简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

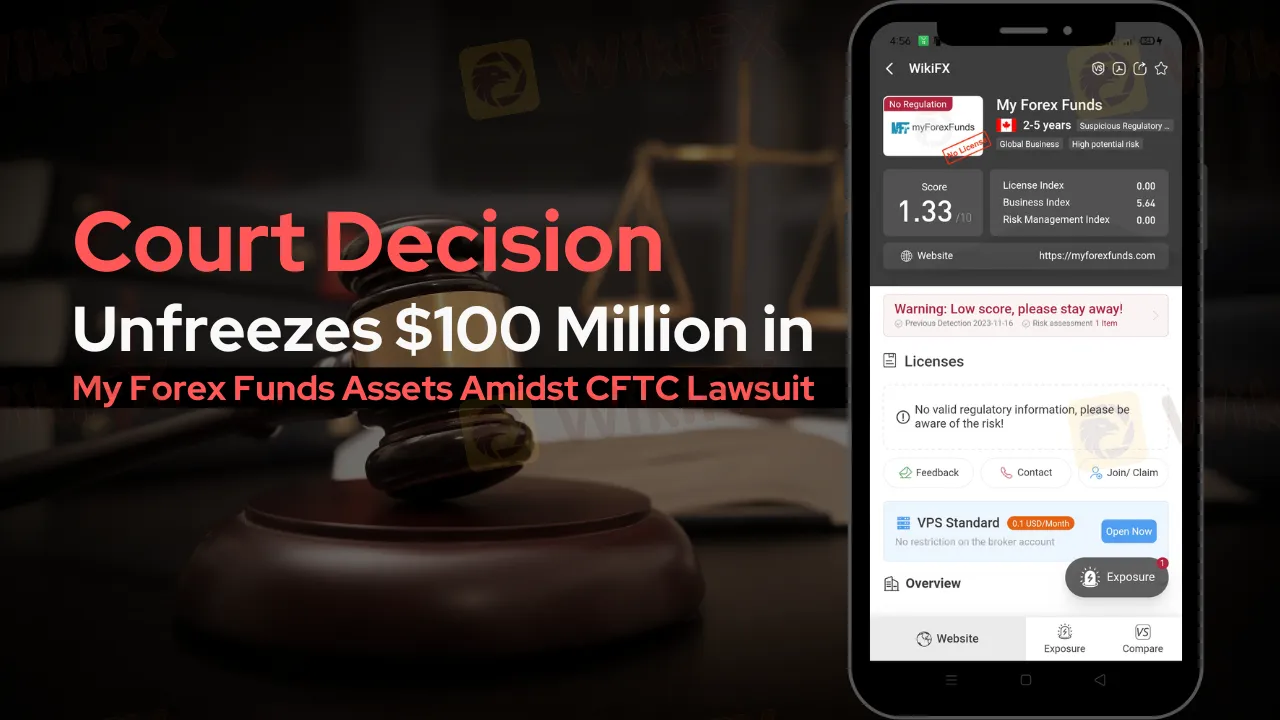

Court Decision Unfreezes $100 Million in My Forex Funds Assets Amidst CFTC Lawsuit

Abstract:Key legal developments in the My Forex Funds vs. CFTC case, including the unfreezing of $100 million in assets. Insights into regulatory challenges for prop trading firms.

In a recent court ruling in New Jersey, My Forex Funds (MFF), a prominent player in the proprietary trading industry, achieved a significant legal victory. The court ordered the unfreezing of approximately $100 million of the company's assets, a decision that marks a turning point in the ongoing legal battle with the US Commodity Futures Trading Commission (CFTC).

Despite this win for MFF, the court has maintained the freeze on $12.08 million of the assets and rejected the proposal for a new temporary receiver. This ruling comes amid allegations by the CFTC against MFF and its CEO, Murtuza Kazmi, for fraudulent activities involving over $300 million.

Key Highlights of the Case

MFF's defense team has vigorously contested the CFTCs allegations, arguing against the agency's jurisdiction and the nature of the statutory restraining order.

The CFTC's complaint highlights various deceptive practices in leveraged retail FX and commodity transactions, including unjust account terminations and unfavorable execution of customer orders.

The case illuminates broader concerns about proprietary trading practices, particularly regarding drawdown rules and revenue generation methods.

MFF, during the period under scrutiny, distributed $137 million to its clients, reflecting its substantial role in the prop trading sector.

MFF's Defense Stance

MFF's defense refutes the CFTC's portrayal of financial transactions, asserting that the funds in question were earmarked for Canadian tax authorities.

The defense also challenges the CFTCs claim regarding the solicitation and acceptance of customer investments, highlighting the firm's compliance with tax obligations.

CFTC's Concerns

The CFTCs investigation into MFF's operational practices raises questions about the transparency and legality of prop firms' income sources and payout mechanisms.

The focus is particularly on how trader payouts were funded and the use of evaluation fees.

Implications for the Proprietary Trading Industry

This case could set a precedent for how prop firms are regulated, especially regarding risk management measures and evaluation fees.

It underscores the need for greater clarity in the regulatory framework governing the proprietary trading sector.

About CFTC

The Commodity Futures Trading Commission (CFTC) is a key regulatory body in the United States, overseeing the futures, options, and derivatives markets. Established in 1974, the CFTC's mandate includes promoting competitive and efficient futures markets while protecting market participants against manipulation, abusive trade practices, and fraud. The CFTC plays a crucial role in ensuring the integrity of the financial markets, a responsibility that extends to overseeing entities like My Forex Funds.

Looking Forward

As the legal proceedings continue, the unfolding case between My Forex Funds and the CFTC remains a focal point in the financial world. It highlights the evolving nature of regulatory challenges in the dynamic and complex domain of proprietary trading. The outcome of this case could potentially reshape regulatory approaches and compliance requirements within the industry, emphasizing the importance of transparency and fair trading practices.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PayPal Expands PYUSD Transfers to Ethereum and Solana

PayPal's PYUSD stablecoin can now transfer across Ethereum and Solana, enhancing flexibility for users through a LayerZero cross-chain integration.

Broker Review: Is Exnova Legit?

A forex broker named Exnova has recently come to our attention. This broker is registered in Saint Vincent and the Grenadines and started its business in 2021. In this article, we will dig into this broker deeply and provide some information if you are interested.

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

The scammer behind a $73 million pig butchering scheme has pleaded guilty to defrauding victims through fake cryptocurrency investments.

Influencer-Led $232M Crypto Scam Exposed in South Korea

South Korean authorities recently dismantled a large-scale cryptocurrency scam, allegedly orchestrated by a popular YouTuber referred to as Mr. A, which misled over 15,000 investors and amassed nearly 325.6 billion Korean won (approximately $232.7 million USD).

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator