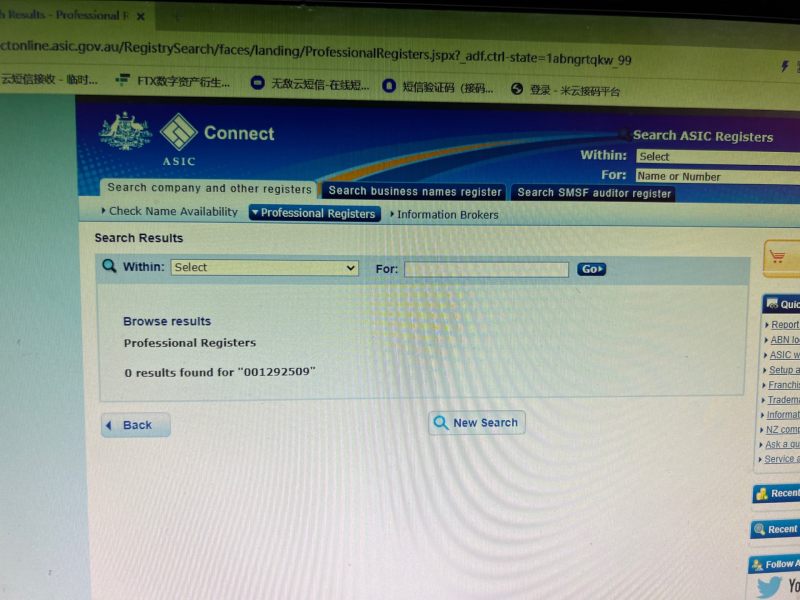

- AustraliaASIC (license number: 001292509) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $10000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $2000 |

| Minimum Spread | 0.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $200 |

| Minimum Spread | 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed CKB also viewed..

XM

AUS GLOBAL

Neex

MultiBank Group

CKB · Company Summary

| CKB | Basic Information |

| Company Name | CKB Markets Co., Limited |

| Founded in | 2021-06-11 |

| Headquarters | No |

| Regulations | Not Regulated |

| Tradable Assets | No |

| Account Types | ECN, VIP, Standard |

| Minimum Deposit | Standard:$200 |

| Maximum Leverage | VIP:1:1000 |

| Minimum Spread | VIP:0.8Standard:1.5 |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Email: support@ckbmarkets.com |

Overview of CKB

CKB Markets Co., Limited, founded on June 11, 2021, operates without regulatory oversight and does not offer any tradable assets. It provides three account types: ECN, VIP, and Standard, each with different minimum deposit requirements, leverage options, and spreads. The platform uses MetaTrader 4 as its trading platform and offers customer support via email. Additionally, CKB does not provide any educational resources or bonus offerings. This concise overview highlights CKB's key features and sets expectations for potential traders regarding its offerings and services.

Regulation

CKB operates without regulation, as indicated by the absence of regulatory information in the provided details. This lack of regulation means that CKB is not subject to oversight by any financial regulatory authorities, raising concerns about investor protections and adherence to industry standards. Traders should be aware that without regulatory oversight, there may be increased risks associated with trading on the platform, as there are no established guidelines or safeguards in place to protect investors' interests. As such, individuals considering CKB should assess risks before engaging with the platform.

Pros & Cons

CKB presents a mix of advantages and challenges for traders. On the positive side, the platform offers high leverage options, particularly appealing to experienced traders seeking amplified returns. Additionally, its provision of multiple account types meets the needs of a diverse range of traders, offering flexibility in trading preferences. Competitive spreads further enhance its appeal, potentially reducing trading costs. However, CKB operates without regulatory oversight, raising concerns about investor protection. Furthermore, the absence of tradable assets, payment methods, and educational resources may limit trading opportunities and hinder trader development.

| Pros | Cons |

|

|

|

|

|

|

|

|

Account Types

CKB offers three distinct account types: ECN, VIP, and Standard. The ECN account is designed for experienced traders seeking direct market access with competitive pricing and execution. The VIP account, with its higher minimum deposit requirement, provides traders with access to enhanced features such as higher leverage and tighter spreads, appealing to those looking for premium trading conditions. The Standard account offers a more accessible entry point for traders with smaller capital sizes, providing basic trading services with standard leverage and spreads.

| Account | ECN | VIP | Standard |

| Minimum Deposit | $10000 | $2000 | $200 |

Leverage

CKB offers varying leverage options across its account types to accommodate different trading preferences and risk appetites. The ECN account provides leverage of up to 1:500, offering traders the ability to amplify their positions in the market. For VIP account holders, CKB offers even higher leverage, up to 1:1000, providing traders with greater flexibility and potential for larger returns. The Standard account also offers leverage of up to 1:500, ensuring that traders with smaller capital sizes can still access competitive leverage ratios.

Spreads & Commissions

CKB offers competitive spreads across its account types, with tighter spreads available for VIP account holders compared to the Standard account. VIP account holders enjoy minimum spreads starting at 0.8 pips, providing them with favorable pricing conditions and potentially reducing trading costs. Standard account holders, on the other hand, experience slightly wider spreads, starting at 1.5 pips, yet still competitive within the industry. Notably, CKB does not charge commissions on trades, ensuring transparency and simplicity in its fee structure.

| Account | ECN | VIP | Standard |

| Minimum Deposit | $10000 | $2000 | $200 |

| Minimum Spread | - | 0.8 | 1.5 |

Trading Platform

CKB's trading platform of choice is MetaTrader 4 (MT4), a widely recognized and respected platform in the industry. MetaTrader 4 offers a user-friendly interface, advanced charting tools, and a comprehensive suite of technical indicators, allowing traders to conduct thorough analysis and execute trades with precision. Its customizable features and compatibility with automated trading systems make it suitable for traders of all experience levels.

Customer Support

Clients can contact this broker through the following contact channels:

Email: support@ckbmarkets.com

Conclusion

In conclusion, CKB presents itself as a trading platform offering a range of account types tailored to accommodate diverse trader preferences, from the ECN, VIP, to Standard accounts. With competitive leverage options and favorable spreads, particularly for VIP account holders, CKB aims to provide a conducive environment for traders to execute their strategies efficiently. However, the platform operates without regulatory oversight, which may raise concerns for some traders regarding investor protection. Additionally, the absence of tradable assets and limited customer support channels, with only email support available, may impact the overall trading experience. Traders should carefully weigh the platform's offerings and risks to determine its suitability for their trading needs and risk tolerance levels.

FAQs

What account types does CKB offer, and how do they differ?

CKB offers three account types: ECN, VIP, and Standard.

What leverage options are available on CKB?

CKB offers varying leverage options across its account types. The ECN account provides leverage of up to 1:500, while the VIP account offers leverage of up to 1:1000, providing traders with greater flexibility and potential for larger returns. The Standard account also offers leverage of up to 1:500, ensuring accessibility for traders with smaller capital sizes.

Does CKB charge commissions on trades?

No, CKB does not charge commissions on trades. The platform operates on a commission-free model, with trading costs primarily incurred through spreads. This ensures transparency and simplicity in its fee structure, allowing traders to execute transactions without additional costs.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now