Score

Trive

The Virgin Islands|10-15 years|

The Virgin Islands|10-15 years| https://www.trive.com/int/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Contact

Licenses

Single Core

1G

40G

Contact number

+44 1460944002

+49 69 66102161

+91 1800 270 4273

+82 7047318492

Other ways of contact

Broker Information

More

Trive International Ltd

Trive

The Virgin Islands

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The The Virgin Islands FSC regulation with license number: SIBA/L/14/1066 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | No deposit limit |

| Minimum Spread | From 1.2 |

| Products | Majo, minor, exotic currency pairs, commodity, indices, stock & cryptocurrency |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (9+) Neteller PerfectMoney Skrill |

| Withdrawal Method | (8+) PerfectMoney Skrill Neteller |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | 2000USD |

| Minimum Spread | From 0.6 |

| Products | Majo, minor, exotic currency pairs, commodity, indices, stock & cryptocurrency |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (9+) Neteller PerfectMoney Skrill |

| Withdrawal Method | (8+) PerfectMoney Skrill Neteller |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | No deposit limit |

| Minimum Spread | From 0.0 |

| Products | Majo, minor, exotic currency pairs, commodity, indices, stock & cryptocurrency |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (9+) Neteller PerfectMoney Skrill |

| Withdrawal Method | (8+) PerfectMoney Skrill Neteller |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | No deposit limit |

| Minimum Spread | From 1.2 |

| Products | Majo, minor, exotic currency pairs, commodity, indices, stock & cryptocurrency |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (9+) Skrill Neteller PerfectMoney |

| Withdrawal Method | (8+) PerfectMoney Skrill Neteller |

| Commission | -- |

Neteller

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 10 | 0 | Market rate | -- | EUR , USD |

Skrill

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 10 | 0 | Market rate | -- | EUR , USD |

Local Bank Transfer

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 10 | 0 | Market rate | -- | THB , ZAR , CNY , KRW , INR , VND |

PerfectMoney

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 10 | 0 | Market rate | -- | EUR , USD |

DC/EP

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 15 | 0 | Market rate | -- | USD , EUR |

AliPay

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 150 | 0 | Market rate | -- | CNY , USD |

SticPay

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 5 | 0 | Market rate | -- | USD , EUR |

Local Bank Transfer

| Minimum withdrawal | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| 10 | 0 | Market rate | 2-5 days | INR , CNY , VND , KRW , THB , ZAR |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Trive also viewed..

XM

Exness

GO MARKETS

IC Markets Global

Trive · Company Summary

Company Summary

Company profile

| Trive Review Summary | |

| Founded | 5-15 years |

| Registered Country/Region | BVI |

| Regulation | FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, FSCA, Mauritius FSC, BVI FSC |

| Market Instruments | Forex, stocks, indices, commodities, cryptocurrency |

| Leverage | 1:2000 |

| EUR/USD Spread | 1.2 pips (Std) |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | Depends on region and payment methods |

| Customer Support | Monday through Friday, 9 am - 7 pm (Email and phone) |

What is Trive?

Trive Financial Holding, based in the Netherlands, is a group of financial companies providing investment, credit, banking, wealth management and insurance services on a global scale.

Trive Investment B.V. delivers investment services through its investment platform. It has wholly owned subsidiaries spanning the globe from the United States to Europe, Africa, the Middle East, Indonesia, Australia, and Southeast Asia.

Offering investors agile customer support and rich investment experience, Trive provides constant innovation based on the client's needs. Trive keeps evolving continuously to meet market challenges and to provide a competitive edge in an ever-changing investment environment.

Trive also provides credit, banking, wealth management and insurance.

Regulatory Status

Upholding the trust of tens of thousands of investors, Trive-named companies hold licences from reputable regulatory authorities worldwide, including the Financial Industry

Regulatory Authority (FINRA) in the United States, the Australian Securities and Investments Commission (ASIC) in Australia, the Malta Financial Services Authority (MFSA) in Malta, the Capital Markets Board (CMB) in Türkiye, the Commodity Futures Trading Regulatory Agency (BAPPEBTI) in Indonesia, the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and the Financial Services Commission (FSC) in the British Virgin Islands.

Here are the displayed licenses:

Pros and Cons

| Pros | Cons |

| 9 licenses | No 24/7 customer support |

| Competitive spreads | |

| A range of trading instruments | |

| MT4 and MT5 supported | |

| A wide variety of payment options and methods | |

| 24/5 customer support | |

| No fees from deposits and withdrawals |

Market Instruments

Trive offers a range of trading instruments across several asset classes, making it a diverse trading platform that caters to the needs of many traders.

- Forex: Trive offers traders access to the world's largest and most liquid financial market, the forex market. This allows traders to speculate on the price movements of currency pairs, including major, minor, and exotic currency pairs.

- Stocks: The platform provides access to global equity markets, including those listed on major exchanges. This includes many of the world's most well-known companies, such as Apple, Amazon, and Microsoft.

- Indices: Trive offers traders access to global stock market indices, including the S&P 500, Dow Jones Industrial Average and NASDAQ, among others

- Commodities: Trive also offers traders access to commodity markets, including precious metals such as gold, silver and platinum.

- Cryptocurrency: Trive provides traders with access to cryptocurrency markets, including Bitcoin, Ethereum, Litecoin, and Ripple, among others.

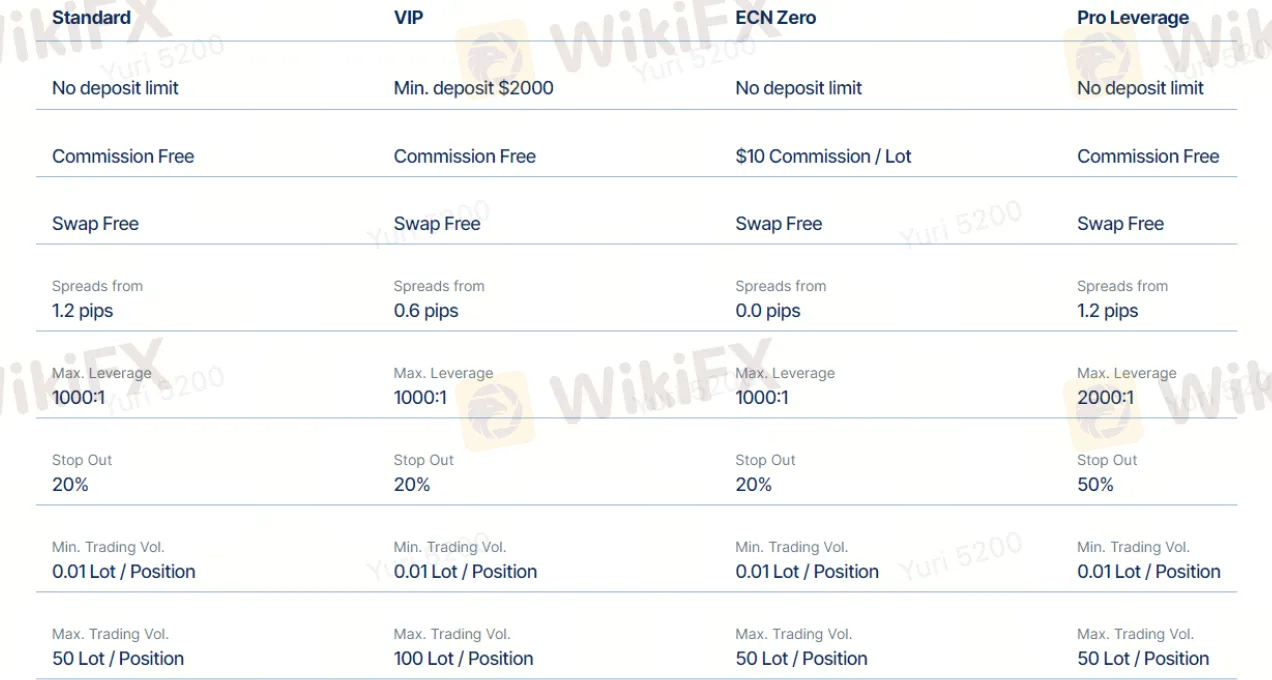

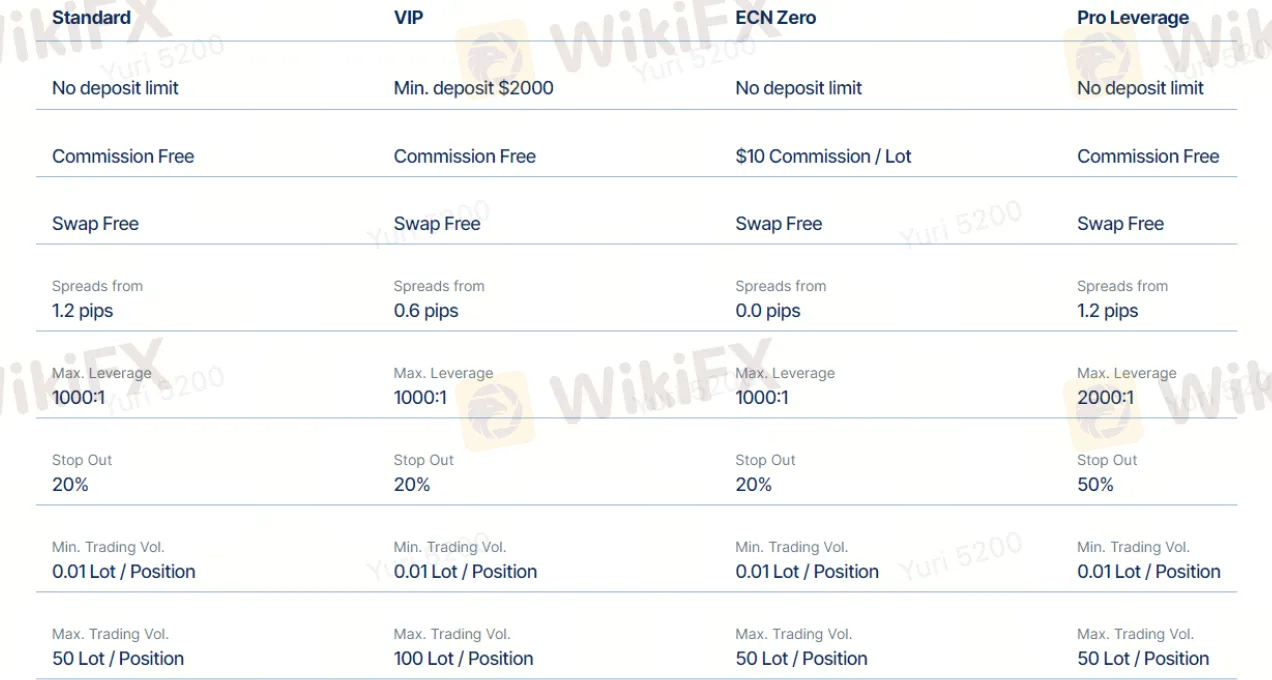

Account Types

Standard Account:

The Standard Account is designed for new traders who are just starting in forex trading. It requires no minimum deposit.

Pro-Leverage Account:

The Pro-Leverage Account is designed for more experienced traders who are looking for a wider range of trading instruments. It requires no minimum deposit

VIP Account:

The VIP Account is designed for advanced traders who are looking for superior trading conditions. It requires a minimum deposit of $2,000 and offers traders access to trading, as well as lower spreads and commissions.

ECN Zero Account:

The ECN Zero Account is designed for high-volume traders who require competitive spreads and faster order execution. It requires no minimum deposit.

The following is a table comparing the features of each account:

| Feature | Standard Account | VIP | ECN Zero | Pro Leverage |

| Trading Varieties | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency |

| Major Spreads | From 1.2 pips | From 0.6 pips | From 0.0 pips | From 1.2 pips |

| Spread Type | Floating | Floating | Floating | Floating |

| Explosion Rate | 20% | 20% | 20% | 50% |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:2000 |

| Deposit Requirement | No deposit limit | 2000 USD | No deposit limit | No deposit limit |

| Minimum Position | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot |

| Scalping Allowed | Allowed | Allowed | Allowed | Allowed |

| EA Trading Allowed | Allowed | Allowed | Allowed | Allowed |

| Locking Allowed | Allowed | Allowed | Allowed | Allowed |

Leverage

Trive offers leverage of up to 1:2000, allowing traders to control larger market positions than their account balance would permit. This can lead to greater returns, as small price movements can yield significant profits. However, it also increases potential losses, risking more than the initial investment.

To manage these risks, Trive advises traders to use leverage responsibly by understanding the associated risks and ensuring they have adequate experience. Traders should avoid over-leveraging and only risk what they can afford to lose. Utilizing risk management tools, like stop-loss orders, is also recommended to limit potential losses.

Spreads & Commissions

Trive offers various spread options for its clients. The Standard and Pro accounts have a spread of 1.2 pips with no additional commission, while the VIP account features a spread of 0.6 pips, also with no commission. Traders pay a fixed spread for each trade, regardless of size.

Additionally, the ECN Zero account offers a spread of 0.0 pips, but incurs a commission fee of $10 per lot traded, catering to those who prioritize tight spreads and are willing to pay for this benefit.

Trading Platforms

Trive provides its clients with the popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer a wide range of features and tools that cater to the needs of different types of traders, from beginners to experienced professionals.

MetaTrader 4 (MT4)

MT4 is a widely recognized and established platform in the forex and CFD trading industry. Trive clients using MT4 can access real-time market quotes, execute trades, and manage their positions with ease. The platform supports various types of orders, including market, pending, and stop orders. Traders can also utilise automated trading strategies with the help of expert advisors (EAs), which can be developed or downloaded from the MetaTrader's extensive library.

MetaTrader 5 (MT5)

MT5 offers an enhanced trading experience, building upon MT4's foundation. Traders using MT5 can access a broader range of financial instruments, including stocks, futures, and options, in addition to forex and CFDs. The platform also offers more advanced charting tools and technical indicators, enabling traders to perform in-depth market analysis. MT5 introduces a revised MQL programming language, allowing for more efficient development and customization of indicators and trading robots.

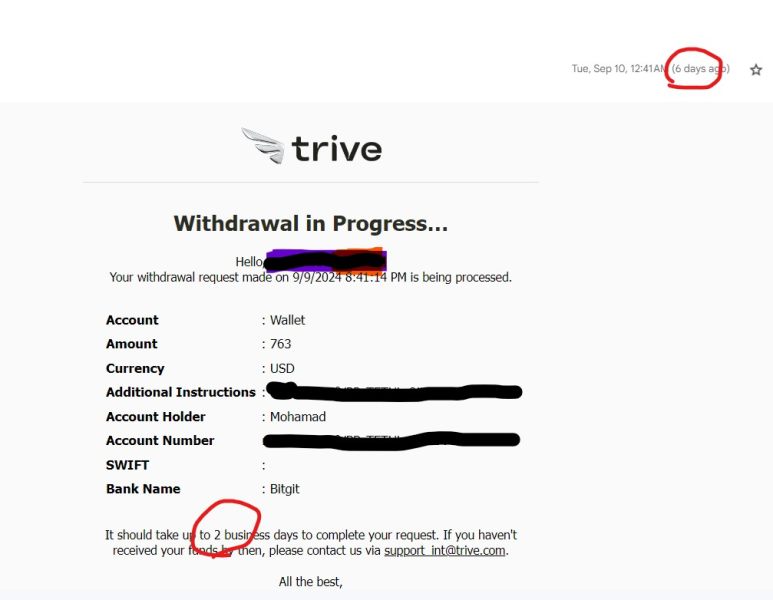

Deposits & Withdrawals

Trive prioritises client satisfaction by offering a variety of convenient and secure deposit and withdrawal methods that ensure seamless transactions. Clients can effortlessly fund their trading accounts via diverse payment options including credit cards and debit cards (such as Visa and MasterCard), electronic payment systems (Alipay, E-CNY, Neteller, Skrill, Sticpay, AstroPay, Perfect Money), international bank transfer (SWIFT) for USD, EUR, GBP available while local transfers for INR,

CNY, THB, VND, KRW, ZAR, PHP available, and digital assets (Tether - ERC20, TRC20, and BinancePay).

Importantly, there are no deposit fees associated with any of these funding options, enhancing overall client experience. Each funding option supports different currencies - credit cards accommodate all famous currencies, e-payments cater to USD and EUR, local bank transfers are available for INR, CNY, THB, VND, KRW, PHP and TWD, while Tether supports ERC20, TRC20, and BinancePay.

Here is the table that includes the detailed information on deposit and withdrawal methods:

| Deposit & Withdrawal Method | Handling Fee | Deposit Rate | Minimum Deposit | Withdrawal Process Time | Supported Currencies |

| Local Bank Transfer | 0 | Market rate | Depends on region | 1 business day (may take up to 2-3 business days) | INR, CNY, THB, VND, KRW, ZAR, PHP |

| International Bank Transfer (SWIFT) | 0 | Market rate | 300 | 2-5 business days | USD, EUR, GBP |

| Electronic Payment Systems | 0 | Market rate | 10 | 1 business day | USD, EUR |

| E-Wallet - AliPay | 0 | Market rate | 150 | N/A | USD, CNY |

| E-Wallet - DC/EP | 0 | Market rate | 15 | 1 business day | USD, EUR |

| Cryptocurrency | 0 | Market rate | 5 | 1 business day | USDT ERC20, USDT TRC20 |

Trading Central

Trading Central is accessible to all Trive customers with a live account, offering valuable insights and analysis. Simply log in to your secure client area and click the analysis tab. From there, you can seamlessly log in to view the latest market feed, expert analysis, and cutting-edge research tailored to your needs.

Additionally, TC Alpha Generation Indicators are available for download as a plugin, enabling installation directly onto your MetaTrader platform for enhanced trading capabilities.

Trive offers economic calenders as well to all traders. This ensures proper information is reached to traders in a timely and accurate manner.

Trive PAMM

Trive PAMM Service is an investment solution that enables traders of all levels to collaborate and take advantage of market opportunities. Our service empowers you to trade alongside experienced money managers (Masters) with verified track records. You can choose a Master whose investing strategy aligns with your goals. If you join us as a Master, you can attract followers who invest in your trading expertise and monetize your strategies with performance fees.

Trive MAM

Trive offers Multi Account Manager (MAM) for substitute fund and account management.

A MAM account allows all ordinary order types to be simultaneously executed, securely across multiple accounts from just one master account. Our MAM technology lets you allocate your trades in five different modules.

Trive HUB

Explore our comprehensive financial education platform, where market insights, expert guidance, and premium content come together to shape your investment journey. Whether it's stocks, currencies, or cryptocurrencies that pique your interest, we provide the knowledge you need to make informed decisions.

Promotions Available

(Hold for Now)

Become a partner (IB)

Join Trive's partner program today for a rewarding affiliate experience with the highest payouts and a globally regulated broker.

Partners have the power to set their contracts with unprecedented flexibility to meet unique business needs. Define every aspect of your contracts - markup, rates, and more - based on your business model. Customize in just a few clicks, making it easier than ever to adapt to market and client demands.

By joining our competition-beating affiliate program, you can earn attractive commissions, revenue for promoting our offers in a variety of ways: website promotions, emails, social media campaigns, and more!

Frequently asked questions about Trive

Is Trive a regulated company?

Yes, Trive is regulated by multiple agencies such as FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, FSCA, Mauritius FSC, BVI FSC.

What are the account types offered by Trive?

Trive offers four account types: Standard Account, VIP Account, ECN Zero, Pro Leverage Account.

What is the minimum deposit required to open a Trive account?

There is no minimum deposit for Standard Account, ECN Zero, and Pro Leverage Account. Meanwhile for VIP account a minimum deposit of $2000 is required.

What trading platforms does Trive offer?

Trive offers the most popular trading platforms in the industry: MT4 and MT5.

What is the maximum leverage offered by Trive?

The maximum leverage offered by Trive is 1:2000.

Does Trive offer a demo account?

Yes, Trive offers a demo account for clients to practice without risking their own money.

| Trive Review Summary | |

| Founded | 5-15 years |

| Registered Country/Region | BVI |

| Regulation | FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, FSCA, Mauritius FSC, BVI FSC |

| Market Instruments | Forex, stocks, indices, commodities, cryptocurrency |

| Leverage | 1:2000 |

| EUR/USD Spread | 1.2 pips (Std) |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | Depends on region and payment methods |

| Customer Support | Monday through Friday, 9 am - 7 pm (Email and phone) |

What is Trive?

Trive Financial Holding, based in the Netherlands, is a group of financial companies providing investment, credit, banking, wealth management and insurance services on a global scale.

Trive Investment B.V. delivers investment services through its investment platform. It has wholly owned subsidiaries spanning the globe from the United States to Europe, Africa, the Middle East, Indonesia, Australia, and Southeast Asia.

Offering investors agile customer support and rich investment experience, Trive provides constant innovation based on the client's needs. Trive keeps evolving continuously to meet market challenges and to provide a competitive edge in an ever-changing investment environment.

Trive also provides credit, banking, wealth management and insurance.

Regulatory Status

Upholding the trust of tens of thousands of investors, Trive-named companies hold licences from reputable regulatory authorities worldwide, including the Financial Industry

Regulatory Authority (FINRA) in the United States, the Australian Securities and Investments Commission (ASIC) in Australia, the Malta Financial Services Authority (MFSA) in Malta, the Capital Markets Board (CMB) in Türkiye, the Commodity Futures Trading Regulatory Agency (BAPPEBTI) in Indonesia, the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and the Financial Services Commission (FSC) in the British Virgin Islands.

Here are the displayed licenses:

Pros and Cons

| Pros | Cons |

| 9 licenses | No 24/7 customer support |

| Competitive spreads | |

| A range of trading instruments | |

| MT4 and MT5 supported | |

| A wide variety of payment options and methods | |

| 24/5 customer support | |

| No fees from deposits and withdrawals |

Market Instruments

Trive offers a range of trading instruments across several asset classes, making it a diverse trading platform that caters to the needs of many traders.

- Forex: Trive offers traders access to the world's largest and most liquid financial market, the forex market. This allows traders to speculate on the price movements of currency pairs, including major, minor, and exotic currency pairs.

- Stocks: The platform provides access to global equity markets, including those listed on major exchanges. This includes many of the world's most well-known companies, such as Apple, Amazon, and Microsoft.

- Indices: Trive offers traders access to global stock market indices, including the S&P 500, Dow Jones Industrial Average and NASDAQ, among others

- Commodities: Trive also offers traders access to commodity markets, including precious metals such as gold, silver and platinum.

- Cryptocurrency: Trive provides traders with access to cryptocurrency markets, including Bitcoin, Ethereum, Litecoin, and Ripple, among others.

Account Types

Standard Account:

The Standard Account is designed for new traders who are just starting in forex trading. It requires no minimum deposit.

Pro-Leverage Account:

The Pro-Leverage Account is designed for more experienced traders who are looking for a wider range of trading instruments. It requires no minimum deposit

VIP Account:

The VIP Account is designed for advanced traders who are looking for superior trading conditions. It requires a minimum deposit of $2,000 and offers traders access to trading, as well as lower spreads and commissions.

ECN Zero Account:

The ECN Zero Account is designed for high-volume traders who require competitive spreads and faster order execution. It requires no minimum deposit.

The following is a table comparing the features of each account:

| Feature | Standard Account | VIP | ECN Zero | Pro Leverage |

| Trading Varieties | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency | Major, minor, exotic currency pairs, commodities, indices, stocks & cryptocurrency |

| Major Spreads | From 1.2 pips | From 0.6 pips | From 0.0 pips | From 1.2 pips |

| Spread Type | Floating | Floating | Floating | Floating |

| Explosion Rate | 20% | 20% | 20% | 50% |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:2000 |

| Deposit Requirement | No deposit limit | 2000 USD | No deposit limit | No deposit limit |

| Minimum Position | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot |

| Scalping Allowed | Allowed | Allowed | Allowed | Allowed |

| EA Trading Allowed | Allowed | Allowed | Allowed | Allowed |

| Locking Allowed | Allowed | Allowed | Allowed | Allowed |

Leverage

Trive offers leverage of up to 1:2000, allowing traders to control larger market positions than their account balance would permit. This can lead to greater returns, as small price movements can yield significant profits. However, it also increases potential losses, risking more than the initial investment.

To manage these risks, Trive advises traders to use leverage responsibly by understanding the associated risks and ensuring they have adequate experience. Traders should avoid over-leveraging and only risk what they can afford to lose. Utilizing risk management tools, like stop-loss orders, is also recommended to limit potential losses.

Spreads & Commissions

Trive offers various spread options for its clients. The Standard and Pro accounts have a spread of 1.2 pips with no additional commission, while the VIP account features a spread of 0.6 pips, also with no commission. Traders pay a fixed spread for each trade, regardless of size.

Additionally, the ECN Zero account offers a spread of 0.0 pips, but incurs a commission fee of $10 per lot traded, catering to those who prioritize tight spreads and are willing to pay for this benefit.

Trading Platforms

Trive provides its clients with the popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer a wide range of features and tools that cater to the needs of different types of traders, from beginners to experienced professionals.

MetaTrader 4 (MT4)

MT4 is a widely recognized and established platform in the forex and CFD trading industry. Trive clients using MT4 can access real-time market quotes, execute trades, and manage their positions with ease. The platform supports various types of orders, including market, pending, and stop orders. Traders can also utilise automated trading strategies with the help of expert advisors (EAs), which can be developed or downloaded from the MetaTrader's extensive library.

MetaTrader 5 (MT5)

MT5 offers an enhanced trading experience, building upon MT4's foundation. Traders using MT5 can access a broader range of financial instruments, including stocks, futures, and options, in addition to forex and CFDs. The platform also offers more advanced charting tools and technical indicators, enabling traders to perform in-depth market analysis. MT5 introduces a revised MQL programming language, allowing for more efficient development and customization of indicators and trading robots.

Deposits & Withdrawals

Trive prioritises client satisfaction by offering a variety of convenient and secure deposit and withdrawal methods that ensure seamless transactions. Clients can effortlessly fund their trading accounts via diverse payment options including credit cards and debit cards (such as Visa and MasterCard), electronic payment systems (Alipay, E-CNY, Neteller, Skrill, Sticpay, AstroPay, Perfect Money), international bank transfer (SWIFT) for USD, EUR, GBP available while local transfers for INR,

CNY, THB, VND, KRW, ZAR, PHP available, and digital assets (Tether - ERC20, TRC20, and BinancePay).

Importantly, there are no deposit fees associated with any of these funding options, enhancing overall client experience. Each funding option supports different currencies - credit cards accommodate all famous currencies, e-payments cater to USD and EUR, local bank transfers are available for INR, CNY, THB, VND, KRW, PHP and TWD, while Tether supports ERC20, TRC20, and BinancePay.

Here is the table that includes the detailed information on deposit and withdrawal methods:

| Deposit & Withdrawal Method | Handling Fee | Deposit Rate | Minimum Deposit | Withdrawal Process Time | Supported Currencies |

| Local Bank Transfer | 0 | Market rate | Depends on region | 1 business day (may take up to 2-3 business days) | INR, CNY, THB, VND, KRW, ZAR, PHP |

| International Bank Transfer (SWIFT) | 0 | Market rate | 300 | 2-5 business days | USD, EUR, GBP |

| Electronic Payment Systems | 0 | Market rate | 10 | 1 business day | USD, EUR |

| E-Wallet - AliPay | 0 | Market rate | 150 | N/A | USD, CNY |

| E-Wallet - DC/EP | 0 | Market rate | 15 | 1 business day | USD, EUR |

| Cryptocurrency | 0 | Market rate | 5 | 1 business day | USDT ERC20, USDT TRC20 |

Trading Central

Trading Central is accessible to all Trive customers with a live account, offering valuable insights and analysis. Simply log in to your secure client area and click the analysis tab. From there, you can seamlessly log in to view the latest market feed, expert analysis, and cutting-edge research tailored to your needs.

Additionally, TC Alpha Generation Indicators are available for download as a plugin, enabling installation directly onto your MetaTrader platform for enhanced trading capabilities.

Trive offers economic calenders as well to all traders. This ensures proper information is reached to traders in a timely and accurate manner.

Trive PAMM

Trive PAMM Service is an investment solution that enables traders of all levels to collaborate and take advantage of market opportunities. Our service empowers you to trade alongside experienced money managers (Masters) with verified track records. You can choose a Master whose investing strategy aligns with your goals. If you join us as a Master, you can attract followers who invest in your trading expertise and monetize your strategies with performance fees.

Trive MAM

Trive offers Multi Account Manager (MAM) for substitute fund and account management.

A MAM account allows all ordinary order types to be simultaneously executed, securely across multiple accounts from just one master account. Our MAM technology lets you allocate your trades in five different modules.

Trive HUB

Explore our comprehensive financial education platform, where market insights, expert guidance, and premium content come together to shape your investment journey. Whether it's stocks, currencies, or cryptocurrencies that pique your interest, we provide the knowledge you need to make informed decisions.

Promotions Available

(Hold for Now)

Become a partner (IB)

Join Trive's partner program today for a rewarding affiliate experience with the highest payouts and a globally regulated broker.

Partners have the power to set their contracts with unprecedented flexibility to meet unique business needs. Define every aspect of your contracts - markup, rates, and more - based on your business model. Customize in just a few clicks, making it easier than ever to adapt to market and client demands.

By joining our competition-beating affiliate program, you can earn attractive commissions, revenue for promoting our offers in a variety of ways: website promotions, emails, social media campaigns, and more!

Frequently asked questions about Trive

Is Trive a regulated company?

Yes, Trive is regulated by multiple agencies such as FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, FSCA, Mauritius FSC, BVI FSC.

What are the account types offered by Trive?

Trive offers four account types: Standard Account, VIP Account, ECN Zero, Pro Leverage Account.

What is the minimum deposit required to open a Trive account?

There is no minimum deposit for Standard Account, ECN Zero, and Pro Leverage Account. Meanwhile for VIP account a minimum deposit of $2000 is required.

What trading platforms does Trive offer?

Trive offers the most popular trading platforms in the industry: MT4 and MT5.

What is the maximum leverage offered by Trive?

The maximum leverage offered by Trive is 1:2000.

Does Trive offer a demo account?

Yes, Trive offers a demo account for clients to practice without risking their own money.

News

NewsTRIVE REVIEW: IS IT A GOOD CHOICE FOR TRADERS?

Trive is a Malta-based trading platform that has been operating for approximately 5-10 years. It is regulated by MFSA.

WikiFX

WikiFX

NewsGKFX Prime and Fairmarkets Evolves into Trive: A Strategic Move Towards Financial Empowerment

GKFX Prime and Fairmarkets Evolves into Trive

WikiFX

WikiFX

NewsThriving Forward: Trive Group's Strategic Takeover of GKFX Prime and FairMarkets

Trive Group's Strategic Takeover of GKFX Prime and FairMarkets

WikiFX

WikiFX

ReviewDaily Outlook: Continue Long Pound?

All indicators point towards a bullish scenario for GBP/USD. The improvement in global risk sentiment is strengthening GBP and weakening USD. Both retail sentiment and seasonality analyses align, recommending a long position for GBP/USD, emphasizing the potential for GBP gains and USD losses.

WikiFX

WikiFX

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now