Score

Opofinance

Seychelles|2-5 years|

Seychelles|2-5 years| http://www.opofinance.com/en

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Netherlands

NetherlandsContact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Seychelles

SeychellesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Opofinance also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

opofinance.com

Website Domain Name

opofinance.com

Server IP

104.21.36.71

Company Summary

| Broker Name | Opofinance |

| Registered Country | Seychelles |

| Found | 2022 |

| Regulation | FSA |

| Market Instrument | Forex, Metals, Commodities, Stocks, Cryptocurrencies, and Indices |

| Account Type | Standard, ECN, Social Trade, and ECN Pro |

| Demo Account | yes |

| Maximum Leverage | 1:2000 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | cryptocurrencies, UnionPay, Advcash, Visa/Master Cards, Perfect Money, TopChange, Local Bank Transfer, wire transfer, fasapay |

| Customer Service | Phone, Email, Whatsapp, Telegram, Online Chat |

What is Opofinance?

Opofinance, a trading brand of Opo Group Ltd, is a forex broker registered in Seychelles, providing access to massive financial markets. With the Opofinance platform, four trading accounts are available, with the lowest required opening deposit to start a standard account or an ECN account from $100, and traders can employ a maximum leverage of 1:2000 on their positions.

Opofinance is a modern financial platform that combines the power of artificial intelligence and blockchain technology to revolutionize financial management. It offers a comprehensive suite of financial services, including banking, investments, lending, and insurance, all integrated into a single platform. By leveraging AI algorithms, Opofinance provides personalized financial recommendations tailored to individual needs, while its decentralized blockchain infrastructure ensures transparency in transactions.

Opofinance stands out for its extensive range of market instruments, including forex, metals, commodities, stocks, cryptocurrencies, and indices. Traders can choose from various account types, such as Standard, ECN, Social Trade, and ECN Pro, to suit their preferences and trading styles. The platform offers popular trading platforms like MetaTrader 4 and MetaTrader 5, along with a web-based terminal for convenient access. Additionally, Opofinance provides traders with useful tools like Technical Views for market analysis, an Economic Calendar to track economic events, and a Newsletter service for valuable insights.

Here is the home page of this brokers official site:

Pros and Cons

On the positive side, Opofinance offers a comprehensive range of financial services, including banking, investments, lending, and insurance, all accessible within a single integrated platform. The incorporation of artificial intelligence algorithms enables personalized financial recommendations tailored to individual users, enhancing the user experience. Furthermore, the utilization of blockchain technology ensures immutability in financial transactions.

However, there are a few concerns associated with Opofinance. One notable drawback is the lack of regulatory oversight, which may raise questions about the platform's security and transparency. Without regulatory scrutiny, users may not have the same level of protection and recourse as they would with regulated financial institutions. It is crucial for individuals and businesses to carefully evaluate the potential risks and benefits before engaging with Opofinance.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is Opofinance Legit?

Opofinance is regulated by the Seychelles Financial Services Authority (FSA). However, it's important to note that the Seychelles FSA is an offshore regulatory authority. Offshore regulations generally have less stringent requirements compared to major financial regulators in other jurisdictions. This means that the level of investor protection and oversight may be lower.

Opofinance holds a retail forex license issued by the Seychelles FSA, with license number SD124. The licensed institution is Opo Group Ltd, and its address is CT House, Office 9D, Providence, Mahe, Seychelles. The website of Opofinance is https://www.opofinance.com/.

It's crucial to be cautious when dealing with offshore-regulated entities, as they may not offer the same level of security and investor protection as those regulated by renowned financial authorities. Consider conducting thorough research and due diligence before engaging in any financial activities with Opofinance or any other offshore-regulated entity.

Opofinance also holds an Investment Advisory License authorized by ASIC in Australia, with license no. 420043. However, this licensing classification falls outside the parameters of its operational purview, implying that its forex related trading offerings are rendered in an unregulated capacity.

Market Instruments

Opofinance offers access to a wide range of market instruments, including:

1. Forex: Opofinance provides trading opportunities in major currency pairs such as GBP/USD, GBP/CAD, EUR/USD, USD/CAD, and USD/JPY. These instruments have specific contract sizes, tick sizes, and swap rates associated with them.

2. Metals: Traders can participate in the precious metals market with instruments like XAU/USD (Gold/US Dollar), XAG/USD (Silver/US Dollar), and XPT/USD (Platinum/US Dollar). Each metal instrument has its own contract size, tick size, and swap rates.

3. Commodities: Opofinance offers commodities trading, including instruments like WTI/USD (West Texas Intermediate/US Dollar), BRN/USD (Brent/US Dollar), and NGC/USD (Natural Gas/US Dollar). These instruments have specific contract sizes, tick sizes, and swap rates.

4. Stocks: Traders can access the stock market through Opofinance, with instruments like APPL (Apple Inc), TSLA (Tesla Inc), NKE (Nike Inc), QQQ (Invesco QQQ Trust), and NFLX (Netflix Inc). Each stock instrument has a contract size, tick size, and swap rates associated with it.

5. Cryptocurrencies: Opofinance allows trading in popular cryptocurrencies like BTC/USD (Bitcoin/US Dollar), ETH/USD (Ethereum/US Dollar), BNB/USD (Binance Coin/US Dollar), ADA/USD (Cardano/US Dollar), and XRP/USD (XRP Ledger/US Dollar). These cryptocurrency instruments have specific contract sizes, tick sizes, and swap rates.

6. Indices: Traders can engage in index trading with instruments like NDX/USD (Nasdaq 100/US Dollar), DJI/USD (Dow Jones/US Dollar), DAX/EUR (DAX/EURO), and SPX/USD (SP 500/US Dollar). Each index instrument has its own contract size, tick size, and swap rates.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Types

Opofinance offers four different types of trading accounts to cater to the needs of different traders:

1. Standard Account: The Standard account requires a minimum deposit of $100 USD. It does not charge any commission and offers normal spreads. Traders can access this account type through the MT4, MT5, and web trading platforms. The leverage provided for Standard account holders is up to 1:2000. This account is suitable for traders who prefer a simple trading structure with no commission charges.

2. ECN Account: The ECN account also has a minimum deposit requirement of $100 USD. It offers low commissions and low spreads. Traders can access this account type through the MT4, MT5, and web trading platforms. The leverage available for ECN account holders is up to 1:2000. This account is suitable for traders who prefer tighter spreads and are comfortable with paying a commission.

3. Social Trade Account: The Social Trade account requires a minimum deposit of $200 USD. It does not charge any commission and offers normal spreads. Traders can access this account type through the MT4, MT5, and web trading platforms. The leverage provided for Social Trade account holders is up to 1:2000. This account is designed for traders who are interested in social trading and wish to follow and mirror the trades of professional traders.

4. ECN Pro Account: The ECN Pro account has a higher minimum deposit requirement of $5,000 USD. It offers low commissions and the lowest spreads. Traders can access this account type through the MT4, MT5, and web trading platforms. The leverage available for ECN Pro account holders is up to 1:2000.

Opofinance also provides DEMO trading accounts for beginners and experienced traders alike. These demo accounts allow traders to practice and test their trading strategies in a simulated environment using virtual funds, without any risk to their capital. Once traders gain confidence and proficiency, they can switch to live trading accounts.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

How to Open an Account?

To create a live account with Opofinance, follow these steps:

1. Log in to the user panel on Opofinance's website.

2. From the Dashboard or Account menu, click on “Open an Account.”

3. Fill in the required personal information, including your last name, date of birth (month, day, and year), country, phone number, email address, and password. Optionally, you can enter a referral code if you have one.

4. If you have already registered an account, you can simply log in using your existing credentials.

5. Select the trading platform you prefer, either MetaTrader 4 or MetaTrader 5, from the “Select trading platform” section.

6. Choose the type of account you want and the desired leverage. Opofinance offers different account types with varying features and leverage options.

7. Click “Continue” to proceed.

8. Review the account information displayed on the final page to ensure accuracy.

9. Once you have confirmed the details, your live account will be created, and you can start trading with Opofinance.

Demo Accounts

With Opofinances demo account, prospective traders can test out different trading strategies to trading without putting their own money in danger, resulting in a more relaxed trading experience.

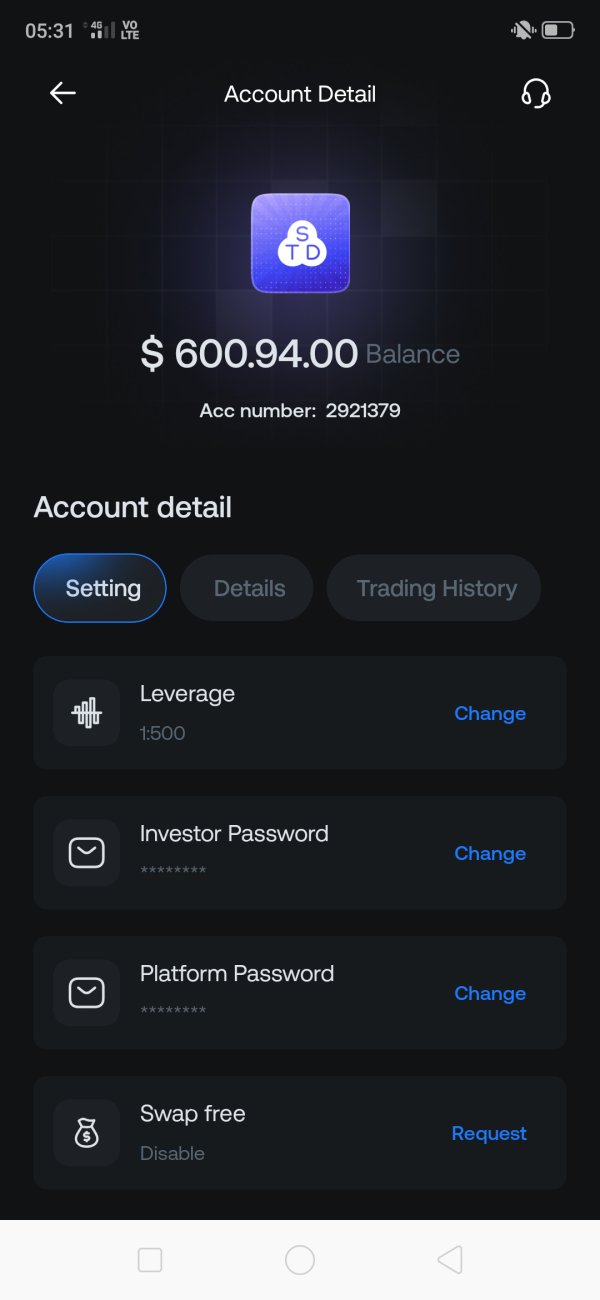

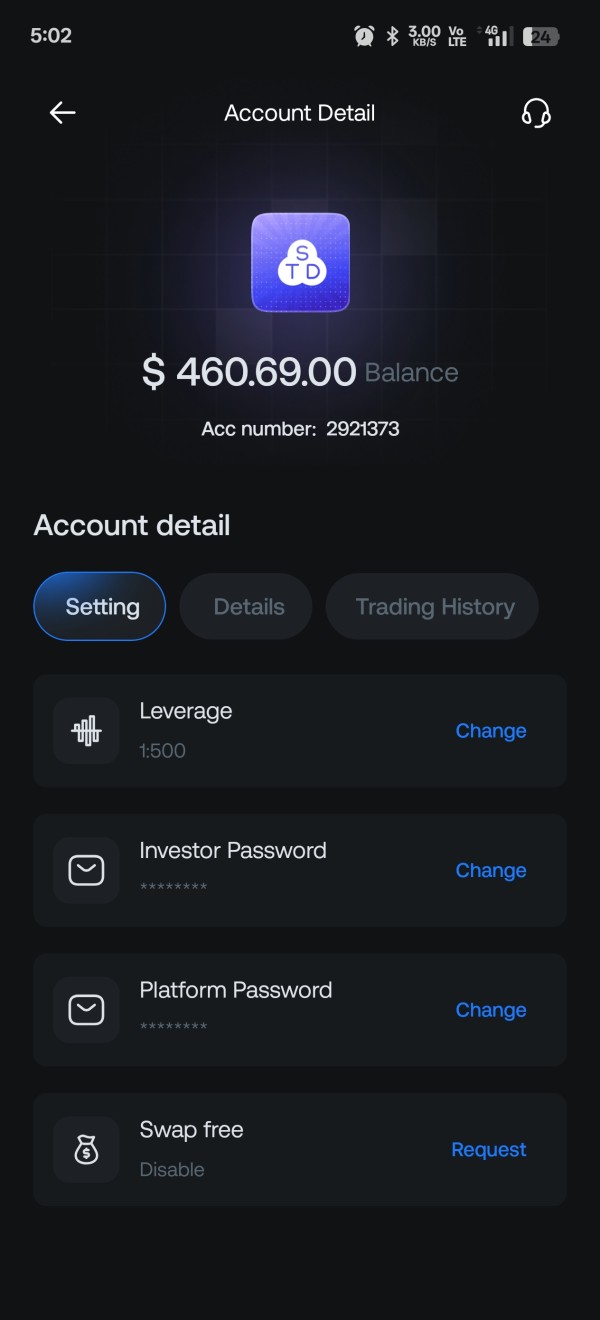

Leverage

Opofinance offers a range of leverage options for traders, starting from 1:100 and going up to 1:2000. Leverage allows traders to control larger positions in the market with a smaller amount of capital. However, it's important to note that while leverage can magnify potential gains, it also amplifies potential losses. It is crucial for traders to understand the risks associated with leverage and use it responsibly. For beginners or those with limited trading experience, it is generally recommended to start with lower leverage levels, such as 1:10, until they have gained sufficient knowledge and confidence in their trading strategies.

Spreads & Commissions

Opofinance offers different trading accounts with varying spreads and commissions. In the Standard account, traders can benefit from spreads starting at 1.8 pips and there is no commission charged for trades. For those who choose the ECN account, lower spreads are available starting from 0.8 pips, but a commission of $6 is applied. The Social Trade account provides a zero-commission trading environment, with spreads starting from 2.5 pips. Lastly, the ECN PRO account offers the spreads starting from 0.0 pips, but a commission of $4 is applicable. These options allow traders to select an account type that aligns with their trading preferences and cost considerations.

Deposit and Withdrawal

Opofinance provides various deposit and withdrawal methods to facilitate transactions for its users. To make a deposit, users need to log in to their client area and navigate to the “Funds” section. From there, they can select “Deposit Funds” and choose their preferred payment method, such as cryptocurrencies, UnionPay, Advcash, Visa/Master Cards, Perfect Money, TopChange, Local Bank Transfer, wire transfer, or fasapay. The minimum deposit amount is 100 US Dollars.

For depositing through TopChange, users need to log in to their client area and select “Deposit Funds” from the Funds menu. They can choose the TopChange option, enter the amount they want to deposit, and proceed by entering their Top-Change username and password. Alternatively, users can deposit through cryptocurrency by selecting the “Cryptocurrency” option and following the provided instructions to enter the deposit amount and select the desired network type.

Regarding withdrawals, users can initiate a withdrawal by logging into their user panel and selecting “Funds” followed by “Withdraw Funds.” They can provide the necessary payment details, including the method of withdrawal and the destination wallet address. Withdrawal requests are initially submitted in Pending mode and are typically processed within 24 working hours. Users can also withdraw funds through TopChange or cryptocurrency by following the specific instructions provided for each method.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Trading Platform

Opofinance offers multiple trading platforms to cater to the diverse needs of traders:

1. MetaTrader 4 (MT4): MT4 is a widely recognized and popular trading platform known for its comprehensive trading and analytical tools. It provides advanced charting capabilities, a wide range of technical indicators, and various order types. Traders can execute trades directly from charts, set stop orders and trailing stops, and access trading history. MT4 is suitable for implementing trading strategies of any complexity.

2. MetaTrader 5 (MT5): MT5 is a multi-asset platform that supports trading in Forex, stocks, and futures markets. It offers advanced price analysis tools, the ability to use algorithmic trading applications (such as trading robots and Expert Advisors), and copy trading functionality. MT5 features Market Depth, separate accounting of orders and trades, and supports various order types including market, pending, and stop orders.

3. MetaTrader WebTerminal: The MetaTrader WebTerminal provides a web-based trading solution that eliminates the need for installing a desktop terminal or using a mobile version. Traders can access the platform from any browser and operating system (Windows, Mac, Linux) with an internet connection. The web-based platform offers comprehensive functionality, including market analysis tools and order placement.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading Tools

Opofinance provides three trading tools to assist its clients in making informed trading decisions: Technical Views, Economic Calendar, and Newsletter.

1. Technical Views: Technical Views is a unique financial market research solution that combines senior analyst expertise with automated algorithms. It offers actionable trading plans based on award-winning methodologies. The proprietary pattern recognition technology continuously monitors the market, providing clear trend lines, alternative scenarios, and beautiful charts. Technical Views helps traders understand the technical scenario at a glance, providing position management for over 8,000 instruments. It offers a premium feature set with real-time, actionable macro-economic data, empowering traders to make confident decisions with simple and actionable trading plans.

2. Economic Calendar: Opofinance's Economic Calendar is a powerful tool for monitoring, anticipating, and acting on potentially market-moving events. It provides real-time, actionable macro-economic data, allowing traders to filter economic events by importance or country. With over 115 FX charts mapped to different economic events and an abundant list of economic events for 38 countries, traders can track events and their impact on prices. The Economic Calendar also offers historical performance data, showing forecast and actual values over the last 5 years, enabling traders to understand the historical trend and the influence of economic events on currencies.

3. Newsletter: Opofinance's newsletter service provides traders with comprehensive content to implement robust trading strategies tailored to their trading styles. The newsletter covers emerging opportunities, immediately actionable trading plans, expert market overviews, and a variety of market insights. Traders can delve deeper into any idea presented in the newsletters, as most of them are based on the rich insights of Opofinance's full online applications. The newsletter covers various topics such as daily US commodities, European market outlook, stock ideas, crypto trade ideas, economic agenda, small cap stocks, bullish ETFs, penny stock ideas, hot market news, and end-of-day S&P analysis. This service ensures that traders have access to valuable information and analysis to stay informed and make informed trading decisions.

These trading tools provided by Opofinance aim to equip traders with the necessary resources and insights to enhance their trading strategies and decision-making processes.Copu

Copy Trading Solution

OPO SOCIAL TRADE PLATFORM: Opo Social Trade Platform offered by Opofinance is an exclusive social trading platform designed to provide traders with the opportunity to explore and copy the trading strategies of high-performance traders. By opening a Social Trade account, users can directly copy the trades of experienced traders from their client area. The platform operates with advanced trading technologies and offers easy access through the client area. With ultra-fast order execution and 30% lower spreads, users can benefit from the expertise and knowledge of successful traders.

METAVERSE In addition, Opofinance has embraced the concept of the metaverse and has established a virtual office in this immersive digital space. As the first forex broker to open a virtual office, Opofinance aims to leverage the potential of the metaverse to connect people worldwide and create an interactive and collaborative environment. This virtual office allows for remote meetings, collaboration, and learning experiences. Opofinance is excited about the possibilities that the metaverse holds and welcomes visitors to explore their virtual office, with plans to introduce new features in the future.

Customer Support

Opofinance offers customer support services to assist users with their queries and concerns. Users can reach out to the support team through various channels:

1. Call Center: Users can contact Opofinance's call center at +447312763042 during the operating hours of 8am-5pm (GMT+3). This provides a direct line of communication for immediate assistance.

2. Email Support: Users can send their inquiries or support requests to support@opofinance.com. This email address is dedicated to addressing customer support issues and providing timely responses.

3. Partnerships Email: For partnership inquiries or collaboration opportunities, users can reach out to partners@opofinance.com. This email address is specifically for partnership-related queries.

4. KYC Email: KYC (Know Your Customer) verification-related inquiries can be sent to KYC@opofinance.com. This email address is designed to assist users with any KYC-related questions or concerns.

5. Telegram: Opofinance provides customer support through their Telegram channel @opofinancesupport. Users can reach out to the support team via Telegram for assistance. The Telegram support operates 24 hours a day, every day of the week.

Conclusion

In conclusion, Opofinance is a modern financial platform that combines artificial intelligence and blockchain technology to provide comprehensive financial services. It offers personalized financial recommendations, automation of processes, and enhanced security through AI algorithms. Opofinance's advantages include its integrated suite of financial services, democratized access to advanced financial technologies, and the potential to reshape the financial industry. However, it is important to note that Opofinance is regulated by the offshore authority of Seychelles, which may have lower investor protection and oversight compared to renowned financial regulators. Traders should exercise caution and conduct thorough research before engaging in financial activities with Opofinance or any other offshore-regulated entity.

Customer Support

Opofinance seems to provide 24/7 dedicated customer support and it can be reached through multiple contact channels, including:

Online Chat or send messages online

Telephone: +447312763042

Whatsapp: +44 2081236500 (Chat Only)

Email: support@opofinance.com

Telegram: @opofinancesupport

Or you can also follow this broker on Facebook, Twitter, and Instagram.

Company Address: CT House, Office 9D, Providence, Mahe Seychelles.

| Pros | Cons |

| • Multiple trading assets, account types and funding options | • Offshore regulation |

| • Demo accounts available | • Regional restrictions |

| • MT4 and MT5 supported |

Frequently Asked Questions (FAQs)

Is Opofinance legit?

Yes. Opofinance is offshore regulated by the Seychelles FSA, with the registration number SD124.

At Opofinance, are there any regional restrictions for traders?

Yes. Opofinance does not accept users from these countries: Turkey, Australia, the USA, Japan, Canada, and North Korea.

Does Opofinance provide swap-free trading accounts?

No. It does not support swap-free trading accounts.

Does Opofinance offer industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

Is Opofinance a good broker for beginners?

No. Opofinance is not a good choice for beginners. Though it advertises very well, it lacks legitimate regulations.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that you fully understand the risks involved, taking into account your investment objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Keywords

- 2-5 years

- Regulated in Seychelles

- Regulated in Australia

- Retail Forex License

- Investment Advisory License

- MT4 Full License

- MT5 Full License

- cTrader

- Global Business

- Suspicious Overrun

- High potential risk

- Offshore Regulated

Review 9

Content you want to comment

Please enter...

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

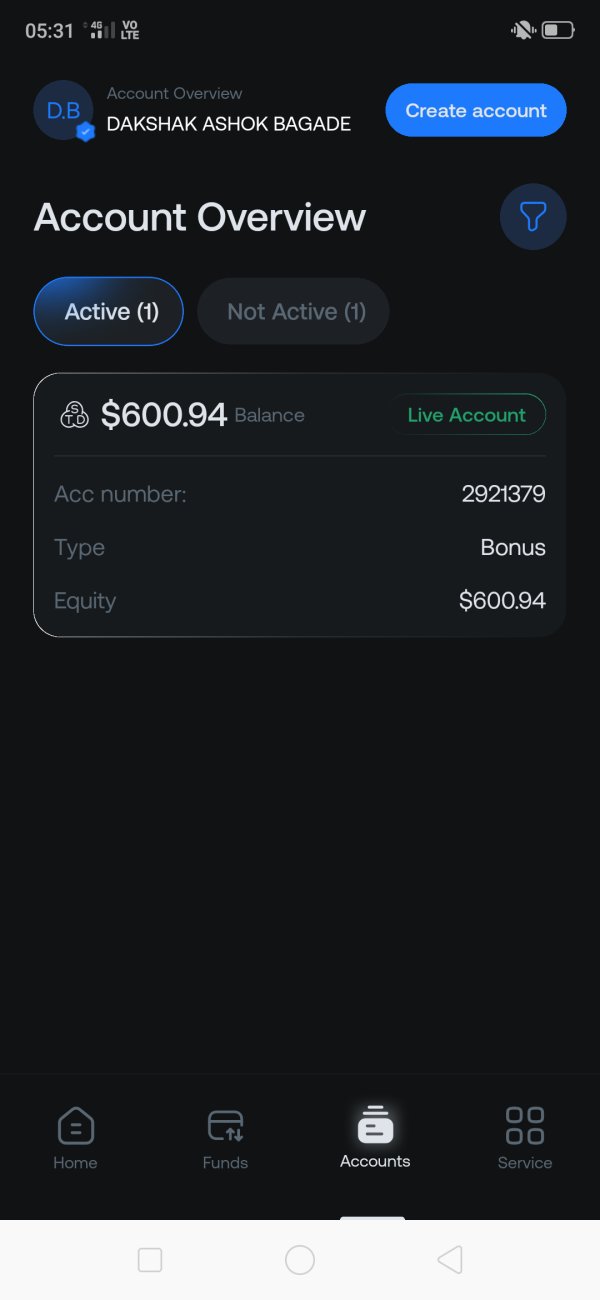

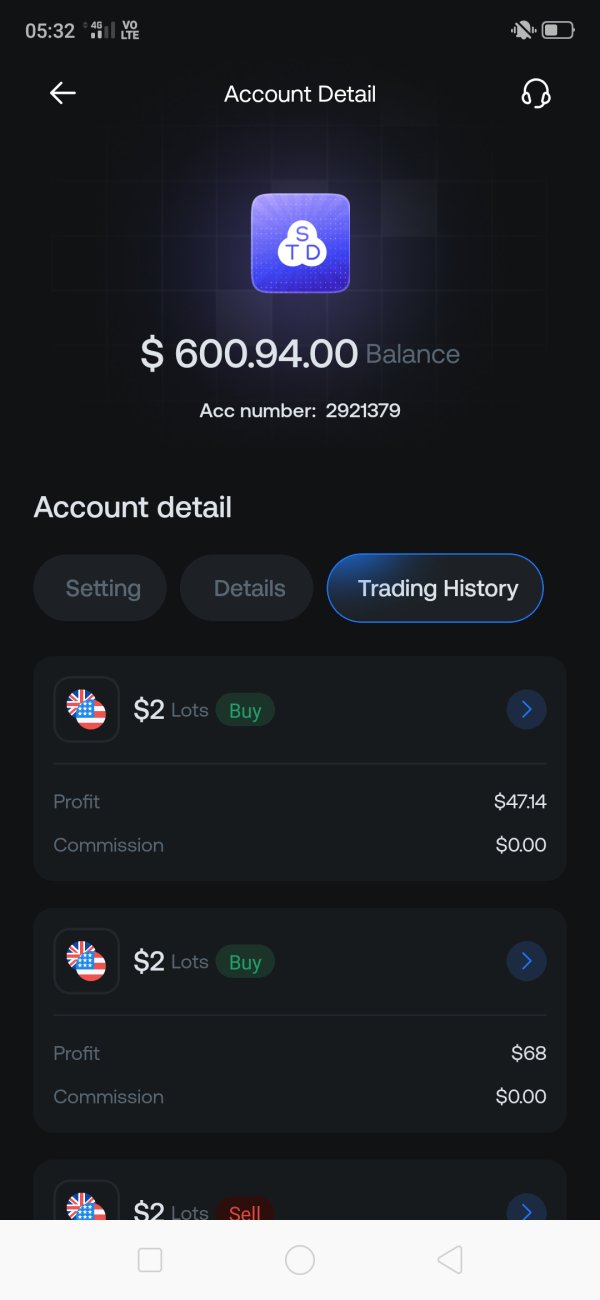

Dakshak

India

I strongly advise against using this platform. Despite completing the required 25 lots on their $100 no-deposit bonus over three weeks ago, my withdrawal request remains unprocessed. Their customer support provides no clear answers, repeatedly stating that my account is under review without offering a timeline or resolution. This lack of transparency and accountability is deeply concerning and suggests the platform is not trustworthy. My experience has been frustrating, with unmet promises and poor communication. If you value your time and resources, I recommend avoiding this platform and seeking a more reliable and reputable service provider instead.

Exposure

01-03

UnknownParticle

India

Do not waste your valuable time. This platform appears to be fraudulent. It has been over two weeks since I completed 25 lots on their $100 no-deposit bonus (NDB), yet they have failed to process my withdrawal request. Their customer support is unresponsive and unhelpful, repeatedly stating that my account is under review.

Exposure

01-03

james46643

Hong Kong

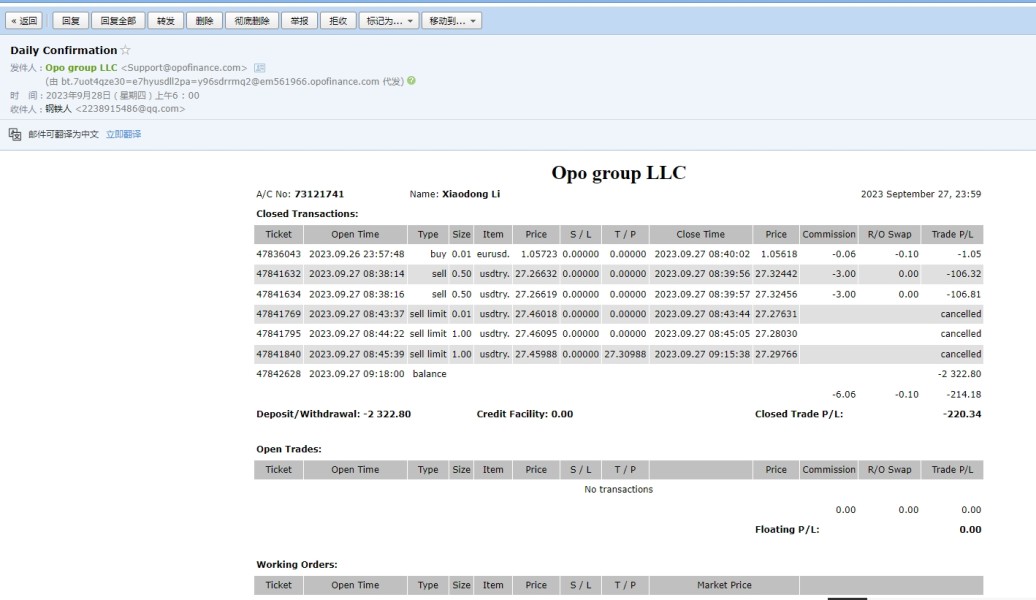

The first liquidation, they said it was a normal situation. The second profit, they said no, the single to be deleted. The same time period my friend and I traded together, he slipped a loss, it did not return, and did not say that it is a violation. The platform is unscrupulous.

Exposure

2023-10-04

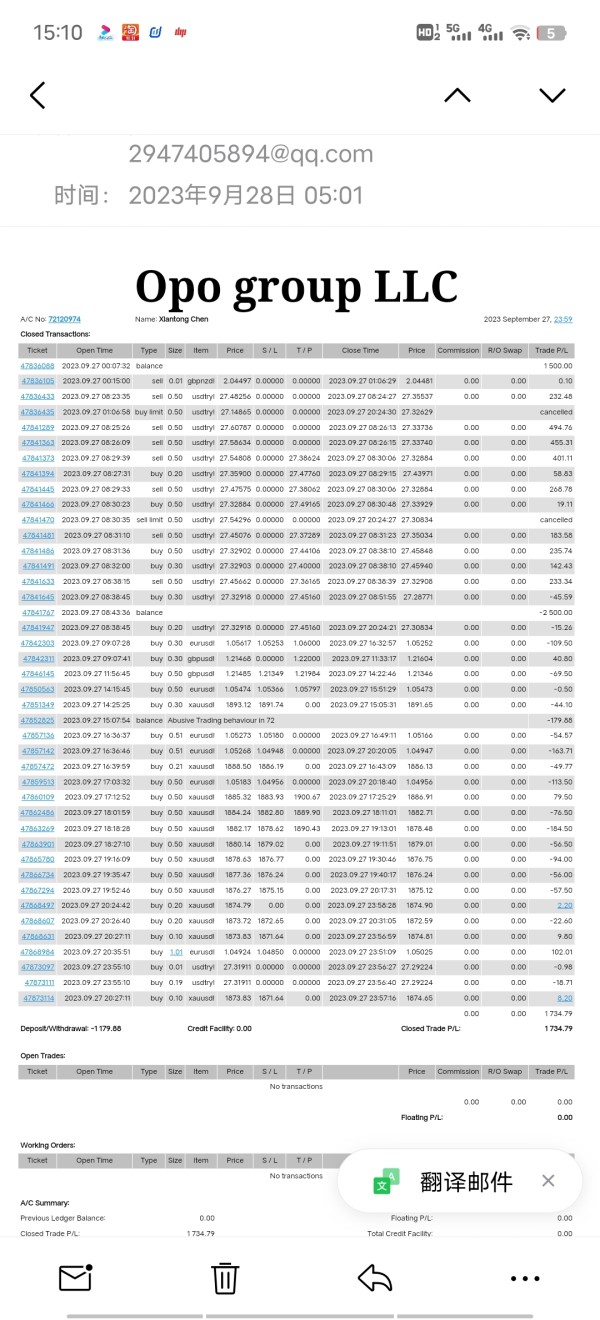

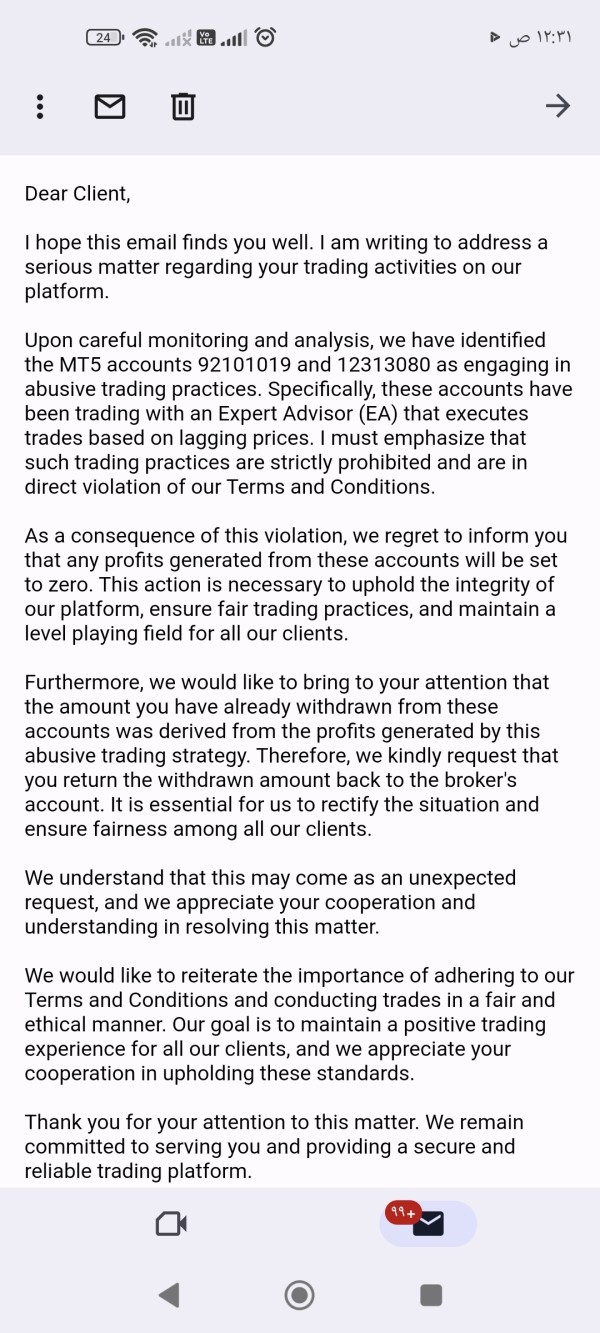

MOHAMMED Qali

Turkey

The problem of withdrawing profits under the pretext of using a fraud company robot. Please pay attention

Exposure

2023-07-16

MOHAMMED Qali

Turkey

I won a high amount I requested a withdrawal They don't accept my request and my account is closed

Exposure

2023-07-08

1233294

Nigeria

It has really stepped up my trading with the Opo Social Trade feature. Copying trades from experienced traders has given me insights and boosted my confidence. It's great to learn from the pros and even mirror their success directly in my account. If you're looking to leverage expert strategies, Opofinance is worth checking out!

Positive

2024-06-04

Visal

Singapore

Overall, based on the information available, Opofinance appears to be a reputable and reliable online trading platform that provides a range of tools and resources to help traders succeed. As such, I would give Opofinance a five-star rating.

Positive

2023-02-27

黎明不懂沙皮狗的忧伤

Philippines

Yes, I love this platform! $100 is enough for me to open a standard account, and I have a wide range of trading assets. Zero-commission trading environment is more suitable for me, only spreads calculated. Opofinance’s customer support is also responsive, always available to help you. An excellent broker. I’ve ready opened an account two days ago, so far so good.

Positive

2022-12-05

乗聿夆

United States

Very pleasant trading experience! There are no commissions, the spread is very low, and the product range is very wide! I made a lot of money from copy trading! Great broker!

Positive

2022-12-02