Score

Bold Prime

Comoros|2-5 years|

Comoros|2-5 years| https://boldprime.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Single Core

1G

40G

Disclosure

Danger

Contact number

Other ways of contact

Broker Information

More

Bold Prime Limited

Bold Prime

Comoros

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

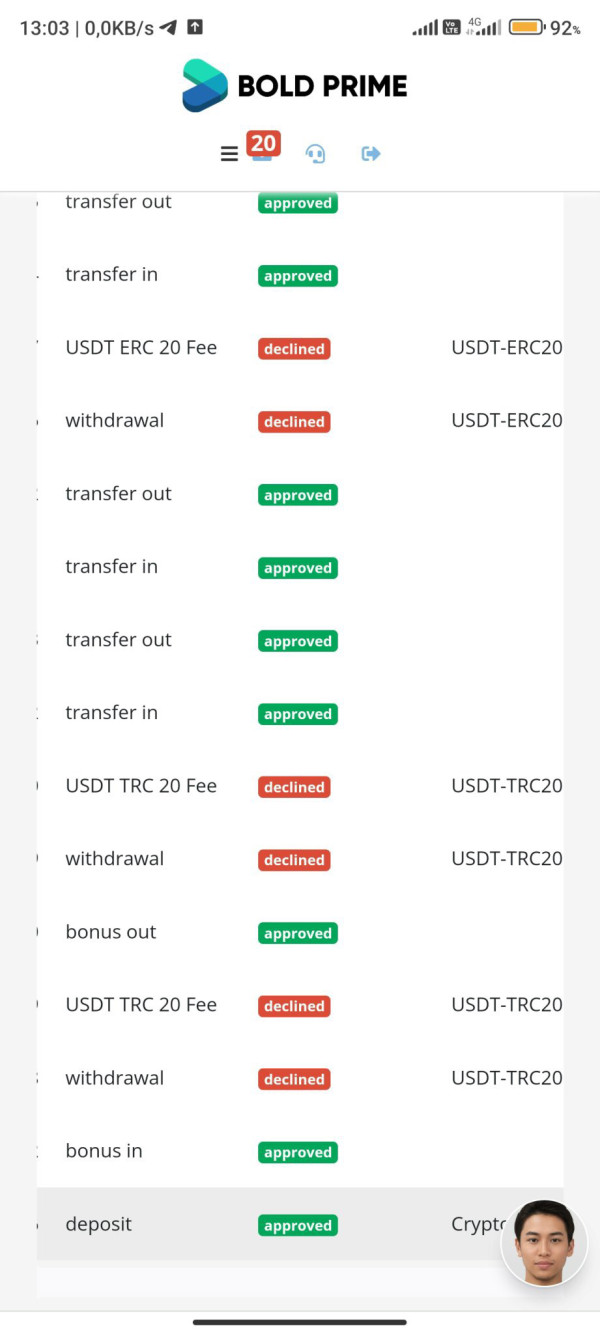

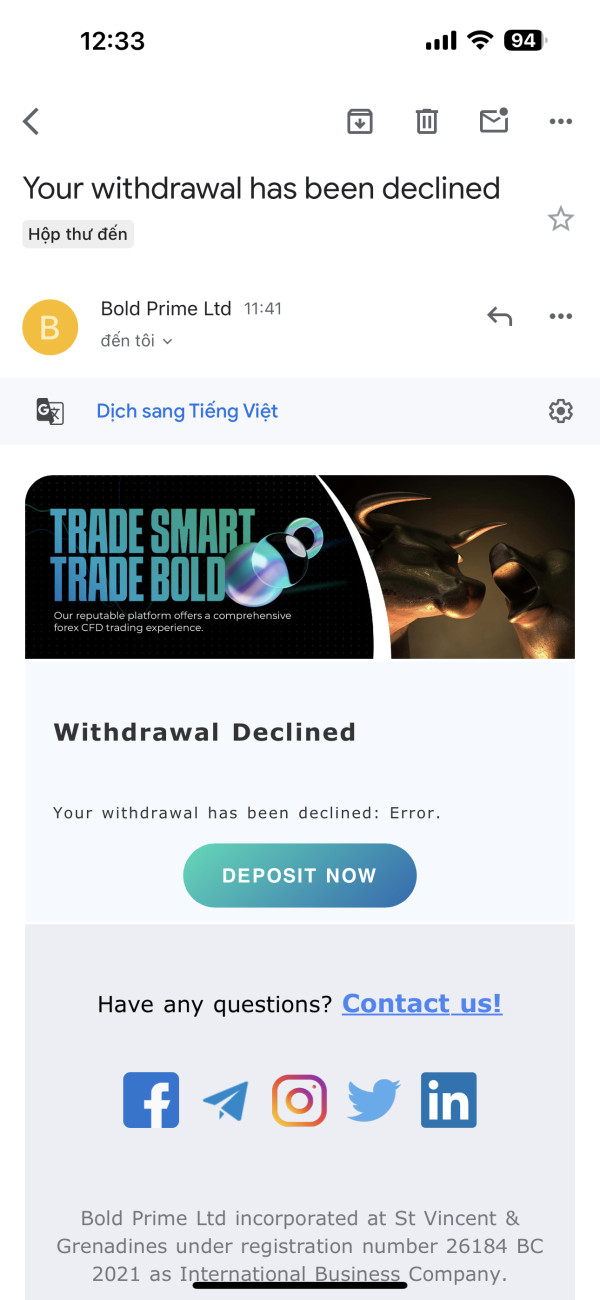

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | $15 |

| Minimum Spread | from 1.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $0.00 |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:2000 |

| Minimum Deposit | $15 |

| Minimum Spread | from 0.1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $0.07 |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:300 |

| Minimum Deposit | $400 |

| Minimum Spread | from 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $7.00 |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:300 |

| Minimum Deposit | $150 |

| Minimum Spread | from 0.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | $7.00 |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Bold Prime also viewed..

XM

Neex

STARTRADER

IC Markets Global

Bold Prime · Company Summary

| Bold Prime | Basic Information |

| Registered Country/Region | Australia |

| Founded in | 2020 |

| Company Name | Bold Prime Limited |

| Regulation | ASIC(AR Licens), FinCEN (Crypto-License) |

| Minimum Deposit | $15 |

| Trading Assets | Forex, Stocks, Cryptocurrencies, Commodities |

| Account Types | Standard, Prime Raw, Prime Platinum |

| Trading Platforms | MT4, MT5 |

| Leverage | Up to 1:1000 |

| Spreads and Commissions | Floating spreads from 0.0 pips, no commissions |

| Deposits and Withdrawal | Bank Transfer, Credit/Debit Card, E-Wallets, Crypto |

| Customer Support | 24/7 support via phone, email, and live chat |

| Educational Resources | Limited educational resources, including trading articles and tutorials |

| Copy Trading | No |

Overview of Bold Prime

Bold Prime Limited is an Australian-based online brokerage firm that offers a variety of tradable assets, including forex, commodities, indices, and cryptocurrencies. The company was founded in 2020 and provides its clients with competitive leverage of up to 1:1000 on forex trading, making it an attractive option for traders seeking high levels of potential profit. Bold Prime also offers multiple account types with varying minimum deposit requirements and features to suit different trading strategies and preferences. The trading platforms offered by Bold Prime are the popular MetaTrader 4 and MetaTrader 5 platforms, which are known for its advanced charting capabilities and user-friendly interface. In addition to its trading services, Bold Prime places a strong emphasis on customer support, providing 24/5 multilingual assistance via live chat, phone, and email.

Is Bold Prime Legit or a scam?

It seems that Bold Prime is a regulated broker, with two entities under regulation:

Bold Prime Limited is authorized and regulated by the Financial Crimes Enforcement Network, holding a Crypto-Licence license, with regulatory license number: 31000223201128.

BOLD PRIME (AU) PTY LTD is authorized by the Australia Securities & Investment Commission (ASIC), holding a license of Appointed Representative(AR), with regulatory license no. 001300520.

Pros and Cons

When considering a brokerage firm for your trading needs, it's important to weigh the advantages and disadvantages before making a decision. Bold Prime is no exception, and as seen in the above table detailing its pros and cons, there are several key factors to take into account. While the broker offers a range of tradable assets, competitive leverage, and user-friendly trading platforms, it's important to also consider factors such as limited educational resources and potential withdrawal fees. By carefully evaluating these pros and cons, you can make an informed decision about whether Bold Prime is the right choice for your trading needs.

| Pros | Cons |

| High leverage options up to 1:500 | Limited payment options for deposits and withdrawals |

| Wide range of account types | Clients from some countries are not accepted |

| User-friendly MetaTrader 4 & 5 platform | No proprietary trading platform |

| Online Chat Available | Limited educational resources |

| Minimum deposit of $15 | No 7/24 customer support |

| Zero deposit fees | |

| Demo accounts and Islamic accounts offered |

Market Intruments

Bold Prime offers a variety of tradable instruments across multiple asset classes to its clients. The following are the major categories of instruments that can be traded on Bold Prime's platform:

Forex: Bold Prime offers access to major, minor, and exotic currency pairs for trading. Traders can take advantage of the 24-hour market and high liquidity of the forex market to trade with tight spreads and low commissions.

Indices: Bold Prime provides traders with the ability to trade on a range of global indices, including the S&P 500, NASDAQ, FTSE 100, and more.

Commodities: Traders can also trade commodities such as gold, silver, crude oil, and natural gas on Bold Prime's platform.

Cryptocurrencies: Bold Prime offers trading in popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, as well as other altcoins.

Account Types

Bold Prime offers three types of trading accounts: Standard, Prime Raw, and Prime Platinum. Each account has its own set of features and requirements to cater to different levels of traders.

The Standard account is suitable for beginners and requires a minimum deposit of $15. It offers variable spreads starting from 1.8 pips, and a leverage of up to 1:500. Traders can access over 200 trading instruments, including forex, commodities, indices, and cryptocurrencies.

The Prime Raw account is designed for experienced traders and requires a minimum deposit of $150. This account offers raw spreads starting from 0.2 pips, with a commission of $7 per lot traded. The leverage offered is up to 1:400, and traders can access over 250 trading instruments.

The Prime Platinum account is for advanced traders who require more competitive pricing and a tailored trading experience. It requires a minimum deposit of $150, with spreads starting from 0.0 pips and a commission of $7 per lot traded. The leverage offered is up to 1:200, and traders can access over 300 trading instruments.

| Pros | Cons |

| Standard account requires a low minimum deposit of $15 | Limited number of account types to choose from |

| Wide variety of tradable assets across all account types | High commission on Prime Raw and Prime Platinum accounts |

| High leverage offered on Standard and Prime Raw accounts | Prime Platinum account requires a higher minimum deposit |

| Raw spreads starting from 0.2 pips on Prime Raw account | |

| Tailored trading experience for advanced traders on Prime Platinum account | |

| Competitive pricing on Prime Platinum account |

Demo Accounts

Bold Prime offers a free demo account to traders who want to test their trading strategies and familiarize themselves with the trading platform before opening a live account. The demo account simulates real market conditions and allows traders to practice trading with virtual funds. The demo account is available for all three account types and comes with all the features of a live account.

The demo account is a useful tool for beginners who want to learn the basics of trading and for experienced traders who want to test new trading strategies without risking their capital. It allows traders to get a feel for the market, practice analyzing charts and indicators, and learn how to manage risk.

One of the advantages of Bold Prime's demo account is that it is available for an unlimited period, which means that traders can use it as long as they need to. The demo account is also easy to set up and does not require any personal information or deposits.

How to open an account?

Go to the Bold Prime website and click on the “Open Account” button.

2. Fill in the registration form with your personal information, including name, email address, and phone number.

3.Choose the account type you want to open and fill in the required information, such as your country of residence, trading experience, and financial information.

4.Upload your verification documents, such as a copy of your ID and proof of address.

5. Once your account is verified, you can fund your account and start trading.

Leverage

Bold Prime offers flexible leverage options for traders, providing them with the ability to amplify their potential profits, but it's important to note that high leverage also carries a higher level of risk. The maximum leverage offered by Bold Prime is 1:500 for the Standard account, 1:400 for the Prime Raw account, and 1:200 for the Prime Platinum account, giving traders the ability to trade larger positions with a smaller amount of capital, but also requiring them to exercise caution and implement effective risk management strategies.

Spreads & Commissions (Trading Fees)

Bold Prime offers competitive spreads and commissions to its clients. The spreads vary depending on the account type and market conditions. The Standard account has variable spreads starting from 1.8 pips, while the Prime Raw and Prime Platinum accounts offer raw spreads starting from 0.2 pips and 0.0 pips, respectively, with a commission of $7 per lot traded. This means that traders who choose the Prime Raw or Prime Platinum accounts can benefit from lower trading costs, but they also have to pay a commission on top of the spread. Overall, Bold Prime's spreads and commissions are competitive when compared to other brokers in the industry, making it an attractive option for traders looking to keep their trading costs low.

| Pros | Cons |

| Competitive spreads for Prime Raw | Standard account has higher spreads |

| No commission for Standard account | Prime accounts require a higher deposit |

| Low commission for Prime Raw/Platinum | |

| Raw spreads for Prime Raw/Platinum |

Non-Trading Fees

Bold Prime does not charge any fees for deposits or withdrawals made via bank wire transfer or cryptocurrency. However, there may be fees associated with certain payment methods, such as credit/debit card or e-wallet transfers, which are imposed by the payment providers themselves. Additionally, there are no inactivity or account maintenance fees charged by the broker.

Trading Platform

Bold Prime offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are widely recognized as some of the most powerful and user-friendly trading platforms in the industry. MT4 and MT5 are available for desktop, web, and mobile devices, allowing traders to access the platform anytime and anywhere. These platforms offer a range of advanced charting and analysis tools, multiple order types, and customizable indicators and Expert Advisors (EAs) for automated trading. Traders can also take advantage of social trading features and copy trading options available on both platforms.

| Broker | Platform Options | Mobile Trading | Web Trading | Desktop Trading |

| Bold Prime | MetaTrader 4, MetaTrader 5 | Yes | Yes | Yes |

| AvaTrade | MetaTrader 4, MetaTrader 5 | Yes | Yes | Yes |

| IC Markets | MetaTrader 4, MetaTrader 5 | Yes | Yes | Yes |

| FP Markets | MetaTrader 4, MetaTrader 5 | Yes | Yes | Yes |

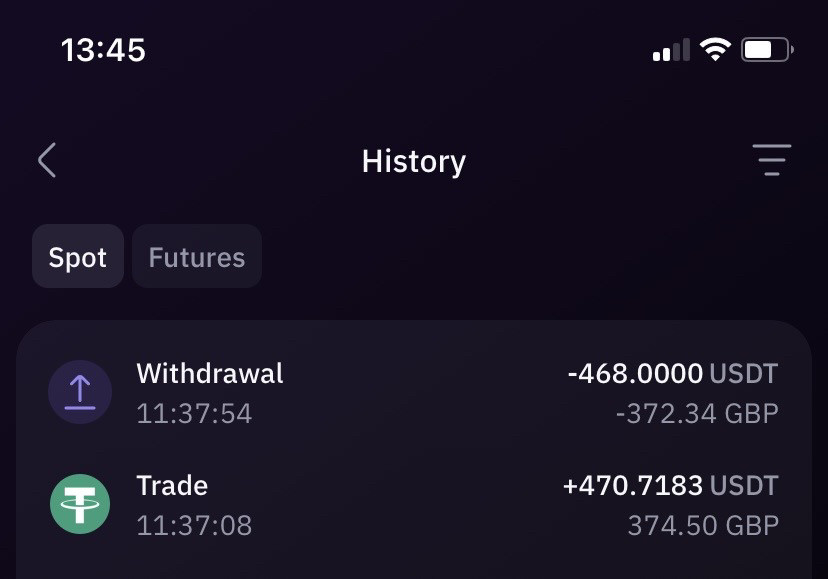

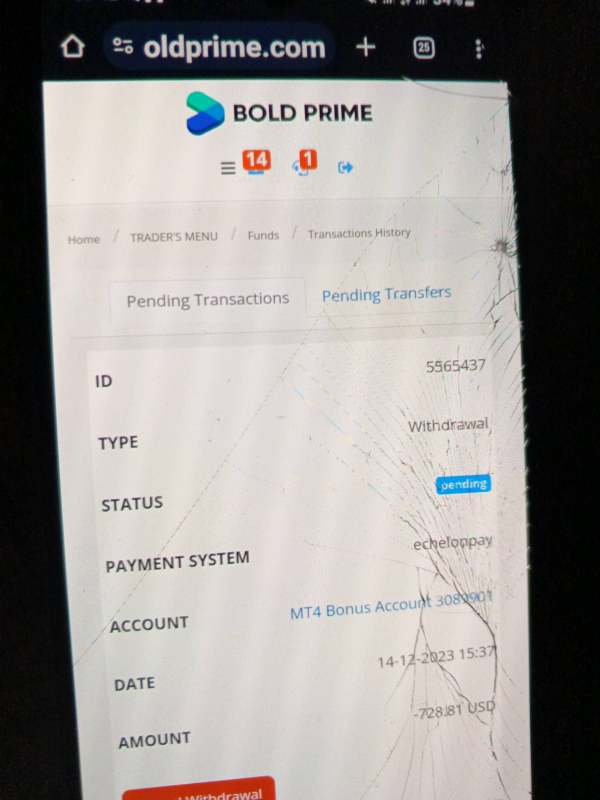

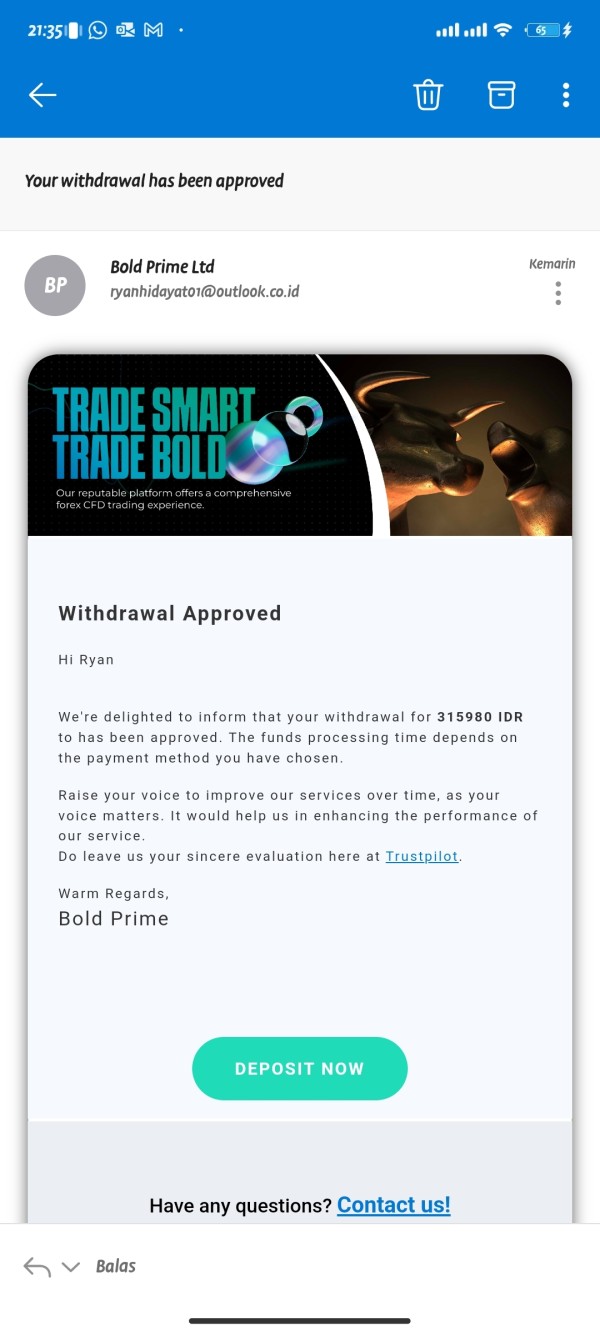

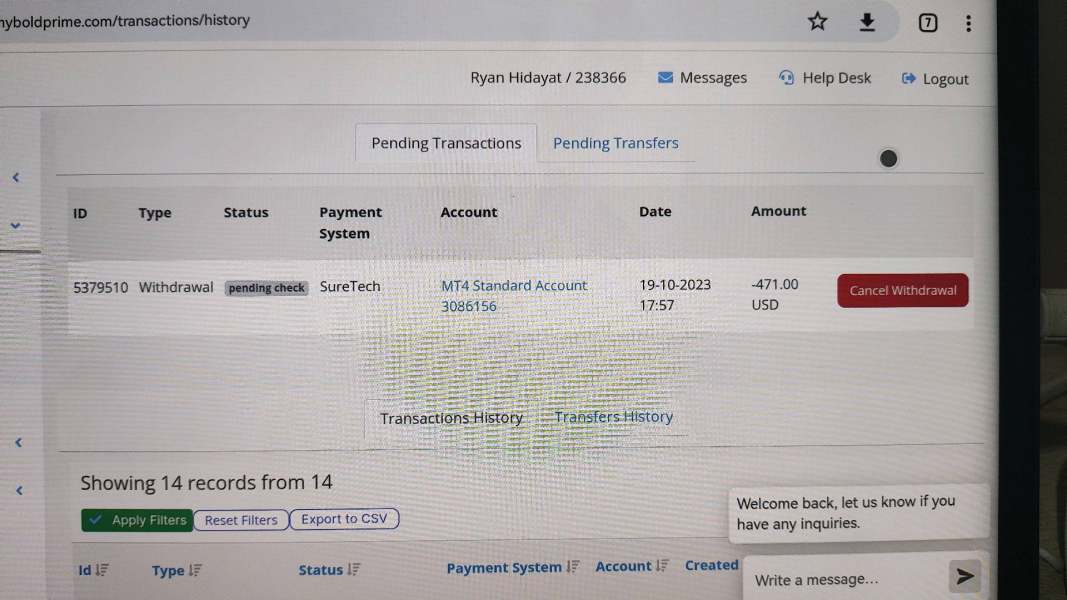

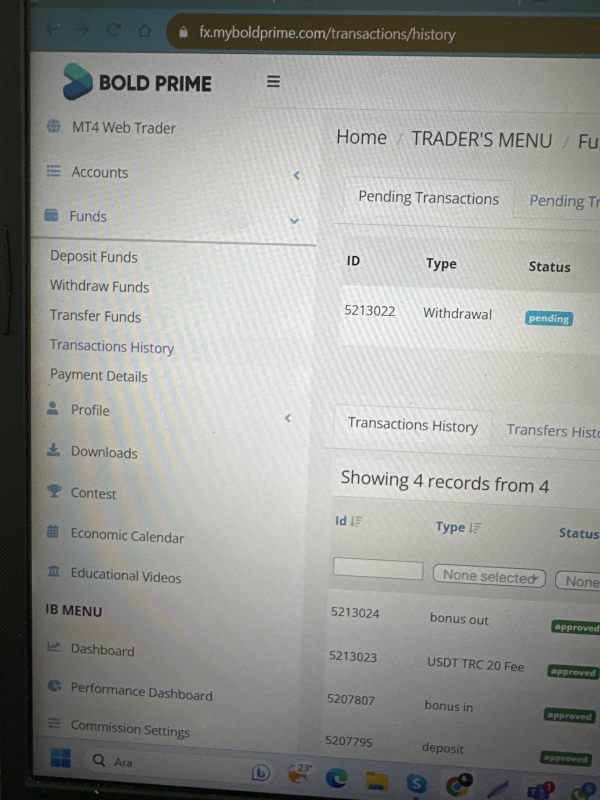

Deposit & Withdrawal

Bold Prime offers multiple deposit and withdrawal methods for its clients. The deposit and withdrawal methods include bank wire transfer, credit/debit card, and e-wallets such as Neteller and Skrill. The minimum deposit amount is $15, and the minimum withdrawal amount is $50. Bold Prime does not charge any deposit fees; however, there may be withdrawal fees depending on the payment method used.

Here is a summary of the deposit and withdrawal methods available at Bold Prime:

| Deposit Method | Deposit Fees | Deposit Processing Time | Withdrawal Method | Withdrawal Fees | Withdrawal Processing Time |

| Bank Wire Transfer | None | 1-5 business days | Bank Wire Transfer | $20-$50 | 1-5 business days |

| Credit/Debit Card | None | Instant | Credit/Debit Card | None | 3-5 business days |

| Neteller | None | Instant | Neteller | None | Instant |

| Skrill | None | Instant | Skrill | None | Instant |

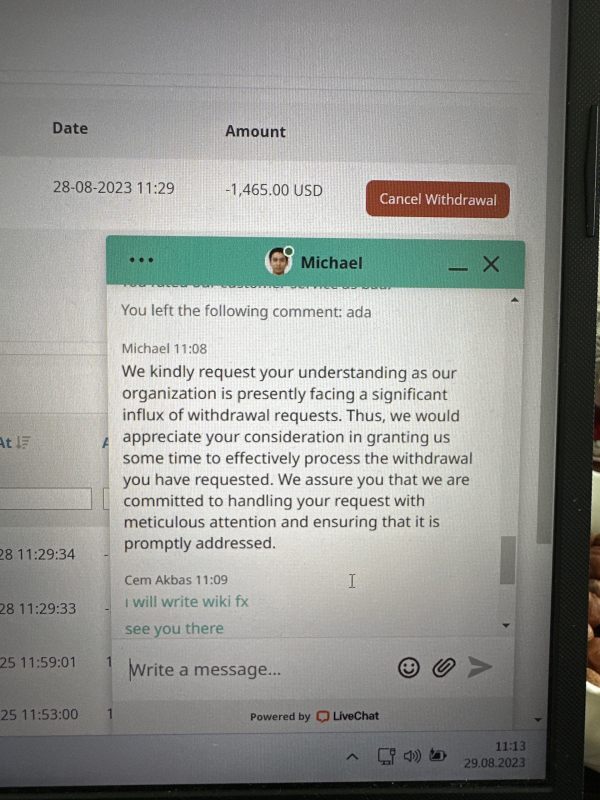

Customer Support

Bold Prime offers customer support via several channels, including email, live chat, and phone support. Traders can contact the support team for any account-related queries or technical issues they may encounter while using the platform.

The customer support team is available 24/5, and traders can contact them through the following methods:

Email Support: Traders can email their queries or issues to the support team at support@boldprime.com. The support team usually responds within 24 hours.

Live Chat Support: Traders can chat with the support team in real-time by clicking on the live chat icon on the Bold Prime website. The live chat support is available from Monday to Friday, 24 hours a day.

Phone Support: Traders can also call the support team for immediate assistance. Phone support is available from Monday to Friday, 24 hours a day. The contact numbers are available on the Bold Prime website.

| Pros | Cons |

| 24/5 customer support via phone, email, and live chat | No 24/7 customer support |

| Multilingual customer support available | No physical office locations for in-person support |

| Quick response times to customer inquiries | Limited educational resources on the website |

| Dedicated account manager for Prime Platinum account holders | No social media support |

Educational Resources

Bold Prime offers a range of educational resources to its traders, aimed at enhancing their trading skills and knowledge. These resources include:

Trading Academy: Bold Prime's trading academy offers a variety of courses, webinars, and video tutorials covering topics such as technical analysis, risk management, and trading psychology.

Economic Calendar: A comprehensive economic calendar is available on the Bold Prime website, providing traders with up-to-date information on important market events and their potential impact on the markets.

Market Analysis: Bold Prime's team of experienced analysts provides daily market analysis, including technical and fundamental analysis, to help traders make informed trading decisions.

eBooks: Bold Prime also offers a selection of eBooks on trading strategies and market analysis.

Glossary: A comprehensive glossary of trading terms is available on the Bold Prime website to help traders understand industry-specific terminology.

Conclusion

In conclusion, Bold Prime Limited offers a range of trading accounts with various features and requirements to cater to traders of different levels, offering a wide range of tradable instruments, including forex, commodities, indices, and cryptocurrencies. The trading fees are quite competitive, with tight spreads and low commissions, and the broker offers both MT4 and MT5 trading platforms. Bold Prime also provides a good range of educational resources for traders. However, there are some drawbacks to consider, such as limited deposit and withdrawal options, no 24/7 customer support and the lack of social trading platforms. Overall, Bold Prime Limited can be a good option for traders who value regulatory compliance, competitive trading fees, and a good range of trading instruments and educational resources.

FAQs

Q: Is Bold Prime a regulated broker?

A: Yes, Bold Prime Limited holds an AR license from the Australian Securities and Investments Commission (ASIC), which is a reputable regulatory body.

Q: What trading platforms does Bold Prime offer?

A: Bold Prime offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are well-known and widely used in the industry.

Q: What is the minimum deposit required to open an account with Bold Prime?

A: The minimum deposit required for a Standard account is $15, while Prime Raw and Prime Platinum accounts require a minimum deposit of $150.

Q: What are the spreads and commissions charged by Bold Prime?

A: Spreads start from 1.8 pips for Standard account holders, while Prime Raw and Prime Platinum accounts offer raw spreads starting from 0.2 pips with a commission of $7 per lot traded.

Q: What trading instruments are available with Bold Prime?

A: Bold Prime offers over 300 trading instruments, including forex, commodities, indices, and cryptocurrencies.

Q: Does Bold Prime offer a demo account?

A: Yes, Bold Prime offers a demo account for traders to practice their trading strategies and get familiar with the trading platform.

Q: What are the available methods for deposit and withdrawal with Bold Prime?

A: Bold Prime offers a variety of deposit and withdrawal methods, including bank transfer, credit/debit cards, and e-wallets.

Q: Does Bold Prime provide educational resources for traders?

A: Yes, Bold Prime provides educational resources for traders, including webinars, articles, and market analysis, to help traders improve their skills and knowledge.

News

NewsWikiFX Broker Assessment Series | Bold Prime: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Bold Prime, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

WikiFX

WikiFX

NewsBold Prime Launches Merdeka Bonus for Malaysian Traders

In celebration of Malaysia's Independence Day, Bold Prime, an online broker, has rolled out a special bonus promotion that runs from 26th August to 8th September 2024.

WikiFX

WikiFX

ExposureCan We Boldly Trust Bold Prime?

In today's article, WikiFX will be taking you on an in-depth review of Bold Prime, which is a relatively new CFD broker within the industry that was established in 2020.

WikiFX

WikiFX

ExposureSC adds TTF Global Asia and Bold Prime to Investor Alert List

Recently, the Securities Commission of Malaysia (SC) updated its Investor Alert List. SC has added two entities to the list. They are TTF Global Asia and Bold Prime.

WikiFX

WikiFX

Review 15

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now