Score

GLOBAL PRIME

China|5-10 years|

China|5-10 years| http://www.gpchina.com.au/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesContact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

China

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed GLOBAL PRIME also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

gpchina.com.au

Server Location

Hong Kong

Website Domain Name

gpchina.com.au

Website

WHOIS.AUDNS.NET.AU

Company

AU-NIC

Server IP

182.61.107.182

Company Summary

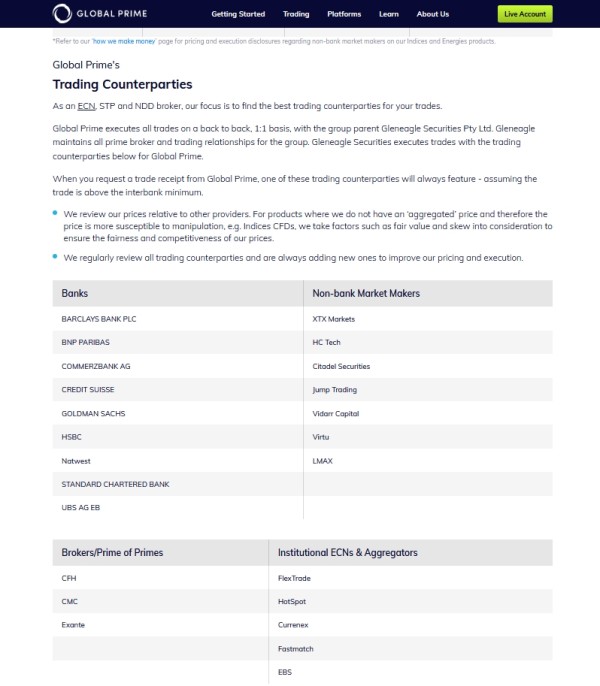

General Information and regulation

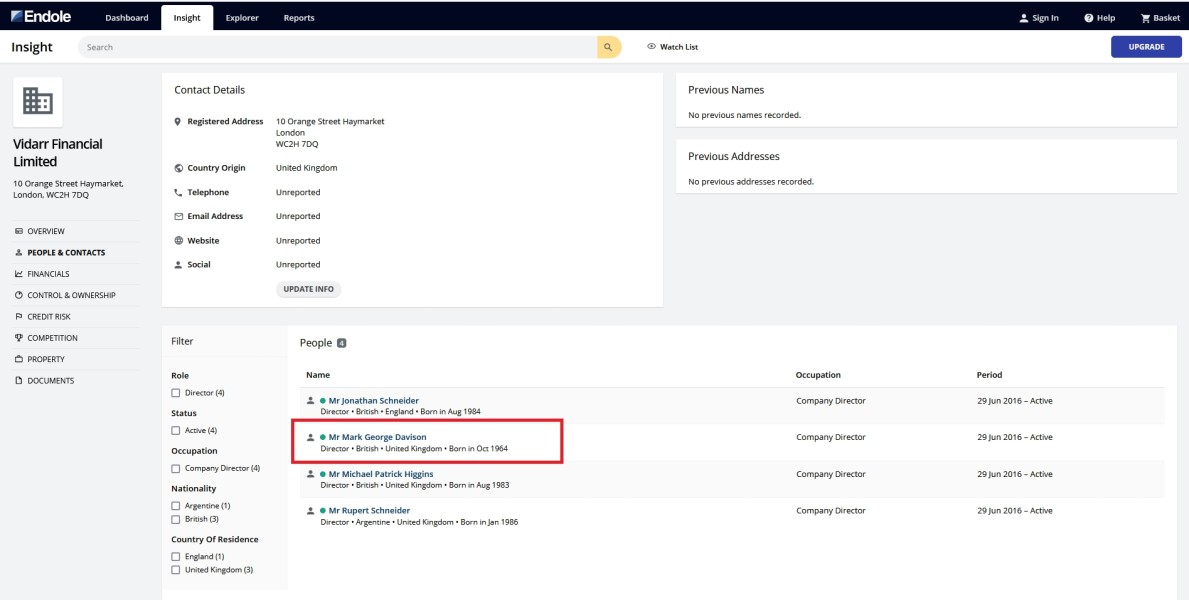

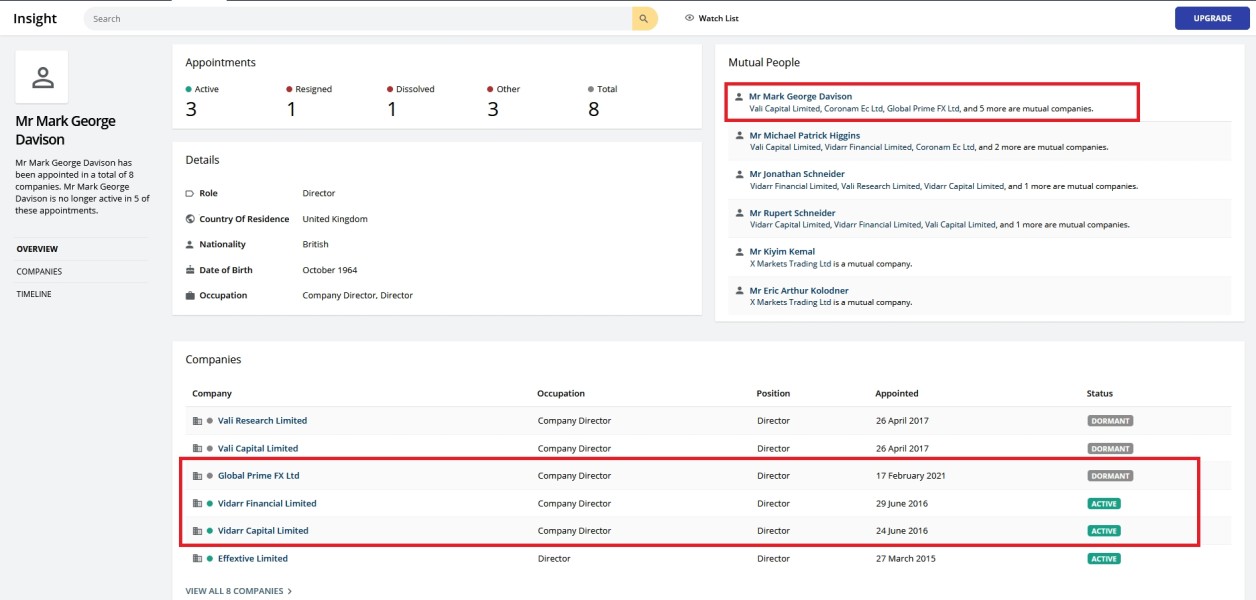

Global Prime was founded in 2010 , and is the trading name of Global Prime Pty Limited, ABN 74 146 086 017. Global Prime Pty Ltd, ABN 74 146 086 017, Global Prime holds an Australian Financial Services Licence (AFSL) to carry on financial services business in Australia, limited to the financial services covered by its AFSL no.385620. Global Prime FX Ltd is a registered Seychelles company (Company Number 8412189-1) and holds a Securities Dealers Licence SD057 issued by the FSA.

Market Instrument

Tradable Instruments on offer at Global Prime includes; Forex, Indices, Commodities, Shares and Bonds. Clients can therefore trade with each of the instruments mentioned.

Account & leverage

Global Prime only offers one account type – The ECN Account. Global Primes ECN comes as Individual, Joint, Corporate and Trust solutions. Traders must deposit at least $200 AUD or the equivalent in any of the supported account currencies (AUD, USD, EUR, GBP, SGD, and CAD) in order to open a Global Prime account. Global Prime also offers competitive overnight swap rates, which are taken directly from the interbank market. The maximum leverage cap offered by this broker tops out between 1:100 – 1:200. The 1:200 option seems to be reserved for those that have received special approval, so it seems that most retail clients will only be able to trade up to the 1:100 option.

Trade size

The Global Prime account allows for a minimum trade size of 0.01 lot (one micro lot). The maximum trade sizes are usually determined by the account‘s size because the margin requirement is 1%. All trading strategies are allowed, but trading news or tick scalping is not recommended because these type7s of strategies do not seem to work well with the broker’s liquidity setup on MT4.

Spreads & Commissions

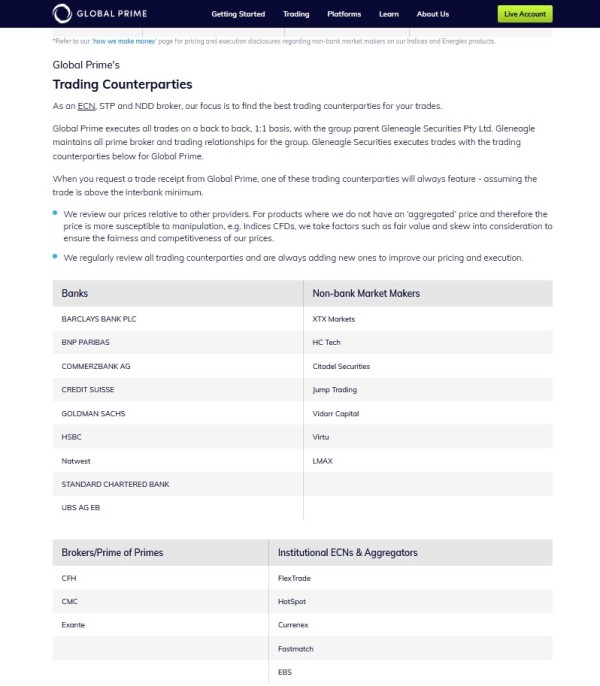

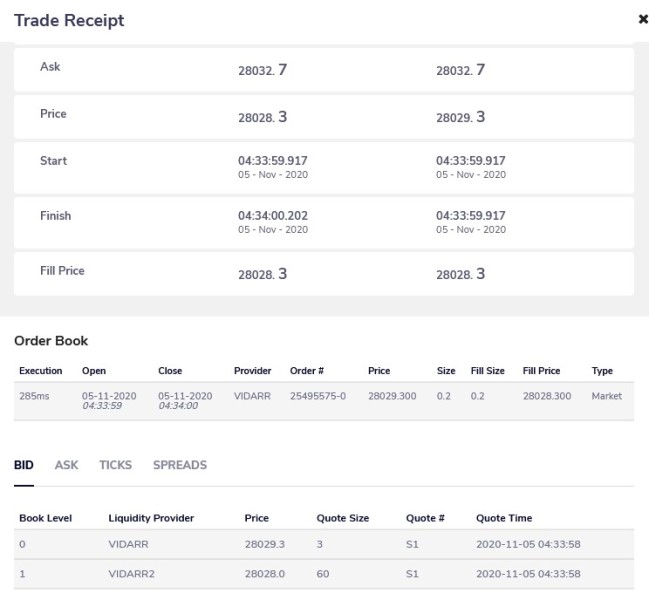

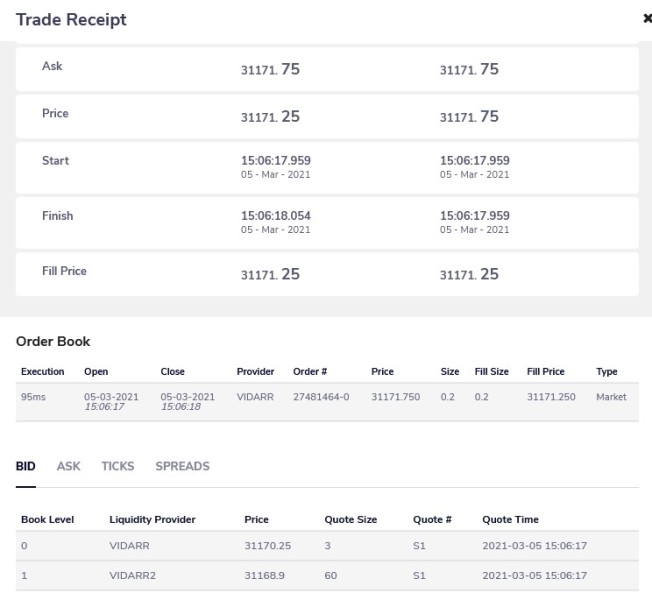

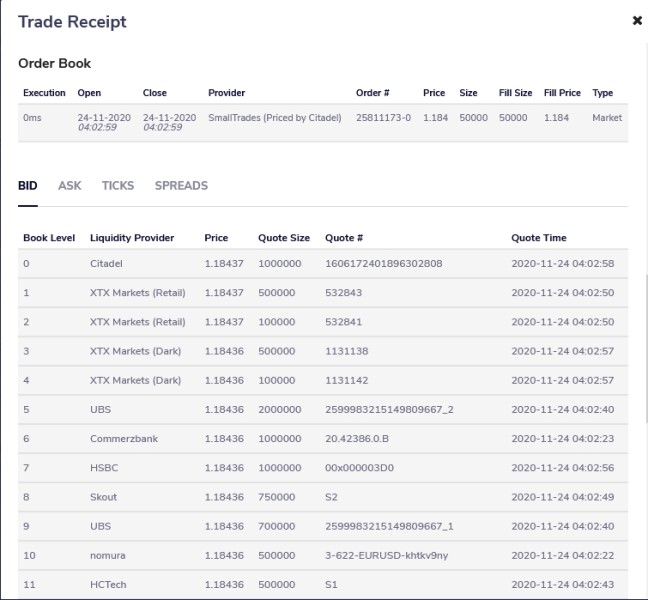

Global Prime combine tier-1 bank, non-bank and ECN liquidity to give clients tight spreads across our range of global markets 24/5.

Spreads at Global Prime are variable starting from 0.0 pips. Typical spreads on leading pairs EUR/USD are 0.1 and 0.6 on GBPUSD. Typical spreads on FTSE100 are 0.84 and 1 on the Nasdaq 100. Global Prime only charges commissions on forex and metal trades with the ECN account. Commission charges per standard lot are as follows: 7 AUD, 7 USD, 6.2 EUR, 5.4 GBP, 9.5 SGD, 9 CAD.

Trading platform available

Global Prime offers MetaTrader 4, TraderEvolution and FIX API platforms. The FIX API solution is also designed for professional traders who are looking to deploy proprietary algorithmic trading solutions with the lowest possible latency. The platform is best suited to experienced traders who want the flexibility to use any programming language.

Trading Tools

Apart from trading platform available on the Global Prime platform, it has also provides some trading tools to help traders adapt to their trading environments, including VPS offers, Zulu Trade, PIP Calculator, as well as MyFXBook Autotrade.

Deposit and Withdrawal

Global Prime offers a wide range of deposit methods. Deposit requirements range from AUD $1 to AUD $200. Clients can use any of the following methods to deposit funds to their Live Trading account. FasaPay, Neteller, Skrill, Master card and Visa, BPay, Bank Wire AccentPay, pagsmile, ZotaPay and more.Withdrawal requests that are received before 11:00 will be processed within the same business day and requests received after that time will be processed the following business day

Customer Service

In terms of customer services, Global Prime supports team can be reached through Live chat, Email or contact Phone Call.

Keywords

- 5-10 years

- Suspicious Regulatory License

- MT4 Full License

- Regional Brokers

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now