Score

Pure Market

Vanuatu|5-10 years|

Vanuatu|5-10 years| https://www.puremarketbroker.com/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

PureMGlobal-Demo

Influence

C

Influence index NO.1

Italy 2.86

Italy 2.86MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

C

Influence index NO.1

Italy 2.86

Italy 2.86Contact

- The claimed United KingdomFCA regulation (license number: 725804) is verified as a clone firm. Please pay attention to the risk!

Basic Information

Vanuatu

VanuatuAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Pure Market also viewed..

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

United States

puremarket.global

Server Location

United States

Website Domain Name

puremarket.global

Server IP

172.67.143.237

puremarketbroker.com

Server Location

United Kingdom

Most visited countries/areas

United States

Website Domain Name

puremarketbroker.com

Website

WHOIS.INSTRA.NET

Company

INSTRA CORPORATION PTY LTD.

Domain Effective Date

2016-10-03

Server IP

35.197.205.151

Company Summary

| Pure MarketReview Summary | |

| Founded | 2016 |

| Registered Country/Region | Vanuatu |

| Regulation | VFSC (offshore), FCA (clone) |

| Market Instruments | FX pairs, spot metals, CFDs, indices, and commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:200 |

| Spread | From 0.2 pips (MT4 Standard account) |

| From 0.0 pips (MT5 Standard account) | |

| Trading Platform | MT4, MT5 |

| Min Deposit | €/$100 |

| Customer Support | Online chat, contact form |

| Tel: +44 20 36 088 986 (24/5) | |

| Email: support@puremarketbroker.com, info@puremarketbroker.com | |

| Social media: Facebook, Instagram | |

| Address: Stade, Leasehold Title: 11/0E22/028, Port – Vila, Vanuatu | |

| Regional Restrictions | Afghanistan, Cuba, Eritrea, Iraq, Islamic Republic of Iran, Israel, Liberia, Libya, Nicaragua, Pakistan, Russian Federation, Somalia, Syrian Arab Republic, Sudan, United States, Malaysia, Vanuatu |

Pure Market was registered in 2016 in Vanuatu, which is a broker offering trading services related to FX pairs, metals, CFDs, indices, and commodities. It uses MT4 and MT5 as trading platforms, and it provides 2 types of accounts, with a minimum deposit of 100 EUR/USD and a maximum leverage of 1:200. However, this company is offshore regulated and it holds a clone license, which means potential risks are high.

Pros and Cons

| Pros | Cons |

| Diverse tradable instruments | Offshore regulation risks |

| Demo accounts | Clone FCA license |

| MT4 and MT5 supported | No popular payment methods |

| No deposit fees | Regional restrictions |

| Multiple channels for customer support | |

| Live chat support |

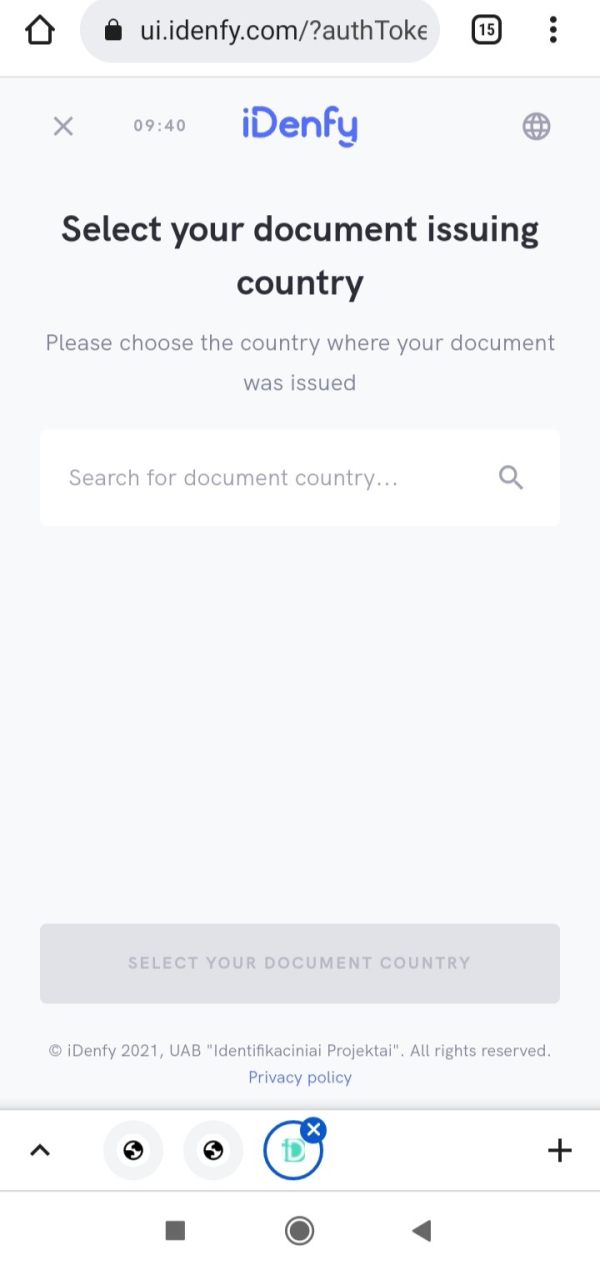

Is Pure Market Legit?

Pure Market is offshore regulated by Vanuatu Financial Services Commission (VFSC). Moreover, it holds a clone license of Financial Conduct Authority (FCA).

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Vanuatu Financial Services Commission (VFSC) | Offshore Regulated | Vanuatu | Retail Forex License | 14801 |

| Financial Conduct Authority (FCA) | Clone Firm | UK | Straight Through Processing (STP) | 725804 |

What Can I Trade on Pure Market?

On Pure Market's trading platforms, customers can trade FX pairs, spot metals, CFDs, indices, and commodities such as oil.

| Tradable Instruments | Supported |

| FX Pairs | ✔ |

| Spot Metals | ✔ |

| CFDs | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

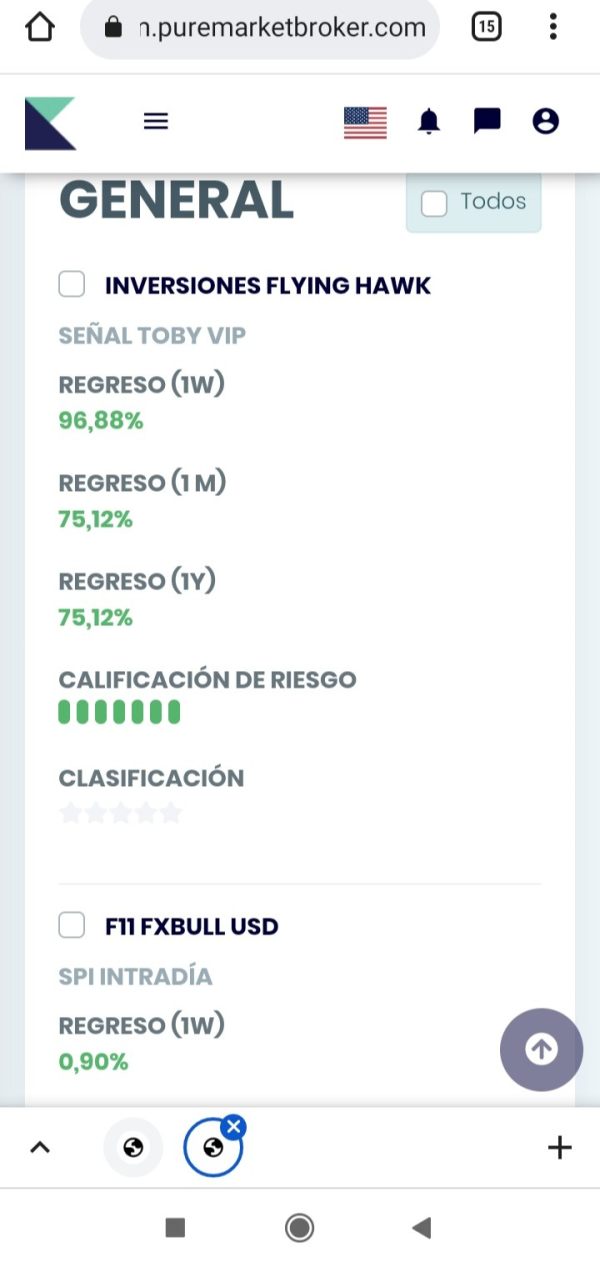

Account Type/Fees

Pure Market offers 2 types of accounts, including MT4 Standard Account and MT5 Standard Account. Besides, a demo account is also available.

| Account Type | Min Deposit | Max Leverage | Spread | Commission |

| MT4 Standard | 100 EUR/USD | 1:200 | From 0.2 pips | $30/Million FX, $0 CFDs |

| MT5 Standard | 1,000 EUR/USD | From 0.0 pips | €6/$6.5 per Standard lot |

Leverage

The leverage can be up to 1:200 for both account types. Careful considerations are recommended, since high leverage is likely to bring high potential risks.

Trading Platform

Pure Market uses MT4 and MT5 as its trading platforms, which are available on PC, web, and mobile devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, PC, mobile | Beginners |

| MT5 | ✔ | Web, PC, mobile | Experienced traders |

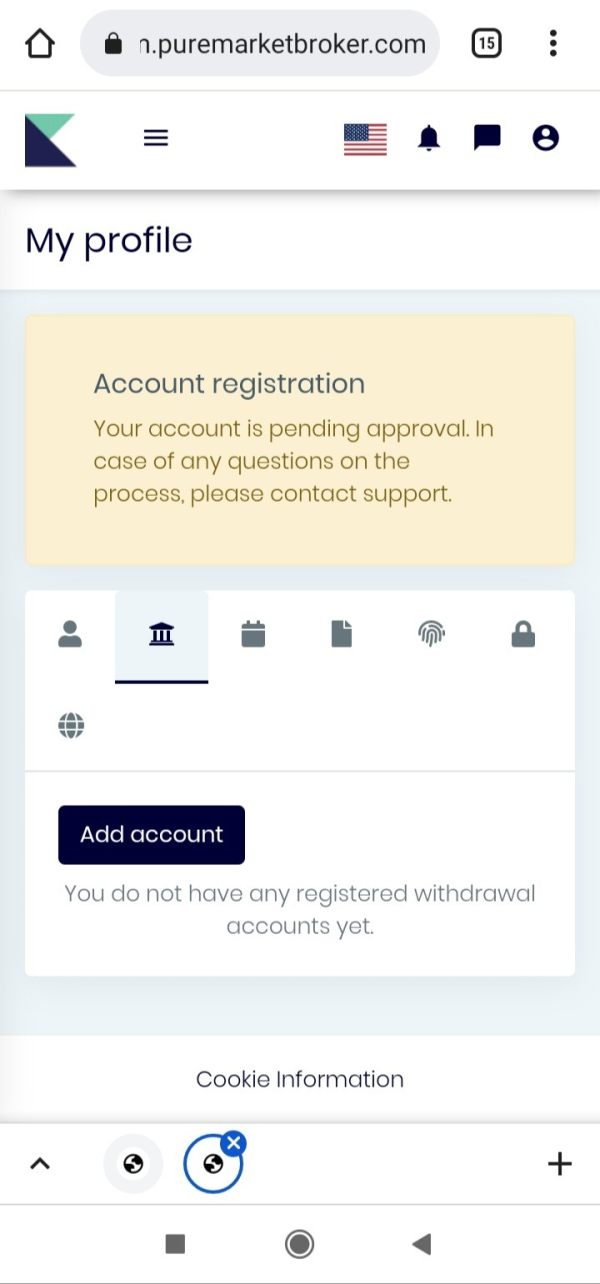

Deposit and Withdrawal

Pure Market supports 4 types of payment options: Sepa, Bitcoin, Ethereum, and Tether.

| Payment Options | Deposit Fees | Withdrawal Fees |

| SEPA | ❌ | €5 |

| BITCOIN | ❌ | |

| ETHREUM | ||

| TETHER |

Keywords

- 5-10 years

- Regulated in Vanuatu

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Regional Brokers

- Clone Firm United Kingdom

- High potential risk

- Offshore Regulated

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

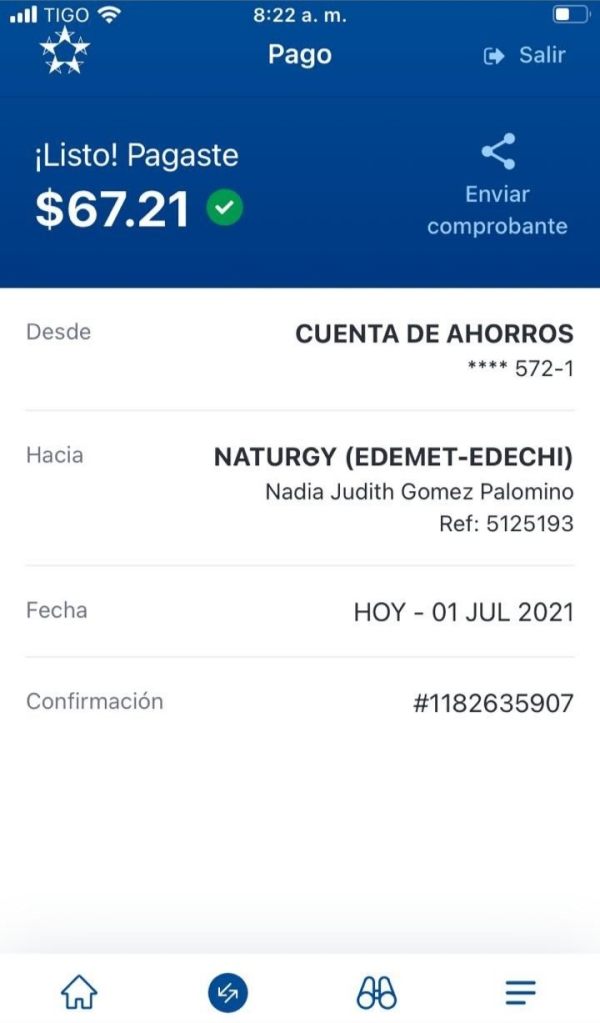

FX4183501898

Hong Kong

Ponzi Scheme that cannot withdraw anymore. Everyone does not be deceived. It is romance scam.

Exposure

2022-08-21

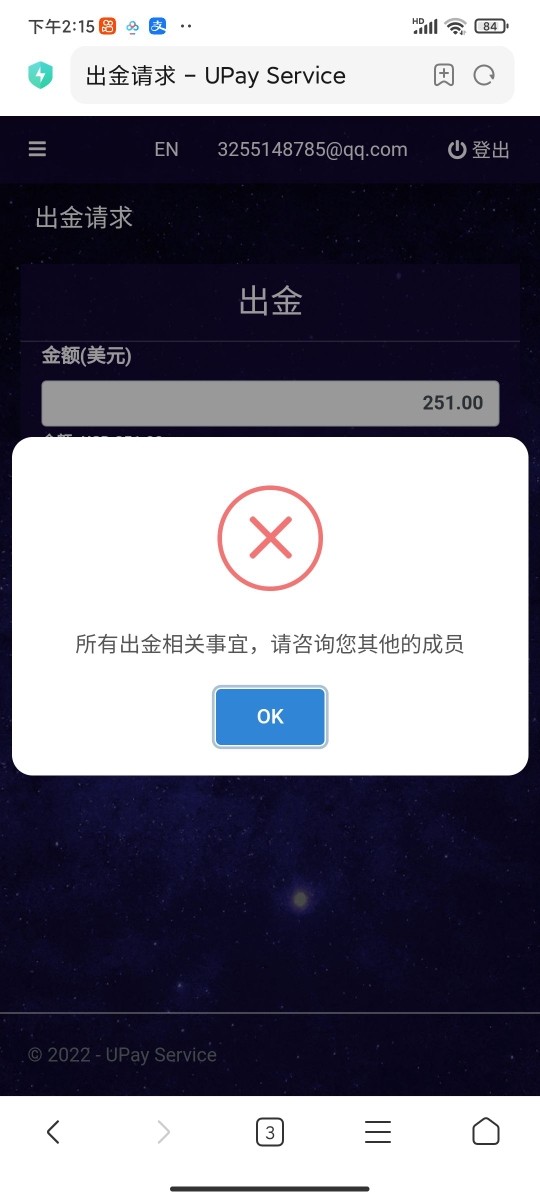

FX2448933115

Argentina

I deposited $ 67.21 in this company but they said everything was wrong. They did not deal with my payment and sent me the signal that they broke down.

Exposure

2021-10-29

Geeky

Malaysia

Trading with Pure Market? It's been okay. Their service - pretty solid and the communication was spot on. Uri, one of their brokers, was really good at finding deals within my budget. That was neat. What wasn’t so neat was their fee structure. High commission, charges for opening and closing trades, even a withdrawal fee. All those costs started eating into my profits. That's something I didn't experience with other brokers. On a brighter note, their customer support was prompt and withdrawals were smooth. After a year of trading though, I’m still waiting to see some serious profits. To sum up, Pure Market has its upsides but the downsides are there too.

Neutral

2024-05-15

Ln

Indonesia

If you look for brokers to trade with, please ignore Pure Market. It is a very bad and cheap broker, offering you fake spreads and trading conditions, slow order execution, and its customer service were very unprofessional… Please don’t come, guys.

Neutral

2023-03-13

7791

Indonesia

It's pretty chill—easy to navigate and the support team is always ready to help. But the fees for opening and closing trades caught me off guard. Just keep that in mind if you're thinking about jumping in.

Positive

2024-06-27