简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Value of Being Regulated by FCA: A Guide for Businesses

Abstract:The Financial Conduct Authority (FCA) regulates financial institutions in the UK, protecting clients from harm. Being FCA-regulated enhances credibility, ensures compliance with regulations, offers consumer protection, improves access to funding, and provides a competitive edge. Businesses must apply to be regulated, meet requirements, and comply continuously. WikiFX and the FCA both offer information on forex brokers, protect traders, promote transparency, and help avoid scams.

You can question if the Financial Conduct Authority's (FCA) regulation of your company is required as a business owner. The answer is that it is highly beneficial. In this piece, we'll discuss the advantages of FCA regulation and how it may assist your business.

What is FCA?

The Financial Conduct Authority (FCA) regulates financial institutions in the United Kingdom, including banks, insurance companies, and investment firms. The FCA's role is to ensure that these institutions operate honestly and transparently while protecting clients from financial harm.

Why Should Businesses be Regulated by FCA?

Being subject to FCA regulation is advantageous for firms for a number of reasons, including:

Credibility and Trust

Having FCA regulations lends confidence and trust to your company. It shows that you are dedicated to safeguarding your consumers and that you take financial rules seriously. Customers and investors that value openness and ethical corporate conduct may be attracted by this.

Compliance with Regulations

To protect consumers from financial harm, the FCA has imposed stringent regulations. To be regulated by the FCA, your firm must adhere to these guidelines, which ensure that you do business fairly and honestly. This may assist you in avoiding any legal troubles or penalties that may occur as a result of noncompliance.

Enhanced Consumer Protection

Consumers are protected against financial damage by the FCA laws. Your company must meet these conditions in order to be regulated by the FCA. You may be able to safeguard your clients from financial dangers such as fraud and unethical business practices by doing so.

Access to Funding

Your company may find it simpler to get capital if you are subject to FCA regulation. Many financial institutions demand that companies be subject to FCA regulation before they would even consider lending money. You may show prospective lenders that you are a reliable and respectable company by becoming regulated.

Competitive Advantage

Being subject to FCA regulation may provide your company with a competitive edge. It might help set your company apart from rivals that operate without regulations and show clients that you value their financial stability.

How to become regulated by FCA?

Your organization must submit an application to be subject to FCA regulation. Your firm must meet a variety of requirements, and the application process may be difficult and time-consuming.

The application procedure includes filling out an application form, submitting supporting documents such as financial statements, and showing that your company complies with FCA requirements. FCA will assess your application once you submit it and may seek more information or clarification.

It is important to remember that FCA regulation is a continuous process. Your firm must adhere to FCA standards on an ongoing basis, and FCA may conduct audits and inspections to guarantee compliance.

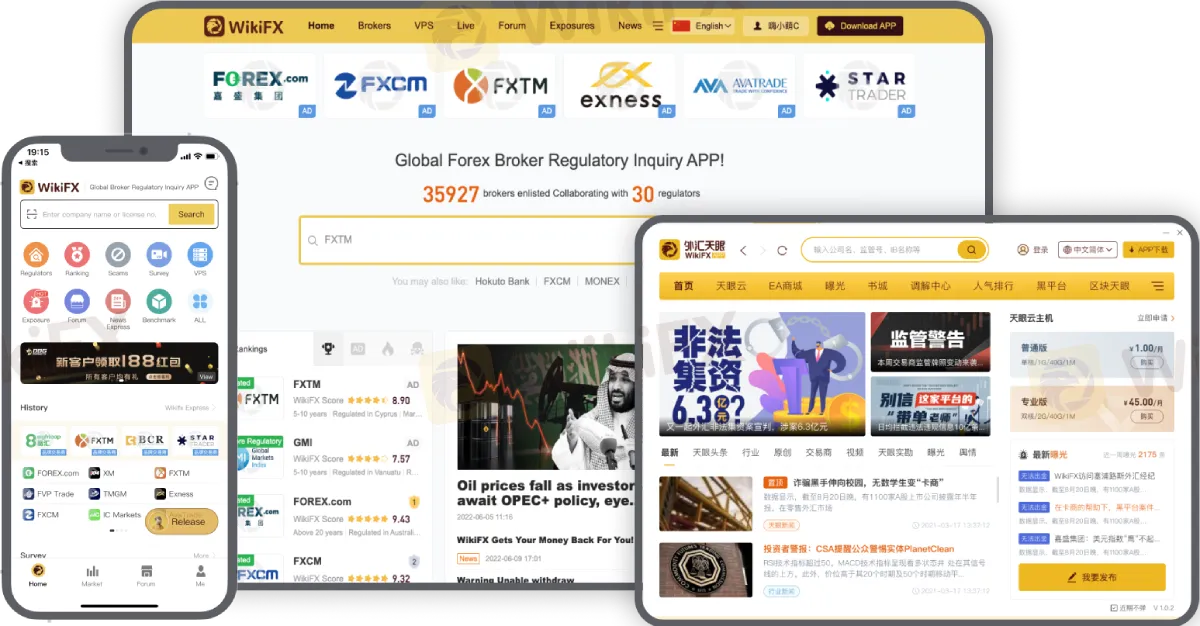

WikiFX and FCA's Similarities

Despite the fact that both WikiFX and the Financial Conduct Authority (FCA) are participating in the forex market, their functions and duties are unique. In the following respects, the two are comparable:

- Both organizations provide information about forex brokers: WikiFX does so on its platform, while the FCA does so on its website in the form of a list of licensed forex brokers.

- Both seek to safeguard traders: To assist traders in making educated selections, WikiFX offers information about forex brokers, and the FCA is a regulatory agency with the mission of safeguarding customers and preserving the integrity of the UK financial markets.

- Both play a part in encouraging transparency: the FCA encourages openness by forcing financial institutions to be open and honest with their consumers, while WikiFX promotes transparency in the forex sector by offering information about forex brokers.

Both WikiFX and the FCA can assist traders in avoiding scams by giving information about unreliable brokers and taking legal action against financial institutions that participate in fraudulent practices.

Conclusion

Having FCA regulation is quite advantageous for firms. It may assure compliance with rules, safeguard customers, boost reputation and confidence, enable access to capital, and give a competitive edge. Regulated status, however, requires continuing compliance and is a difficult procedure. To make sure you satisfy all regulatory criteria, it's crucial to obtain expert guidance if you're thinking of applying to be regulated by the FCA.

Download and Install the WikiFX App on your smartphone to stay updated on the latest news.

Download the App: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Rupee gains against Euro

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator