Score

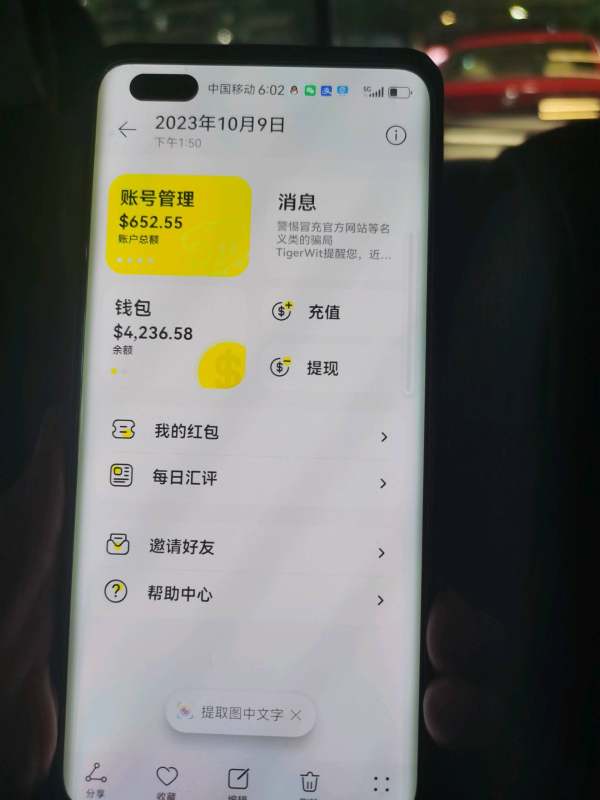

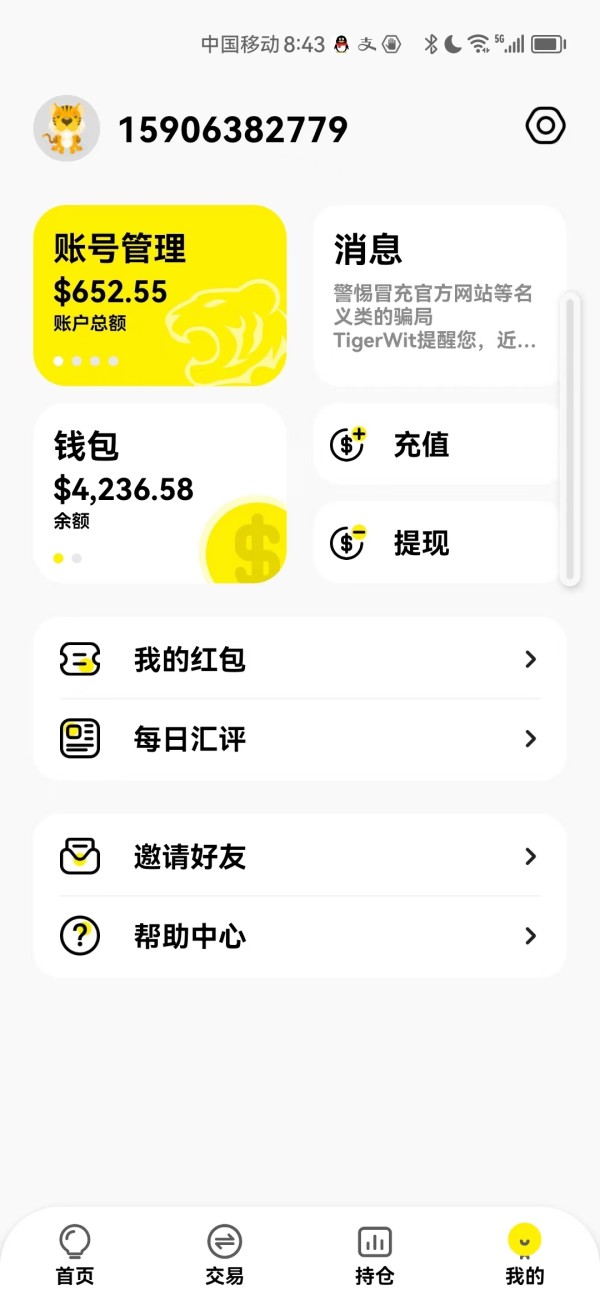

TigerWit

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://uk.tigerwit.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

United States 3.05

United States 3.05Contact

- This broker bas been verified to be stoppage of business, and it has been listed in WikiFX's Stoppage of Business list. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed TigerWit also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Taipei Taipei | 118*** | GBPUSD400 | 08-22 04:53:52 |

Tokyo Tokyo | 907*** | USDCHF400 | 08-22 04:53:53 |

HoChiMinh HoChiMinh | 559*** | USDCHF400 | 08-17 18:13:05 |

Stop Out

1.19%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

tigerwit.tech

Server Location

Hong Kong

Website Domain Name

tigerwit.tech

Server IP

118.193.35.90

tigerwit.com

Server Location

China

Website Domain Name

tigerwit.com

ICP registration

京ICP备16013582号-2

Website

GRS-WHOIS.HICHINA.COM

Company

HICHINA ZHICHENG TECHNOLOGY LTD.

Domain Effective Date

0001-01-01

Server IP

101.132.136.194

Company Summary

Note: TigerWit's official website - https://uk.tigerwit.com/ is currently inaccessible normal.

| TigerWit Review Summary | |

| Founded | 2015 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | FX, precious metals, commodities, indices |

| Demo Account | ✅($10,000 in virtual funds) |

| Leverage | Up to 1:400 |

| Spread | Variable |

| Trading Platform | MT4 |

| Min Deposit | $50 |

| Customer Support | Live chat, contact form |

| Tel: +1 (786) 867-0911 | |

| Email: customerservice@tigerwit.com | |

| Facebook, LinkedIn, Twitter, YouTube, Instagram | |

TigerWit is an unregulated online trading platform founded in 2015 and registered in the United Kingdom. TigerWit claims to provide trading on the well-known MT4 platform in FX, precious metals, commodities, and indices. TigerWit says to have no authority or licensing to provide forex trading or brokerage services in the United Kingdom or any other jurisdictions.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Unregulated status |

| Demo accounts | Single account type |

| Commission-free account offered | Unclear fee structure |

| Flexible leverage ratios | High minimum deposit |

| Tight spreads | |

| MT4 supported | |

| Low minimum deposit | |

| Popular payment methods | |

| Live chat support |

Is TigerWit Legit?

No, TigerWit currently has no valid regulations. Please be aware of the risk!

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Revoked | TigerWit (Hong Kong) Limited | Leveraged foreign exchange trading | BOI171 |

| Australia Securities & Investment Commission (ASIC) | Revoked | TIGERWIT TECHNOLOGY PTY. LIMITED | Common Business Registration | 614234687 |

| Financial Conduct Authority (FCA) | Suspicious Clone | Calico Capital Limited | Market Making(MM) | 679941 |

| The Securities Commission of The Bahamas (SCB) | Suspicious Clone | TigerWit Limited | Retail Forex License | SIA-F185 |

What Can I Trade on TigerWit?

| Trading Asset | Available |

| Forex | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

TigerWit offers flexible leverage ratios of 1:100, 1:200, and 1:400. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread

| Currency Pair | Avg Spread (points) |

| AUD/CAD | 2.4 |

| AUD/CHF | 2.2 |

| AUD/JPY | 2.3 |

| AUD/NZD | 2.4 |

| AUD/SGD | 3.0 |

| AUD/USD | 1.9 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | iPhone, Android, PC | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Deposit

| Deposit Method | Min Deposit |

| Bank transfer | $100 |

| Credit/debit cards | $50 |

| Neteller | |

| Skrill | |

| SafeCharge | |

| China UnionPay |

Withdrawal

| Withdrawal Method | Min Withdrawal |

| Bank transfer | $50 |

| Credit/debit cards | $20 |

| Neteller | |

| Skrill |

Keywords

- Stoppage of Business

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Australia Common Business Registration Revoked

- Hong Kong Leveraged foreign exchange trading Revoked

- Suspicious Overrun

- High potential risk

News

News TigerWit Undergoes Transformation to Calico Capital: Here's What Traders Need to Know

London's TigerWit rebrands to Calico Capital post FCA-licensed sale. Traders urged to stay vigilant amid offshore concerns.

2023-09-06 17:04

Exposure TigerWit is Not Witty!!

In today's comprehensive review, WikiFX will delve into the details of TigerWit, examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service to help you decide whether to use it. Keep reading to find out more!

2023-08-25 17:34

News WIKIFX REPORT: TigerWit Africa trains 840 Nigerians in financial market

TigerWit Africa, a brokerage company that sells Forex, has trained over 840 Nigerians in a two-week session in Port-Harcourt, the capital of Rivers State, in an effort to narrow the knowledge gap in the financial industry.

2022-07-06 12:16

Review 191

Content you want to comment

Please enter...

Review 191

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

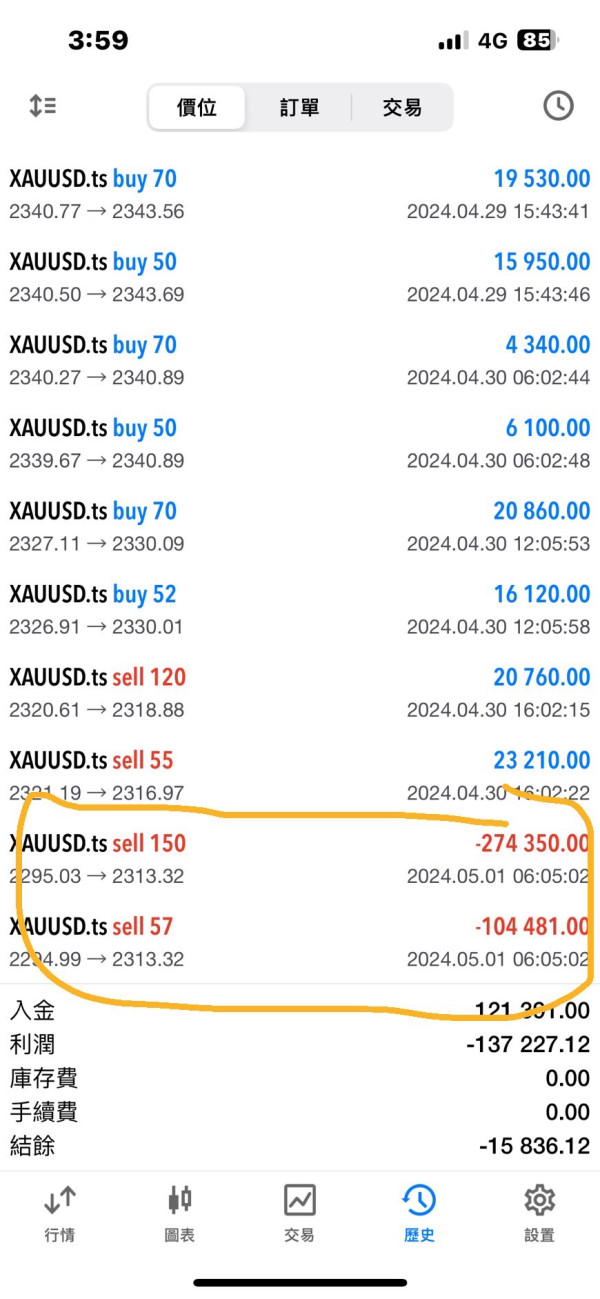

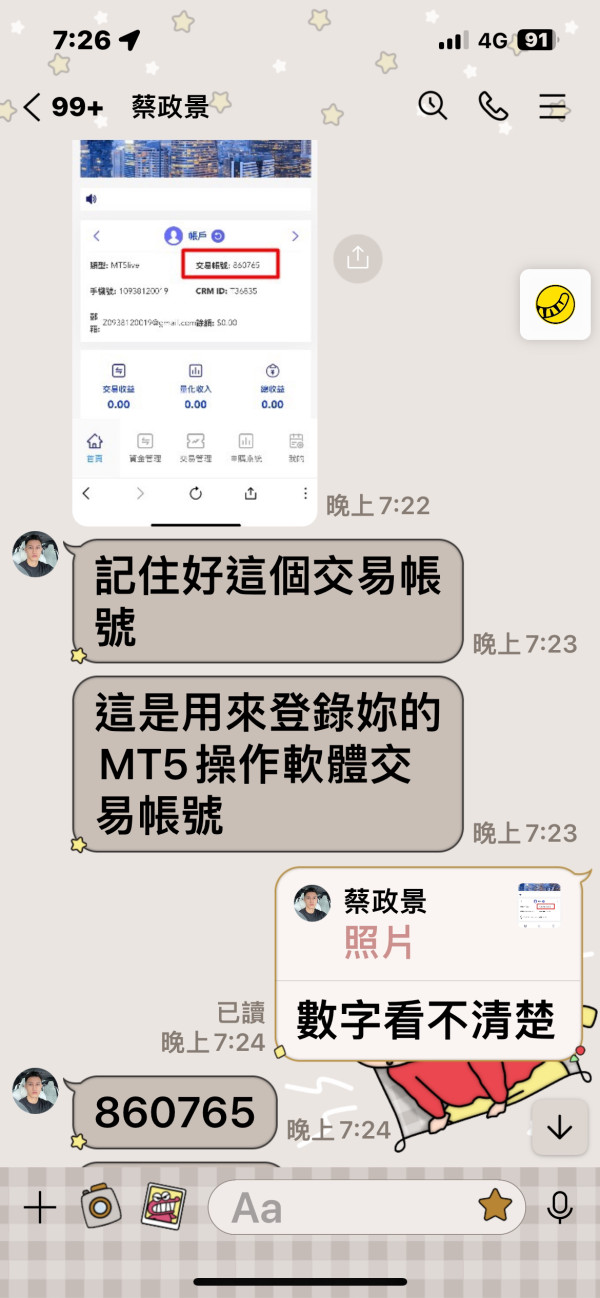

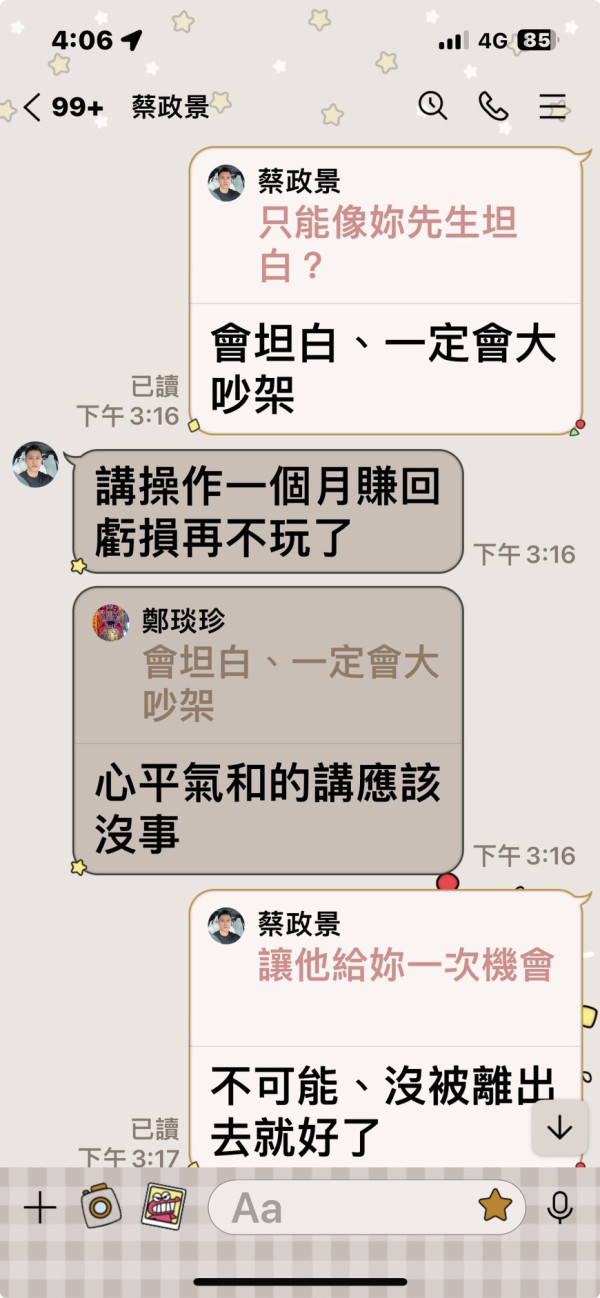

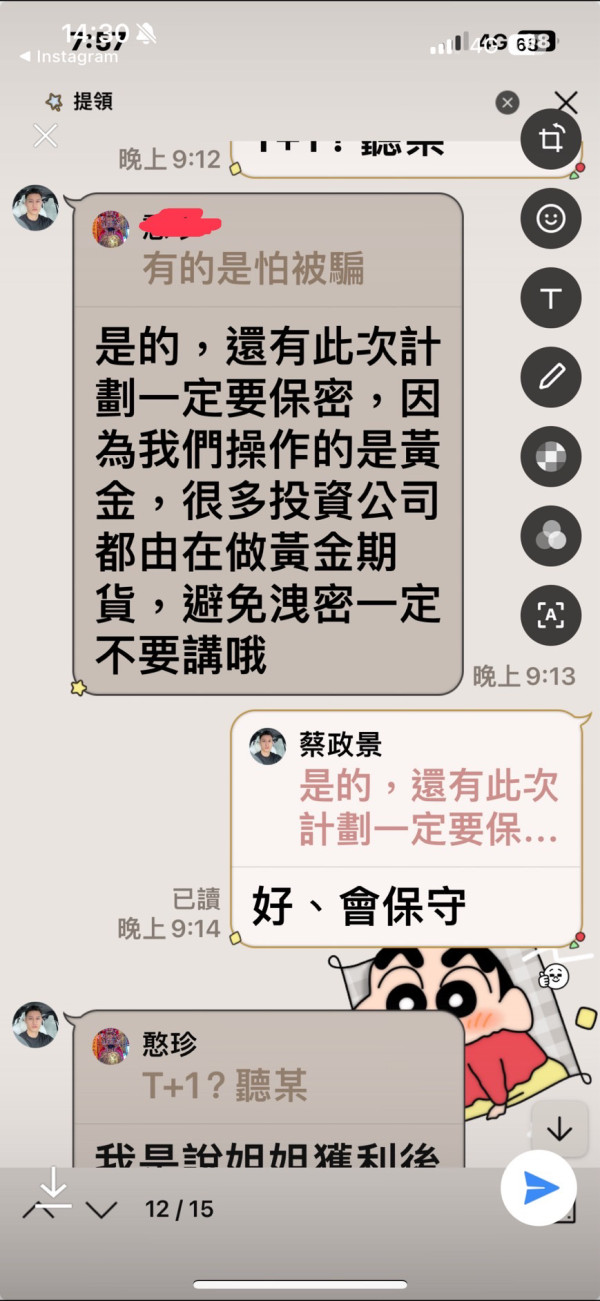

Many chen

Taiwan

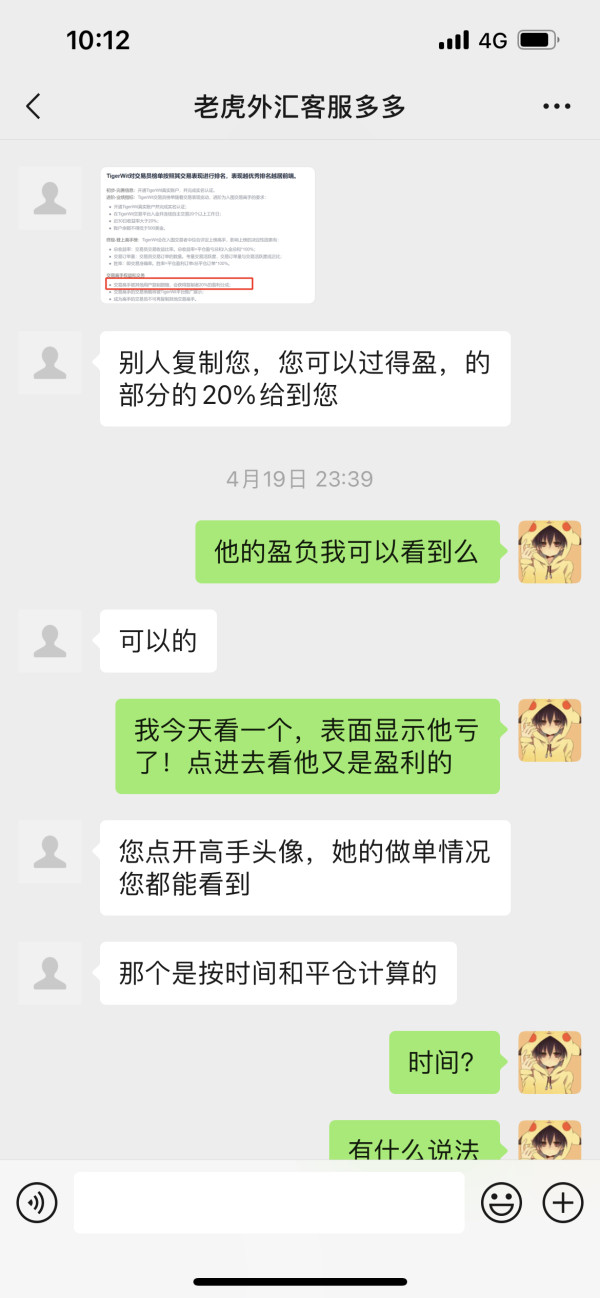

I saw on the Internet that Mr. Lu had a stock investment community. After joining the group, everyone in the group was making profits through PO. I asked the administrator. He told me to copy his trade in forex MT5 and keep it confidential. Because they have inside information and cannot disclose it to others. They told with confidence. Others were making money but I was losing money, and then I found out it was a scam.

Exposure

2024-05-06

由頁

Hong Kong

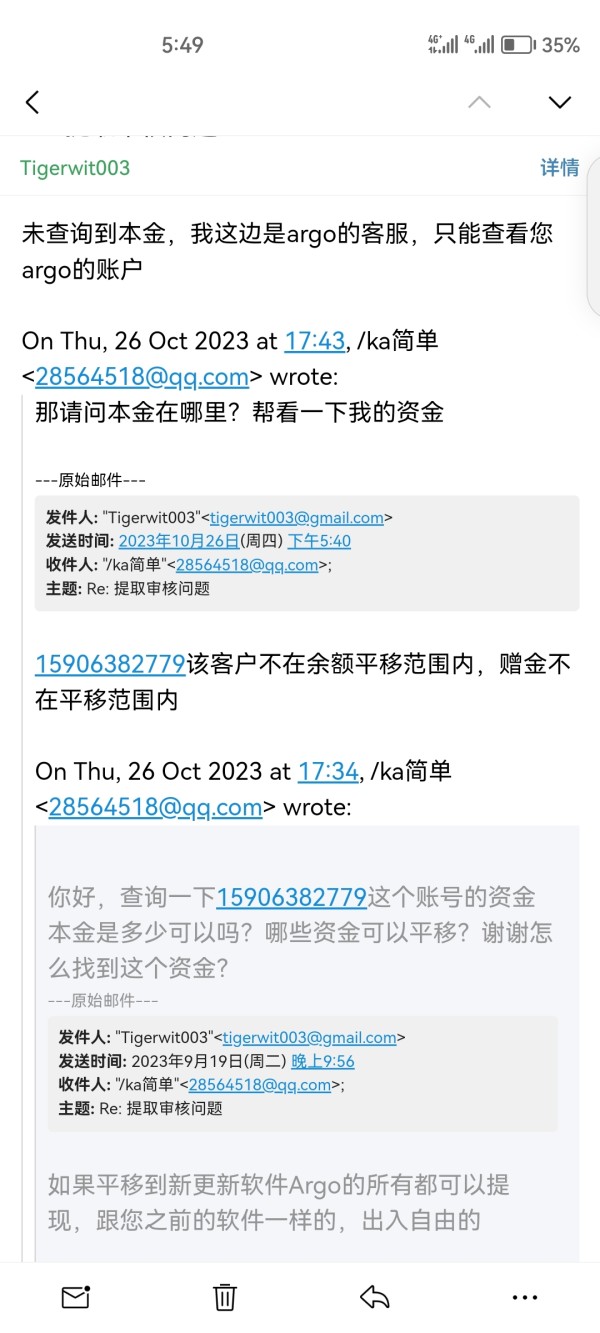

TigerWit, unable to withdraw money, later changed its name to ArgoFX. The account can be logged in directly, but all the accounts were cleared, the customer service logged out, and there was no response to the email.

Exposure

2024-03-25

FX3306923192

Hong Kong

TiggerWit has suspended its business and has been claiming that it has been attacked by hackers, causing the platform to be transferred to ArgoFX, and original users need to migrate to the new system. However, after the system transfer, you need to recharge before you can withdraw money, and you have to withdraw money in batches. In addition, there is no clear explanation for the customer losses caused by the system crash, and the customer service WeChat has logged out. The new system ArgoFX is the same platform as the old system, and they just changed their names to continue to deceive people. In this incident, as far as I know, my friend lost nearly 3 million. If the police station doesn't register a case, I will expose it through the media. All investment friends, please stay away. Currently, ArgoFX has many problems such as lagging, slippage, abnormal price, lack of platform experience, and the possibility to run away at any time.

Exposure

2023-11-07

王女士

Hong Kong

TigerWit cannot be opened, and the withdrawal application has been under review. Funds cannot be transferred to the new platform, and customer service has not responded!

Exposure

2023-10-31

木用易

Hong Kong

The hope of normal operation of the platform is getting slimmer. I just checked the customer service WeChat and it has been logged out. I don’t know if any of your customer service staff still responds.

Exposure

2023-09-12

不一样的烟火82201

Hong Kong

Unable to contact customer service, no response when withdrawing. . .

Exposure

2023-09-07

求稳

Hong Kong

It's terrible. When I logged in to the platform yesterday, all orders were liquidated and all previous trade records were cleared. When I logged in today, the equity was zero.

Exposure

2023-09-07

木用易

Hong Kong

I just logged in to the platform and found that my position was forcibly closed, but I still cannot withdraw cash. There is no customer service contact.

Exposure

2023-09-05

钢铁战士

Hong Kong

The app has also been changed, and cash withdrawals are still stuck in review. Customer service will be maintained by British customer service on Skye. I asked British customer service and they said I have to queue up for cash withdrawals.

Exposure

2023-09-05

瑞风7321

Hong Kong

I can’t get in touch and can’t withdraw money. The notice says it’s a system failure. Does anyone know what to do?

Exposure

2023-09-02

风神2553

Hong Kong

At 9:50 on July 12, I deposited 1444 yuan. The platform suddenly crashed and I forgot to click on paid. The deposit has not arrived in the account, and the customer service cannot be contacted.

Exposure

2023-09-02

求稳

Hong Kong

The quotation has not moved, but the overnight fee is charged every day, waiting to be liquidated, is there anyone in charge, blame me for trusting the salesman too much, saying that there must be no problem with the platform for so long, and only depositing money for a few months the way.

Exposure

2023-09-05

白7411

Hong Kong

TigerWit was unable to withdraw funds, and we have been waiting for a long time without any response. Customer service has not responded to messages. I hope the relevant departments can solve this problem.

Exposure

2023-09-02

不一样的烟火82201

Hong Kong

The platform can't withdraw. The customer service I contact before has already unemployed. There was no respond from customer service. We can make it clear if there was a issue. I have traded on this platform for 5 years. Now It has gone with any notice?

Exposure

2023-09-05

倒霉熊

Hong Kong

I have been using this platform for two years but haven’t used it much for half a year. I used it again three months ago, and there was no problem with withdrawing funds from my account, but it ran away suddenly.

Exposure

2023-09-02

MIUI

Hong Kong

I hope you can help me get my money back. It’s 5,000 US dollars. Now the withdrawal has been under review in the past few days. Did it run away?

Exposure

2023-09-02

叫我就不应

Hong Kong

It has been a week since I received an email saying that the account net value was calculated and the withdrawal was arranged according to the agreement.

Exposure

2023-09-01

笑晓

Hong Kong

The kindlestick is not updated, and the platform that has been used for 7 years suddenly cannot be used[d83d][de12]

Exposure

2023-09-01

杜123

Hong Kong

The platform cannot allow to withdraw funds, and the customer service does not reply to the message. I hope the platform can help me get the funds back.

Exposure

2023-09-01

杨洋2247

Hong Kong

Two days ago, there was a sudden lack of liquidity, I couldn’t trade, I couldn’t sell the order, and I couldn’t withdraw the money. After I downloaded it again, I still couldn’t log in or connect to the network.

Exposure

2023-08-31