简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

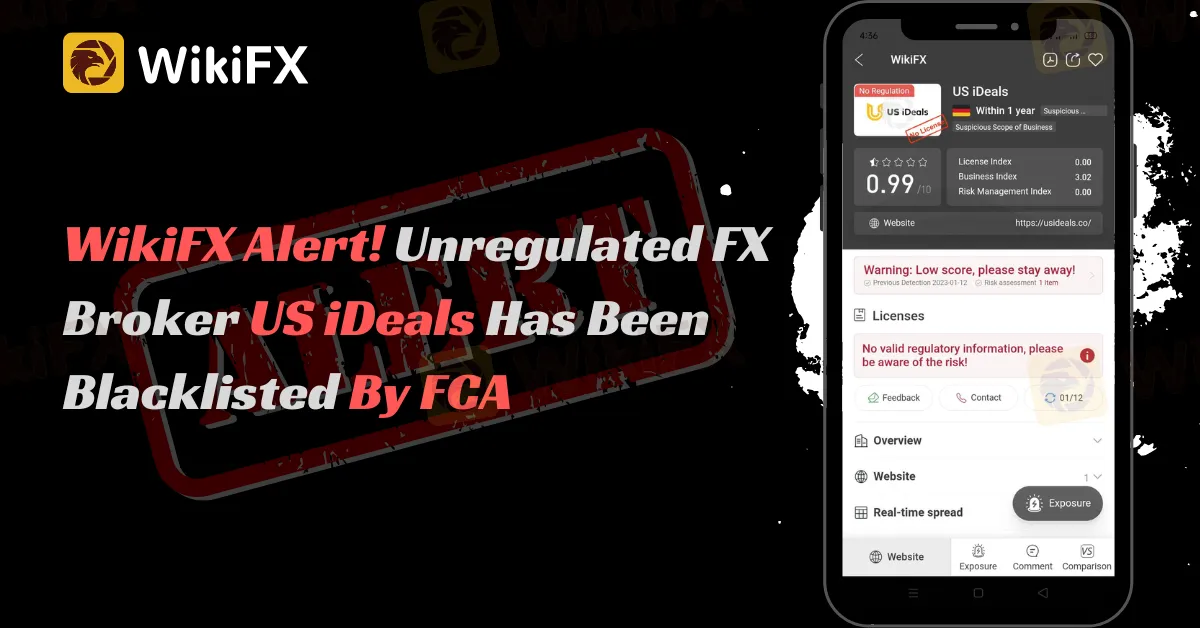

WikiFX Alert! Unregulated FX Broker US iDeals Has Been Blacklisted By FCA

Abstract:FCA listed this broker US iDeals Trade as an undesirable firm that should be avoided by the public.

The FCA publishes a batch list of undesirable firms in order to protect the public from investing and to assist regulated firms in stopping the illicit activities of unregulated brokers, who are the cause of the increased risk of fraud and why people are afraid of trading investments, as well as others attempting to enter the world of online trading.

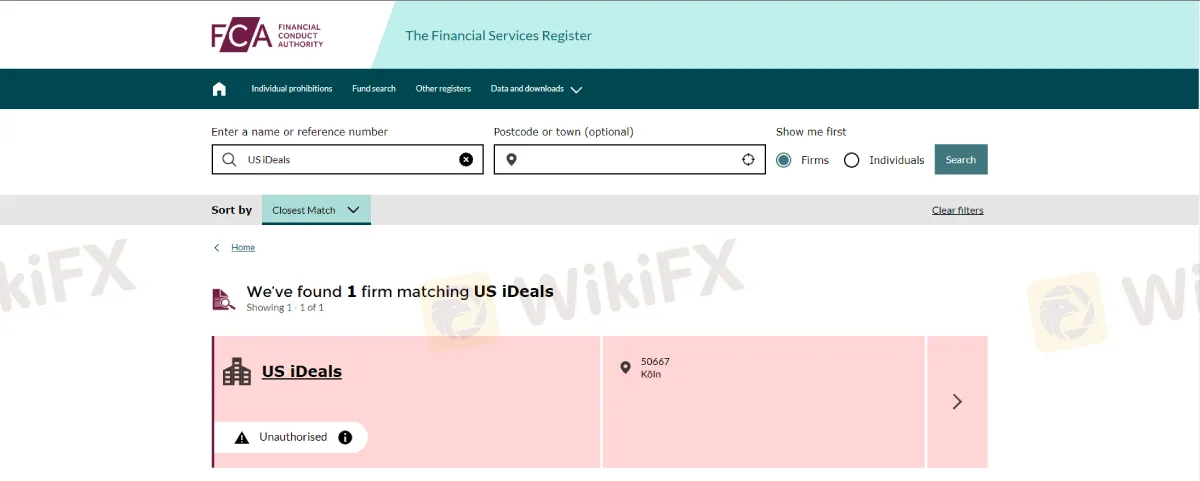

One of the online trading firms listed by the FCA due to a lack of authorization to provide, promote, or sell financial services or products in the UK is US IDEALS.

Let's check the regulatory status of US IDEALS

According to its official website, US iDeals offers a variety of trading instruments to trade from and has different accounts to choose from.

Furthermore, the said firm stated that the company has been regulated among major financial regulators namely ASIC, DFSA, FCA, and CySEC.

They also have affiliations with the world's leading providers of investment such as Blackrock, Ameriprise Financial, UBS Group, and Fidelity.

The statement above means a lot to investors if someone doesn't know how to investigate to make sure the claim is true and correct.

The truth!

Upon checking the name of the broker on the said financial regulators, they claimed. No name of US iDeals registered either of the regulators. In fact, FCA released a warning statement to the public to be avoided by the people in the UK as well as the other countries.

ASIC

DFSA

FCA

CySEC

We also try to find some feedback from their investors but no single feedback was found.

WikiFX, serve as a medium platform for financial regulators especially FCA, to encourage their victims to send a report about the said broker to conduct an investigation.

This kind of broker needs strict monitoring as they may change their name and will back to their operation to fraud the public.

Final word,

It's important to report any suspicious or fraudulent activity to the appropriate regulatory authorities as soon as possible and to seek legal or financial advice if you have been a victim of a scam. Many regulatory authorities have processes in place for dealing with complaints about regulated brokers and may take action against them if they have violated any rules or laws.

It may also be helpful to talk to other people who have gone through similar experiences or to reach out to organizations that provide support for victims of investment fraud. It's also important to understand that being scammed doesn't reflect on your intelligence or character and you should not be ashamed of falling victim to a scam.

Download the install the WikiFX App from the download link below to stay updated on the latest news, even on the go. You can also download the app from the App Store or Google Play Store.

Download link

https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Group Enters Direct Investment Market with £160 Million Freetrade Buyout

IG Group, a prominent global financial trading and investment company, has announced its acquisition of Freetrade, a commission-free investment platform, for £160 million. The deal, funded through IG’s existing capital resources, marks a strategic move to expand its footprint in the United Kingdom.

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

Cinkciarz.pl, one of Central Europe’s largest currency exchange platforms, has made headlines after accusing major Polish banks of conspiring to undermine its operations. The company has threatened legal action amounting to 6.76 billion zlotys ($1.6 billion) in damages. However, the platform is now under intense scrutiny following allegations of fraud and the mismanagement of customer funds.

BSP and JICA Renew Partnership to Expand Credit Risk Database for SMEs in the Philippines

On December 11, 2024, a significant milestone was reached in the Philippines' financial sector as the Bangko Sentral ng Pilipinas (BSP) and the Japan International Cooperation Agency (JICA) officially signed the ‘Records of Discussion’ for the second phase of the Credit Risk Database (CRD) project. The ceremony at the BSP headquarters in Manila marked a pivotal moment in widening access to financing for small and medium enterprises (SMEs) across the country.

Why Copy Trading is Perfect for New Investors

Learn why copy trading is ideal for new investors. Follow expert traders, minimize risks, and start earning confidently—no prior expertise is required.

WikiFX Broker

Latest News

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

“Predict and Win” Big Rewards! Join the Contest Now

South Korean President Yoon Suk Yeol's Arrest Shakes Markets

Titanium Capital LLC Ponzi Scheme: Henry Abdo Admits Fraud, Impacting Over 200 Investors

South Korea's Crypto Regulation Updates for 2025

Currency Calculator