简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Apply Daily Forex News in Forex Trading?

Abstract:Enhance your forex trading strategy by leveraging daily forex news. Understand how economic updates affect currency value and manage your risk effectively.

Introduction

Understanding the currency market may be difficult owing to its volatile nature and the large number of currencies to keep track of. You may, however, negotiate this complexity and perhaps improve your trading performance by adding daily forex news into your trading approach. This article will walk you through the crucial aspects of applying daily forex news in forex trading, outlining which currencies to focus on, the best sources for forex news, and how to interpret economic events and apply fundamental analysis to make informed trading decisions.

Explanation of the Title: Forex News in Forex Trading

The title may appear self-explanatory, but it holds a profound concept in the world of forex trading. Applying daily forex news in forex trading means leveraging the constant stream of economic updates, news events, and data releases to make decisions on when to buy or sell a currency pair. Its about being responsive to global events and using this knowledge to predict potential currency movements.

Which Currencies Should Be Your Focus?

With at least eight major currencies available for trading at most currency brokers, there is always a piece of economic data slated for release that forex traders can use to make informed trades. In fact, seven or more pieces of data are released almost every weekday (except holidays) from the eight major most-followed countries. So for those who choose to trade news, there are plenty of opportunities. The eight major currencies are:

U.S. Dollar (USD)

Euro (EUR)

British Pound (GBP)

Japanese Yen (JPY)

Swiss Franc (CHF)

The Canadian Dollar (CAD)

Australian Dollar (AUD)

New Zealand Dollar (NZD)

Moreover, there are many liquid currency pairs derived from the eight major currencies, including EUR/USD, USD/JPY, AUD/USD, GBP/JPY, EUR/CHF, and CHF/JPY.

Frequently Asked Questions

What are the Best Sources for Forex News?

Reliable and timely information is key in forex trading. Numerous online sources provide regular forex news, including Bloomberg, Reuters, CNBC, Financial Times, and Forex Factory. These platforms cover the global financial news, including forex-related news, and offer analysis and insights that can help traders understand market trends. Additionally, many brokers also provide in-house news and analysis.

How does Economic News Affect Forex Trading?

Economic news plays a critical role in forex trading as currencies represent the economic health of a nation. Currency prices may be greatly influenced by news regarding GDP growth, interest rates, unemployment rates, consumer price index, trade balance, political stability, and other factors. Positive news may help a country's currency rise, while bad news can undermine it. To predict these swings and make educated judgments, traders must remain up to date on economic news.

What is Fundamental Analysis in Forex Trading?

Fundamental analysis in forex trading involves assessing the economic, social, and political forces that may affect a currencys value. It involves keeping tabs on economic indicators, policy changes, and geopolitical events that could influence currency demand or supply. A trader who uses fundamental analysis not only considers the actual economic indicators but also the market sentiment and potential market reactions to these news events.

How can I use Forex News to Make Trading Decisions?

Forex news may be used to forecast market fluctuations, spot trading opportunities, and manage risk. For example, if a country's economic metrics are strong, its currency may increase. Traders can then buy that currency against a weaker one, anticipating a rise in its value. Also, news about geopolitical events or policy changes can lead to market volatility. Traders can use this information to adjust their positions and risk management strategies accordingly.

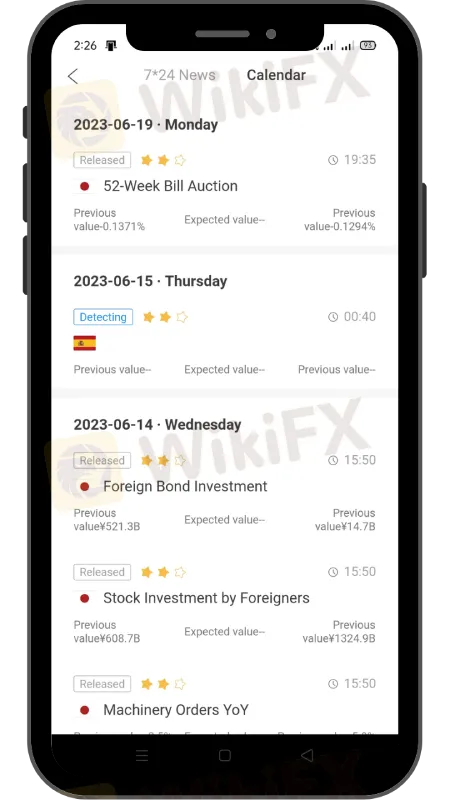

What is an Economic Calendar in Forex Trading?

An economic calendar is a schedule of economic events and data releases, including GDP, unemployment rates, consumer price indices, and central bank meeting outcomes. These events can significantly influence forex markets. The economic calendar provides traders with the schedule of these events, helping them to plan their trades around these key announcements. Websites like Forex Factory, Investing.com, and WikiFX offer comprehensive economic calendars for forex traders.

What are the Risks of Trading Based on the News?

Trading based on news can be risky due to the inherent unpredictability of the markets. News releases can lead to increased market volatility, leading to significant price swings. Also, while an economic indicator may generally suggest a certain outcome, other factors can influence the market differently. Furthermore, the 'buy the rumor, sell the fact' phenomenon can often occur in the market, where prices move in the opposite direction to what is expected after the news release.

How do I Apply Risk Management in Forex Trading?

Risk management in forex trading is crucial to safeguard your trading capital and limit potential losses. It involves setting stop-loss orders to limit potential losses, diversifying your trades to avoid overexposure to a single currency pair, and never risking more than a small percentage of your trading capital on a single trade. Additionally, it involves staying updated with economic news to anticipate market volatility and adjust your positions accordingly.

Conclusion

Applying daily forex news in forex trading is a practical approach that combines an understanding of global economics with specific market indicators. By focusing on major currencies and using reliable sources for forex news, traders can develop a sound strategy that navigates market volatility and leverages economic events for potential gains.

Stay one step ahead of the forex market by using tools like an economic calendar and a trusted forex news source like the WikiFX App. With this app, you can keep up-to-date with the latest forex news and economic events, helping you make more informed trading decisions. Download the WikiFX App here to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Many Social Media 'Investment Gurus' Are Scammers Preying on Malaysian Traders

Social media platforms have become breeding grounds for scammers posing as investment gurus, exploiting the growing interest in forex and cryptocurrency trading among Malaysians. Fraudulent "financial experts" often create the illusion of legitimacy by offering enticing stock analyses and promises of high returns.

Arumpro Capital Ltd Faces Regulatory Setbacks as CySEC Withdraws CIF Licence

The Cyprus Securities and Exchange Commission (CySEC) has officially withdrawn the Cyprus Investment Firm (CIF) licence of Arumpro Capital Ltd. The decision was finalised during a CySEC meeting on 11 November 2024, marking another chapter in the firm's ongoing regulatory challenges.

Webull Expands Trading Services to Japan via TradingView

Webull launches in Japan, offering low-cost trading for U.S. and Japanese securities via TradingView. Start trading with investments as low as $5.

Countdown to WikiEXPO Dubai 2024 — “Seeing Diversity, Trading Safely”

With the booming development of the global Fintech industry, WikiEXPO Dubai 2024, hosted by WikiGlobal and co-organized by WikiFX, will officially kick off on November 27, themed “Seeing Diversity, Trading Safely.” This event will bring together global elites to explore the future of Fintech.

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator