简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | Pepperstone: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Pepperstone, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2010 in Melbourne, Australia, Pepperstone was established by a team of traders on a quest to provide superior technology and low-cost spreads for online trading.

Pepperstone offers a diverse range of over 1,200 tradable assets, including currency pairs, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, and CFD forwards.

Additionally, Pepperstone features several partnership programs for introducing brokers and affiliates to earn commissions by referring new clients to the company, as well as MAM (Multi-Account Manager) services.

Types of Accounts:

Pepperstone offers two account options: the Razor Account and the Standard Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Pepperstone offers a variety of payment options, including bank transfers, Visa, Mastercard, PayPal, Neteller, Skrill, Union Pay, and USDT.

Withdrawal requests received after 21:00 (GMT) will be processed the following day, while those received before 07:00 (AEST) will be processed on the same day.

Due to third-party transaction regulations, funds can only be returned to a bank account registered in the same name (or a joint account) as the Pepperstone trading account.

Any International Telegraphic Transfer (TT) fees charged by the bank are passed onto the client, with most International TTs costing approximately USD $20.

Withdrawals made via Bank Wire Transfer typically take 3-5 working days to reach the clients account.

Trading Platforms:

Pepperstone offers five trading platforms, each designed to cater to the needs of traders at different levels.

- The MT4 platform is customizable and allows traders to tailor the interface to their preferences. Users can create and run Expert Advisors (EAs) using MetaQuotes Language 4 (MQL4) and benefit from tools like Autochartist to identify significant market movements. With access to 28 indicators and EAs via Smart Trader Tools, plus 85 pre-installed indicators on the desktop app, traders gain valuable insights. MT4 also supports back testing and automated trading, enabling 24/5 market engagement without manual intervention.

- The MT5 platform enhances user experience with its intuitive design and advanced features. It employs the MQL5 programming language, simplifying the coding of trading signals. Traders can choose from 21 timeframes and utilize optimized processing for EAs and indicators. MT5 offers additional features like hedging positions and 38 built-in indicators, while still providing Smart Trader Tools and Autochartist.

- cTrader is ideal for newcomers to forex trading, mimicking an institutional trading environment. It offers advanced order management, coding in C#, and an open API for flexibility. Traders can also access optimized processing for EAs, advanced charting tools, and extensive platform customization through cTrader Automate (formerly cAlgo).

- TradingView impresses with its advanced charting technology and connection to the largest social trading network. Its user-friendly Pine Script allows for easy automation, and traders can explore numerous pre-built and customizable indicators. With access to an economic calendar and news updates, as well as a cloud-based platform for data protection, TradingView enables trading on-the-go via desktop or mobile.

- The Pepperstone Trading Platform features a Quick Switch option for seamless chart navigation. Traders can view and amend positions while trading on live streaming prices, benefiting from various charting options and technical analysis tools. Users can track instrument performance, spreads, margins, and market hours, along with easy instrument searches. Each live trading account comes with a demo account, allowing risk-free practice, and users can create customized and public watchlists.

Research and Education:

Pepperstone offers a variety of educational resources to support traders at different levels. These resources are available in the form of daily market analysis, videos, webinars, analyst reviews, and trading guides.

Customer Service:

Pepperstone provides 24/5 customer service support in multiple languages, including English, Chinese, Vietnamese, Spanish, Portuguese, Arabic, and Thai. Clients can reach out to Pepperstone via email at support@pepperstone.com or by submitting an inquiry through the broker's question form. Additionally, trading clients have the option to contact Pepperstone by phone at +1 786 628 1209.

Conclusion:

To summarize, here's WikiFX's final verdict:

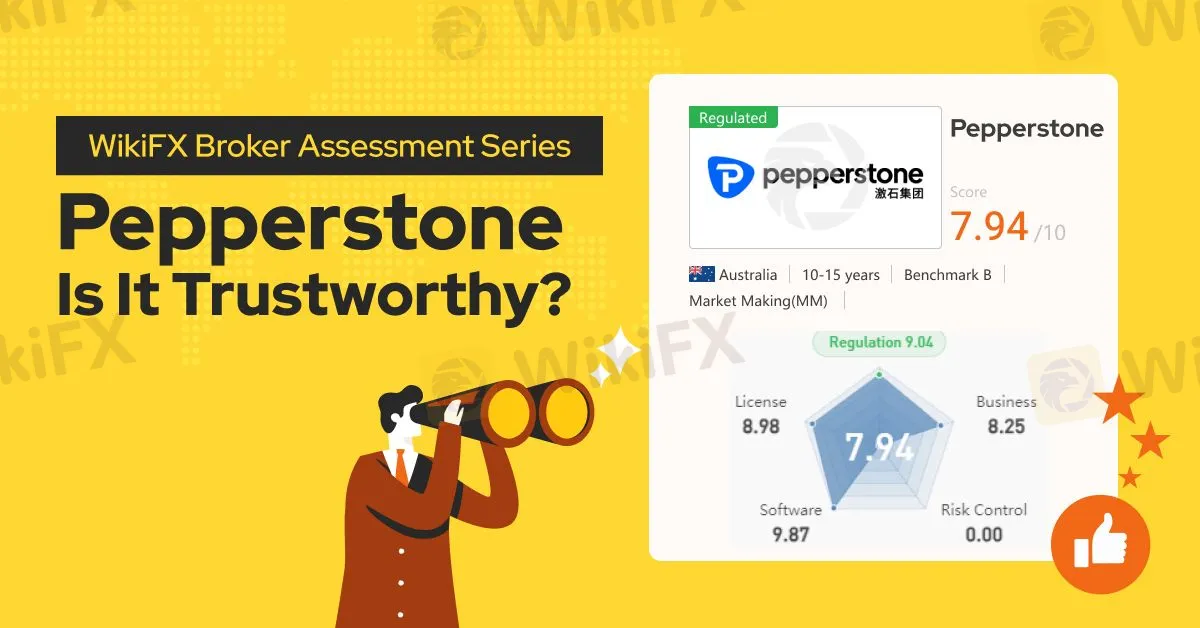

WikiFX, a global forex broker regulatory platform, has assigned Pepperstone a WikiScore of 7.94 out of 10.

Upon examining Pepperstone's licenses, WikiFX found that the broker is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the United Kingdoms Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA), and the Securities Commission of The Bahamas (SCB). WikiFX has also validated the legitimacy of these licenses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Group Enters Direct Investment Market with £160 Million Freetrade Buyout

IG Group, a prominent global financial trading and investment company, has announced its acquisition of Freetrade, a commission-free investment platform, for £160 million. The deal, funded through IG’s existing capital resources, marks a strategic move to expand its footprint in the United Kingdom.

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

Cinkciarz.pl, one of Central Europe’s largest currency exchange platforms, has made headlines after accusing major Polish banks of conspiring to undermine its operations. The company has threatened legal action amounting to 6.76 billion zlotys ($1.6 billion) in damages. However, the platform is now under intense scrutiny following allegations of fraud and the mismanagement of customer funds.

BSP and JICA Renew Partnership to Expand Credit Risk Database for SMEs in the Philippines

On December 11, 2024, a significant milestone was reached in the Philippines' financial sector as the Bangko Sentral ng Pilipinas (BSP) and the Japan International Cooperation Agency (JICA) officially signed the ‘Records of Discussion’ for the second phase of the Credit Risk Database (CRD) project. The ceremony at the BSP headquarters in Manila marked a pivotal moment in widening access to financing for small and medium enterprises (SMEs) across the country.

Why Copy Trading is Perfect for New Investors

Learn why copy trading is ideal for new investors. Follow expert traders, minimize risks, and start earning confidently—no prior expertise is required.

WikiFX Broker

Latest News

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

“Predict and Win” Big Rewards! Join the Contest Now

South Korean President Yoon Suk Yeol's Arrest Shakes Markets

Titanium Capital LLC Ponzi Scheme: Henry Abdo Admits Fraud, Impacting Over 200 Investors

South Korea's Crypto Regulation Updates for 2025

Currency Calculator