Score

Uni Borsa

Iraq|5-10 years|

Iraq|5-10 years| https://uniborsa.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

South Africa 2.47

South Africa 2.47Surpassed 15.20% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+964 07803282483

Other ways of contact

Broker Information

More

Uni Borsa

Uni Borsa

Iraq

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | 500$ |

| Minimum Spread | from 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | 100$ |

| Minimum Spread | From 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | 100$ |

| Minimum Spread | From 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Uni Borsa also viewed..

XM

MiTRADE

FBS

ATFX

Uni Borsa · Company Summary

| Aspect | Information |

| Registered Country/Area | Iraq |

| Founded Year | 2-5 years |

| Company Name | Uni Borsa |

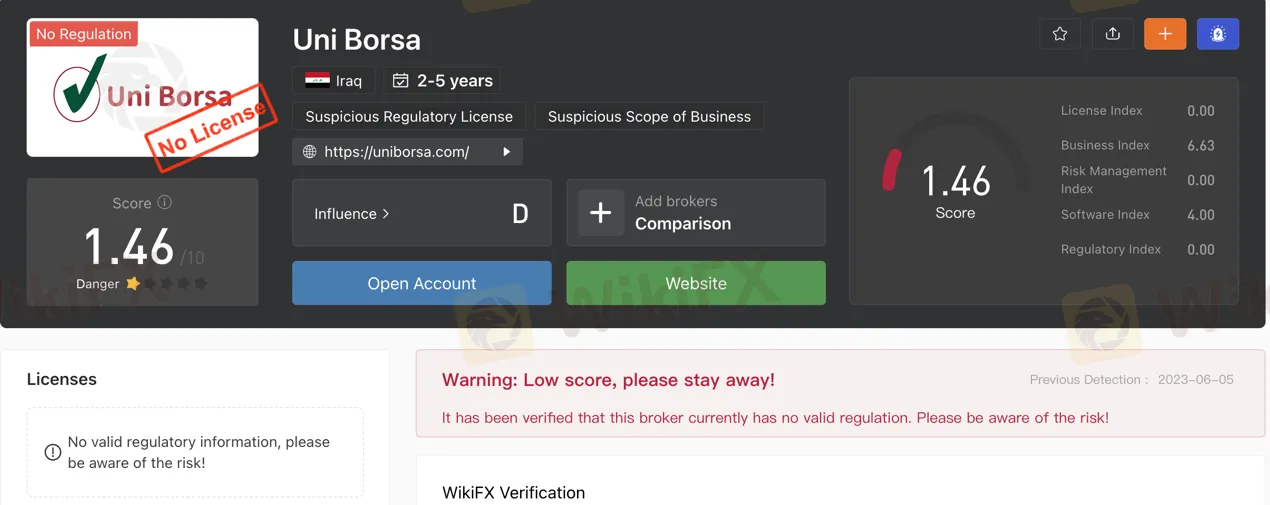

| Regulation | No Regulation (Suspicious Regulatory License) |

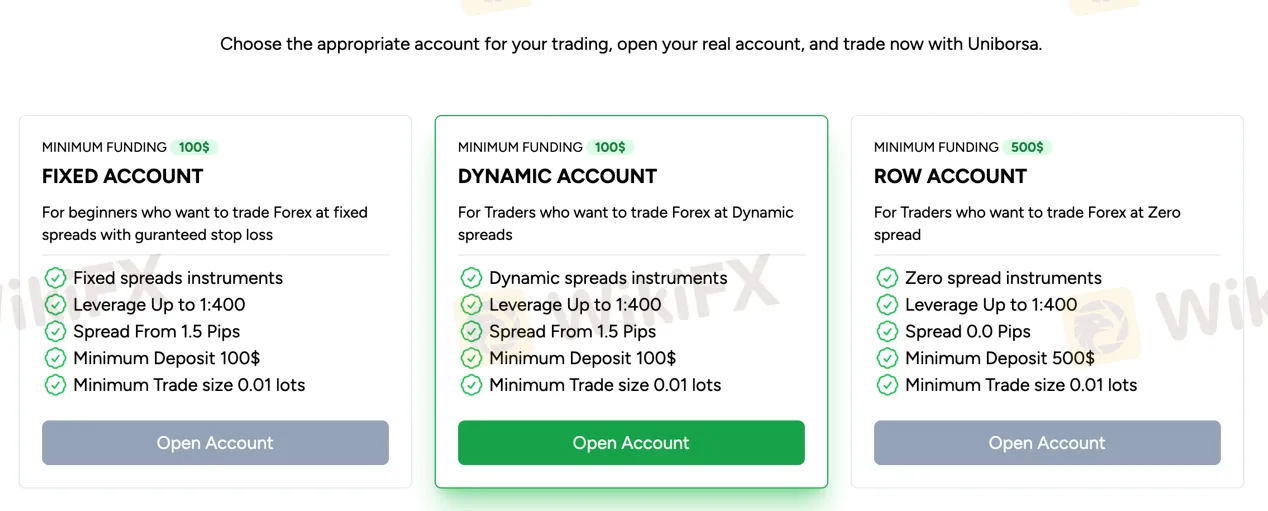

| Minimum Deposit | $100 (Fixed Account, Dynamic Account), $500 (Row Account) |

| Maximum Leverage | Up to 1:400 |

| Spreads | Fixed spreads (Fixed Account), Dynamic spreads (Dynamic Account), Zero spreads (Row Account) |

| Trading Platforms | Not specified |

| Tradable Assets | Currency pairs, energy, metals, CFDs, and other instruments (specifics not provided) |

| Account Types | Fixed Account, Dynamic Account, Row Account |

| Demo Account | Available (specifics not provided) |

| Islamic Account | Not specified |

| Customer Support | Email support, physical address, social media presence |

| Payment Methods | Not specified |

| Educational Tools | Articles |

Overview of Uni Borsa

Uni Borsa is an unregulated brokerage firm based in Iraq. As a financial service provider, the absence of valid regulation raises concerns about its credibility and reliability. Although Uni Borsa offers a wide range of market instruments, including currency pairs, energy commodities, metals, and CFDs, it is important to note that specific details about the tradable assets are not provided. The brokerage offers three types of trading accounts: Fixed Account, Dynamic Account, and Row Account, each with its own features and minimum deposit requirements. However, the lack of regulation should be taken into consideration when evaluating the benefits and risks associated with each account type.

Uni Borsa provides some customer support options, including email support, a physical address in Baghdad, Iraq, and a presence on various social media platforms. However, the absence of specified payment methods and trading platforms is a limitation in terms of convenience and transparency. The availability of a demo account is mentioned but without specific details. The educational resources provided by Uni Borsa include articles covering various topics related to trading and investing. However, the variety and depth of these resources may be limited, and the quality and accuracy may vary.

Overall, individuals interested in Uni Borsa should carefully assess the risks associated with an unregulated broker and consider alternative options that provide more transparency and regulatory oversight. It is important to conduct thorough research, evaluate the available features, and weigh the potential advantages and disadvantages before making any investment decisions.

Pros and Cons

Uni Borsa has both advantages and disadvantages that potential users should consider. On the positive side, the brokerage offers a diverse range of trading opportunities, allowing users to explore different market instruments such as currency pairs, energy commodities, metals, and CFDs. The availability of leverage is another potential benefit, enabling traders to amplify their positions. Additionally, Uni Borsa provides customer support through email, a physical address, and social media platforms, allowing for various communication channels. On the other hand, the absence of regulation raises concerns about the legitimacy and reliability of Uni Borsa as a financial service provider. There are inherent risks involved in trading, and the complexity of different instruments can pose challenges. Furthermore, the educational resources provided by Uni Borsa may be limited in variety and depth, and the quality and accuracy of information may vary. Careful consideration of these factors is essential when making investment decisions.

| Pros | Cons |

| Fixed spreads provide stability | Absence of structured learning programs |

| Stop loss feature | Higher minimum deposit for Row Account |

| Potential for tighter spreads with dynamic spreads | Dynamic spreads may result in wider spreads |

| Zero spreads in Row Account provide cost | Fixed spreads may limit potential for tighter spreads |

| Timely information through economic calendar | Potential complexity of different instruments |

| Market analysis | Limited variety of educational resources |

| Strategic planning | Lack of interactive learning experiences |

| Quality and accuracy of information may vary |

Is Uni BorsaLegit?

Uni Borsa is a brokerage firm that operates in the financial industry. However, it is important to note that there is not any information regarding Uni Borsa being a regulated broker. Regulatory bodies play a crucial role in overseeing and supervising financial institutions to ensure they adhere to specific standards and protect the interests of investors.

The absence of valid regulation raises concerns about the credibility and reliability of Uni Borsa as a financial service provider. Regulation is essential in the financial industry to maintain transparency, integrity, and investor protection. Regulated brokers are required to meet certain criteria, such as capital requirements, client fund segregation, and compliance with regulatory guidelines.

Market Instruments

Currency Pairs:

Uni Borsa offers a wide range of currency pairs for trading. Currency pairs involve the simultaneous buying and selling of different currencies. This market instrument allows traders to speculate on the exchange rate movements between two currencies. It provides opportunities to capitalize on fluctuations in currency values and make profits. Traders can employ various strategies, such as trend analysis and technical indicators, to inform their trading decisions.

Energy:

Uni Borsa provides trading opportunities in energy commodities such as oil and natural gas. Energy markets can be influenced by factors like supply and demand dynamics, geopolitical events, and weather conditions. Trading energy instruments allows investors to profit from price movements in these commodities. Traders can speculate on the direction of prices and utilize leverage to amplify potential gains or losses.

Metals:

Uni Borsa also offers trading instruments in precious metals like gold, silver, platinum, and palladium. Precious metals are often seen as safe-haven assets and can serve as a hedge against inflation or economic uncertainty. Traders can take advantage of price movements in metals by buying or selling contracts, aiming to generate profits based on their predictions.

CFDs (Contracts for Difference):

Uni Borsa provides trading opportunities through CFDs, which allow traders to speculate on the price movements of various underlying assets without actually owning the assets themselves. CFDs offer flexibility as they cover a wide range of financial instruments, including stocks, indices, commodities, and cryptocurrencies. Traders can potentially profit from both rising and falling markets by taking long or short positions.

Other Instruments:

Uni Borsa offers a variety of other market instruments, which may include stock indices, commodities, cryptocurrencies, and more. These instruments provide further opportunities for diversification and trading strategies based on specific market conditions or preferences.

| Pros | Cons |

| Diversification opportunities | Inherent risk involved |

| Leverage available | High volatility in certain instruments |

| Complexity of different instruments | |

| Regulatory considerations |

Account Types

Uni Borsa offers three types of trading accounts: Fixed Account, Dynamic Account, and Row Account. Each account type caters to different trading preferences and risk tolerances. Here is a brief description of each account type:

Fixed Account: The Fixed Account is suitable for beginners who prefer trading Forex with fixed spreads and guaranteed stop loss. This account type provides stability in spreads, allowing traders to have a clear understanding of their trading costs. The leverage offered is up to 1:400, and the minimum deposit required is $100. The minimum trade size is 0.01 lots.

Dynamic Account: The Dynamic Account is designed for traders who prefer trading Forex with dynamic spreads. Dynamic spreads can vary based on market conditions and liquidity. This account type provides traders with the potential for tighter spreads during periods of high market liquidity. Like the Fixed Account, the leverage offered is up to 1:400, and the minimum deposit required is $100. The minimum trade size is 0.01 lots.

Row Account: The Row Account is suitable for traders who want to trade Forex with zero spreads. Zero spread instruments allow traders to execute trades without incurring any spread costs. This account type may be appealing to traders who prefer a transparent cost structure and have specific trading strategies that benefit from zero spreads. The leverage offered is up to 1:400, and the minimum deposit required is $500. The minimum trade size is 0.01 lots.

| Pros | Cons |

| Fixed spreads provide stability | Dynamic spreads may result in wider spreads during low liquidity/volatility |

| Stop loss feature | Fixed spreads may limit potential for tighter spreads |

| Potential for tighter spreads with dynamic spreads | Higher minimum deposit required for Row Account |

| Zero spreads in Row Account provide cost | Each account type has its own limitations and may not suit all strategies |

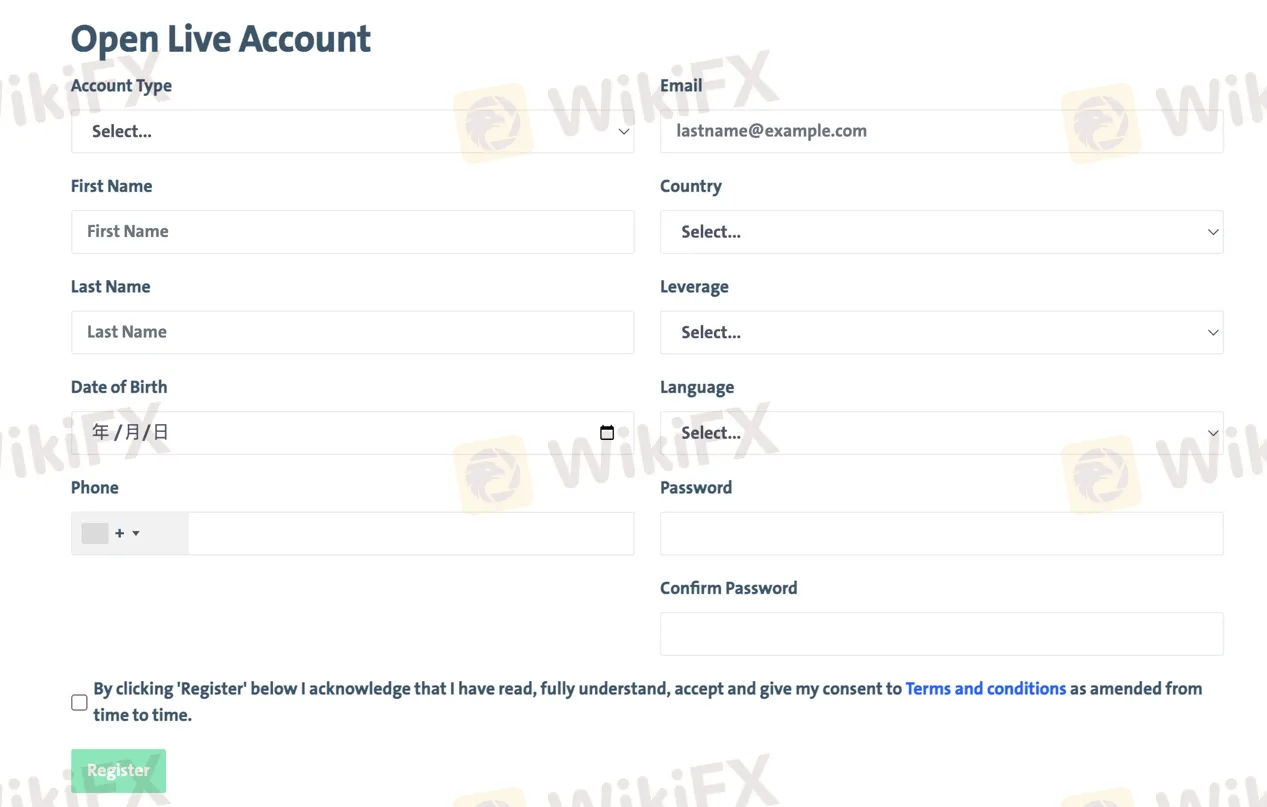

How to Open an Account?

To open an account with Uni Borsa, you can follow these steps:

Visit the Uni Borsa website: Go to the Uni Borsa website using a web browser.

Choose the account type: On the website, select the type of account you want to open. Uni Borsa typically offers options such as live accounts and demo accounts. A live account allows you to trade with real money, while a demo account provides a simulated trading environment for practice.

3. Fill in personal information: Provide your personal details accurately. Enter your first name, last name, date of birth, phone number (with the country code), email address, country of residence, preferred language, and choose a password for your account. If opening a demo account, you may not be required to provide certain details like date of birth.

4. Confirm terms and conditions: Read the terms and conditions carefully and acknowledge your acceptance by clicking the appropriate checkbox or button. Ensure that you understand the terms and conditions before proceeding.

5. Submit your registration: Once you have filled in all the required information and agreed to the terms and conditions, click on the “Register” button to submit your registration.

6. Verification process: After completing the registration, Uni Borsa may require you to verify your identity. This may involve providing additional documentation such as identification proof or address proof. Follow the instructions provided by Uni Borsa to complete the verification process.

Leverage

Uni Borsa offers leverage to its clients, allowing them to amplify their trading positions and potentially increase their profits. The leverage ratio provided by Uni Borsa is up to 1:400, meaning that traders can trade with up to 400 times their initial investment. It is important to note that leverage can be a double-edged sword, offering both advantages and disadvantages.

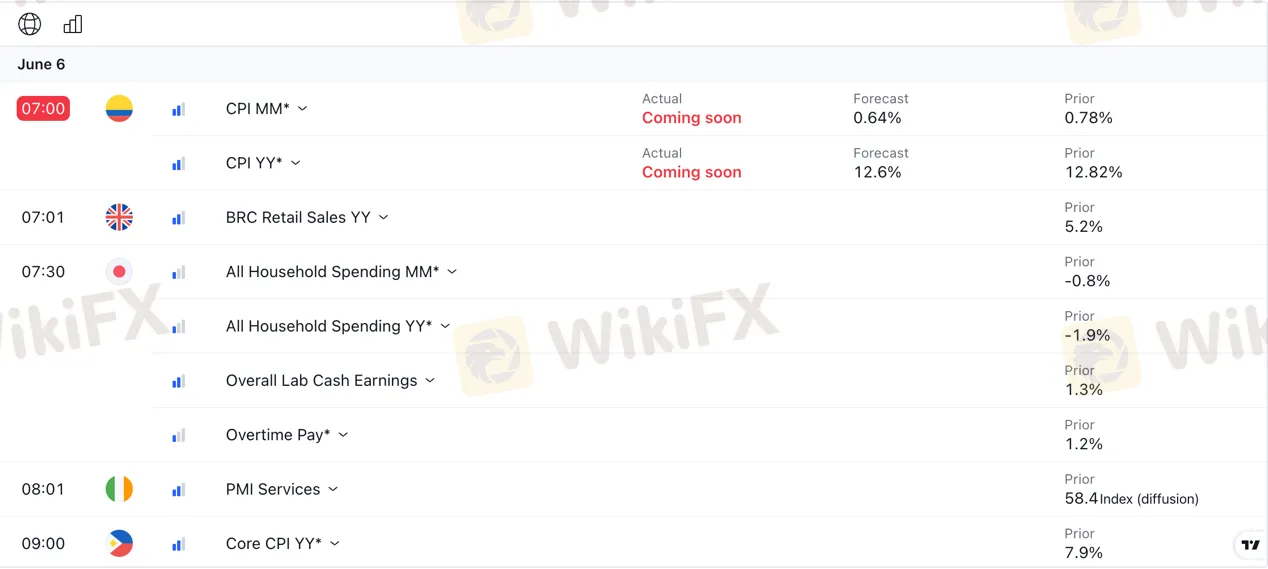

Trading Tools

Uni Borsa offers an economic calendar as one of its trading tools. The economic calendar provides information about upcoming economic events, such as interest rate announcements, GDP releases, employment data, and other important economic indicators. This tool allows traders to stay informed about key events that can impact the financial markets.

| Pros | Cons |

| Timely information | Interpretation challenges |

| Market analysis | Unexpected events |

| Strategic planning | Market reactions |

| Volatility prediction |

Educational Resources

Uni Borsa offers educational resources to assist its clients in gaining knowledge and understanding of the financial markets.

Articles: Uni Borsa provides articles covering various topics related to trading and investing. These articles aim to offer insights, analysis, and updates on market trends, specific financial instruments, and trading strategies. For example, articles like “EUR/USD bounces-back towards 1.1540” and “USD/CAD struggles near 1-1/2 week lows, eyeing 1.30 mark” may provide information about currency pairs and their recent movements.

| Pros | Cons |

| Provides insights and analysis | Limited variety of educational resources |

| Offers updates on market trends | Lack of interactive learning experiences |

| Covers a range of financial topics | Potential lack of depth in information |

| Helps clients stay informed | Quality and accuracy may vary |

| Lack of structured learning programs |

Customer Support

Customer Support of Uni Borsa can be described in the following paragraphs:

Email Support: Uni Borsa provides an email address, info@uniborsa.com, for customers to reach out with their inquiries or questions. This allows customers to communicate their concerns in writing and receive a response from the company's representatives. Email support offers a way to seek assistance without the need for immediate interaction.

Physical Address: Uni Borsa provides a physical address in AI Mansur, Baghdad, Iraq. This address may serve as a location where customers can visit in person to discuss their concerns directly with the company's representatives. A physical address can provide a sense of reliability and accessibility for customers who prefer face-to-face interactions.

Social Media Presence: Uni Borsa maintains a presence on various social media platforms such as Twitter, Facebook, Instagram, YouTube, and LinkedIn. These platforms can serve as channels for customers to engage with the company, ask questions, and seek support. Social media platforms enable real-time interactions.

Conclusion

In conclusion, Uni Borsa is a brokerage firm operating in the financial industry. However, it is important to note that there is no information available regarding Uni Borsa being a regulated broker, which raises concerns about its credibility and reliability. While Uni Borsa offers a wide range of market instruments, trading account options, and some educational resources, there are notable disadvantages to consider, such as the inherent risks involved in trading, potential complexity of different instruments, and the absence of structured learning programs. On the other hand, advantages include the potential for diversification, a wide range of trading opportunities, the availability of leverage, and certain customer support channels. It is crucial for individuals interested in Uni Borsa to carefully assess these factors and consider the risks before making any investment decisions.

FAQs

Q: Is Uni Borsa a regulated broker?

A: There is no information available regarding Uni Borsa being a regulated broker. The absence of valid regulation raises concerns about the credibility and reliability of Uni Borsa as a financial service provider.

Q: What market instruments can I trade with Uni Borsa?

A: Uni Borsa offers a variety of market instruments, including currency pairs, energy commodities, metals, CFDs (Contracts for Difference), and potentially other instruments. These instruments provide opportunities for diversification and trading strategies based on specific market conditions or preferences.

Q: What types of trading accounts does Uni Borsa offer?

A: Uni Borsa offers three types of trading accounts: Fixed Account, Dynamic Account, and Row Account. Each account type caters to different trading preferences and risk tolerances, offering features such as fixed spreads, dynamic spreads, and zero spreads.

Q: How can I open an account with Uni Borsa?

A: To open an account with Uni Borsa, you need to visit their website, choose the account type (live or demo), provide accurate personal information, agree to the terms and conditions, and submit your registration. After registration, Uni Borsa may require you to complete a verification process.

Q: What trading tools does Uni Borsa provide?

A: Uni Borsa offers an economic calendar as one of its trading tools. The economic calendar provides information about upcoming economic events that can impact the financial markets. This tool allows traders to stay informed and plan their trading strategies accordingly.

Q: What educational resources does Uni Borsa provide?

A: Uni Borsa provides articles covering various topics related to trading and investing. These articles aim to offer insights, analysis, and updates on market trends, specific financial instruments, and trading strategies. However, the variety and depth of educational resources may be limited, and the quality and accuracy may vary.

Q: How can I contact Uni Borsa's customer support?

A: Uni Borsa provides email support through the address info@uniborsa.com. Additionally, they have a physical address in AI Mansur, Baghdad, Iraq, where customers can visit in person. Uni Borsa also maintains a presence on various social media platforms, which can serve as channels for customer engagement and support.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now