简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

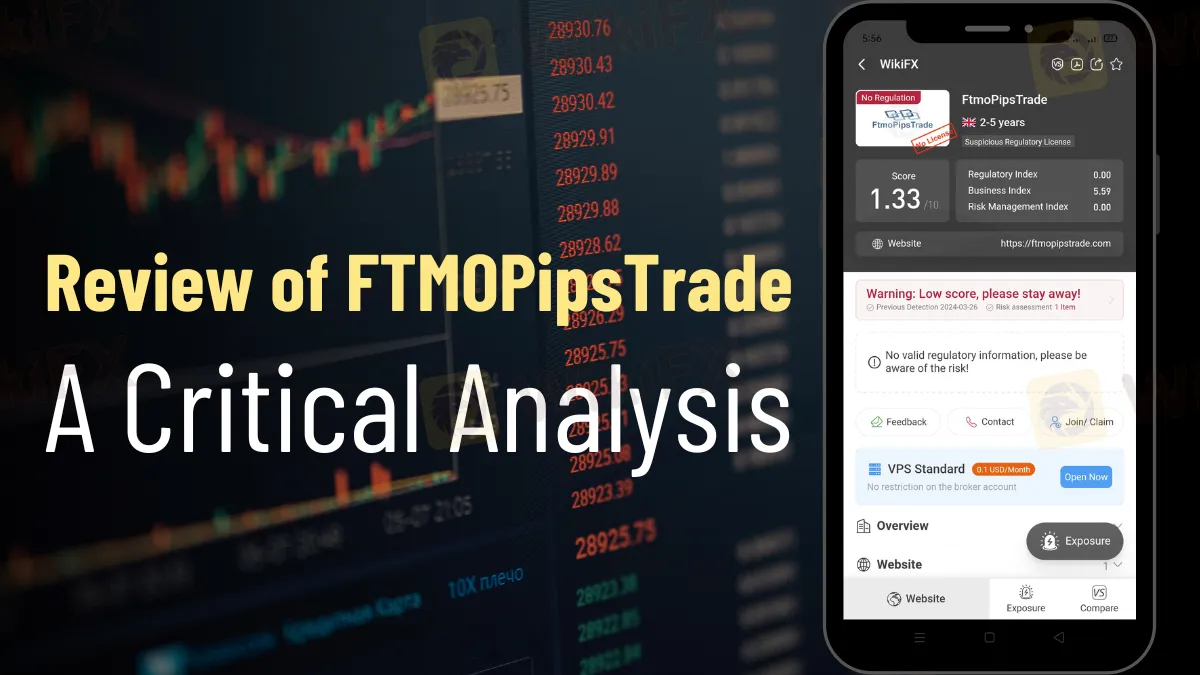

Review of FTMOPipsTrade: A Critical Analysis

Abstract:FTMOPipsTrade scrutiny reveals risks due to a lack of regulation and website issues. Investors are advised to prioritize regulated, transparent brokers.

Securing investments and maintaining the integrity of trading activities in the online trading industry is dependent on choosing the right trading broker. Recent scrutiny has focused on FTMOPipsTrade, a broker whose main headquarters are said to be in the United Kingdom. There are several grounds for concern that both prospective customers and experienced traders ought to take into account.

Regulatory Status: A Red Flag

The regulatory status—or, more precisely, the absence thereof—of FTMOPipsTrade is among the most significant concerns surrounding the platform. Without a license, registration, or regulation, the broker operates. Due to the critical nature of regulatory supervision in ensuring equitable trading practices, client fund security, and the overall dependability of a broker, this presents a significant risk to investors.

Being unregulated or unlicensed, the trading broker is vulnerable to a series of malpractices. These include but are not limited to the manipulation of trading conditions, the misuse of client funds, and the absence of accountability in dispute resolution. Investors are encouraged to exercise prudence and give precedence to brokers who maintain transparency regarding their adherence to regulatory requirements set forth by reputable financial authorities.

Accessibility of the Website: Additional Concerns

The inaccessibility of the FTMOPipsTrade website further compounds the concerns. An operational and enlightening website is essential for a brokerage, playing a dual role in providing users with crucial details regarding its services, charges, and conditions. The absence of a functional website gives rise to inquiries regarding the operational integrity of the broker and its dedication to delivering a trading environment that is both transparent and user-friendly.

The Question of Presence at the Headquarters

FTMOPipsTrade's headquarters are in the United Kingdom, a nation known for its difficulty in the financial regulatory system. Despite this, the broker's authenticity and adherence to the stringent standards expected in the UK financial industry are mainly unsupported due to a lack of physical, verifiable presence and regulatory compliance.

Conclusion: Caution is Advised

Prospective investors are strongly advised to exercise extreme caution regarding FTMOPipsTrade, given the substantial concerns surrounding it. These concerns include a website that is not easily accessible, non-compliance with regulatory requirements, and dubious claims of having a headquarters in the United Kingdom. A conspicuous absence of regulatory supervision suggests that the broker may have neglected to ensure the security and impartiality to which traders are entitled.

Before considering the utilization of FTMOPipsTrade for trading objectives, conduct thorough research and assess alternative platforms that guarantee transparency, compliance with regulatory standards, and a track record of reliable performance. It is impossible to overstate the importance of choosing a trustworthy and accountable broker in the dynamic and often complex world of online trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator