简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WIKIFX REPORT: Timing the S&P500 & the midterm rally; does it make sense?

Abstract:Going into the US midterm elections analysts were mostly split between three different positions:

Going into the US midterm elections analysts were mostly split between three different positions:

• Those analysts who pointed to the strong seasonal pattern in US stocks post the US midterm elections,

• Those who recognised the strong seasonals but said that it is different this time and stocks wont rally,

• Those who wanted to wait and see.

This article will look at some of the main points to consider when trying to track a way through by looking at the strengths and weaknesses of each position.

The seasonal strength

It can‘t be denied that the seasonals are very strong. Every US midterm election since 1950 has resulted in a higher S&P500 6 months later. That is a key statistic that can’t be ignored.

According to other analysts, this time is different and high inflation and the risk of the Fed giving a hard landing should mean that stocks dont perform so well. However, if you take a longer view we have to ask when will the Fed signal a pause in rates? It is likely to when/if the US economy shows signs of slowing.

Jobs and inflation

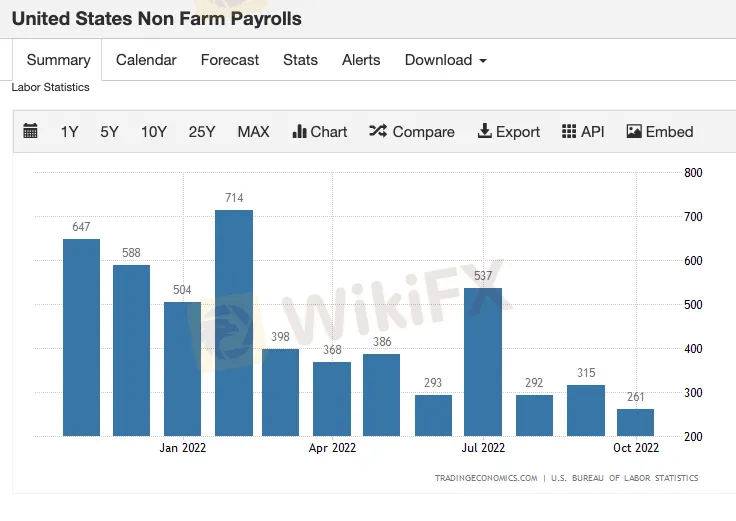

US jobs are still ok although the trend is tracking lower. The Fed will likely press the pause if/when the jobs market starts to slow down significantly.

Core inflation is moving higher and that will be a key metric going forward. If core inflation can show signs of slowing then that will give the Fed space to pause rates. Remember the Feds preferred measure of inflation is PCE.

So, one key thing to remember is that the Fed will try to pre-empt a downturn in the economy and signal a pause before the effects really impact. The Fed has already said that there is a lag effect and that it will be mindful of that. The lag effect is due to the time for interest rate hikes to cool demand. There is usually a 6 month+ lag effect which means the Fed will not want to wait until the economy is struggling in order to signal a pause. This has been born out in history with many stock rallies occurring while the economy is still slowing. See the graphs below to see this effect in play.

So, yesterday‘s CPI miss is good news for US stock bulls. Both groups of analysts may prove to be correct. This time it is different, but if the Fed signals a pause in December’s rate meeting that could still send stocks higher into year-end as potentially part of a US midterm rally after all. Whatever happened we need to be aware that volatility is ahead as each fresh economic data point is assessed in light of what it will mean regarding Fed policy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator