简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TMGM Is Now A Member Of The Financial Commission

Abstract:On September 22nd, the Financial Commission (FinCom), a self-regulatory institution in the financial services sector, recognized TMGM as the newest approved broker member.

The Financial Commission (FinCom), a self-regulatory agency in the financial services industry, announced the inclusion of TMGM as the newest authorized broker member on September 22nd.

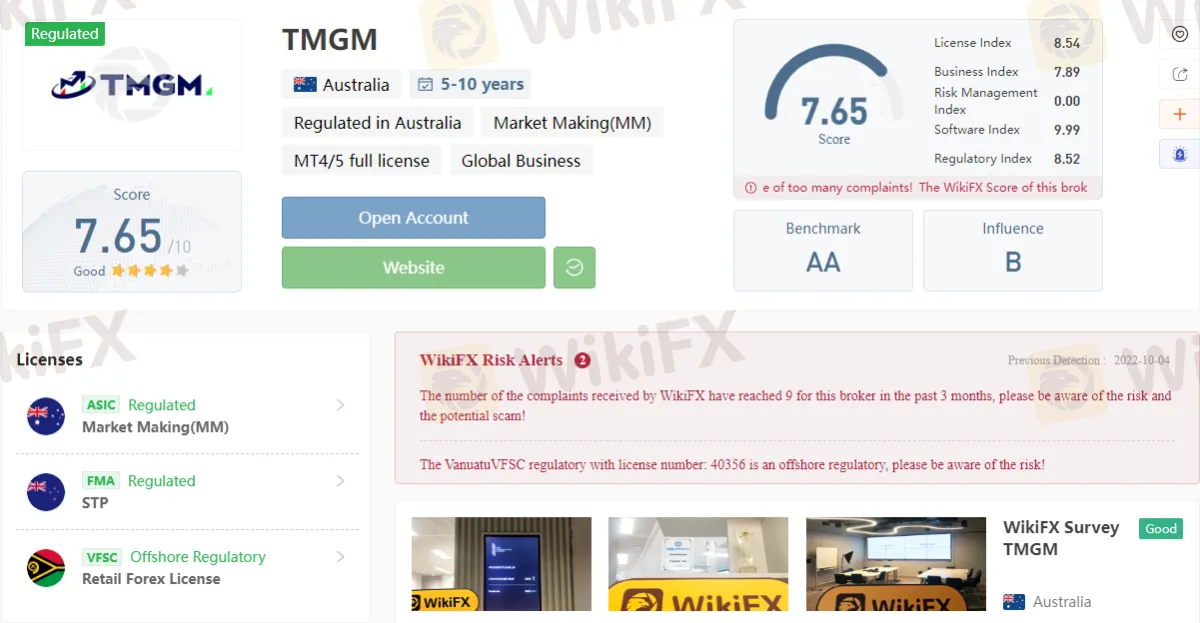

TMGM is a well-known brokerage firm, particularly in the Asia-Pacific area. Its worldwide activities are governed in Australia, New Zealand, and Vanuatu.

The Australia-based broker has joined the ranks of other major brokerage firms, like Pepperstone, Exness, RoboMarkets, Alpari, IC Markets, and many more.

According to FinCom's website, it has 42 forex and contracts for differences (CFDs) brokers as members, including two sibling companies, Alpari and Alpari International. It has also granted membership to a number of blockchain platforms, technology suppliers, investment platform providers, and even educational institutions.

Brokers and their clients benefit from a broader choice of services and perks as FinCom members. The most popular, however, is fund protection of up to €20,000 for each client, guaranteed by the Financial Commission's Compensation Fund. This gives assurance to worldwide brokerage customers whose money is not covered by compensation systems offered by numerous leading authorities, such as the FCA and CySEC.

Furthermore, FinCom acts as a neutral third-party arbitrator in any dispute between any of the member brokers and their customers.

“For approved members and their clients who participate in CFDs, forex, and cryptocurrency markets, the Financial Commission facilitates a simpler, faster resolution process than through traditional regulatory channels such as arbitration or local court systems,” according to a press release shared with WikiFX.

Meanwhile, FinCom has recently evicted many businesses for violating its membership regulations. Fiber Markets, LordFX, and EGMarkets had their membership status revoked early this year owing to rules and standards violations. GANN Markets, on the other hand, elected to leave.

A Brief History of TMGM

TMGM is a solid broker with reasonable fees and advanced trading tools. With one of the top marks in our poll, TMGM stood firm against much bigger industry leaders. Our evaluation is based on a real Classic Account created with the Trademax Global Limited firm using the MetaTrader 4 platform (TMGM.com).

TMGM (Trademax Global Markets) was established in Australia in 2015. The top-tier Australian Securities and Investment Commission (ASIC), the Financial Markets Authority (FMA), and the Vanuatu Financial Services Commission all have jurisdiction over TMGM (VFSC). TMGM has over 12,000 trading products with a leverage of up to 1:500.

TMGM can provide excellent service to experienced, sophisticated traders, including semi-professionals, professionals, and fund managers. TMGM provides excellent teaching materials and customer assistance to novice traders. However, the feature-rich MetaTrader interface takes time to understand and is less intuitive than some other brokers' systems.

WikiFX Overview

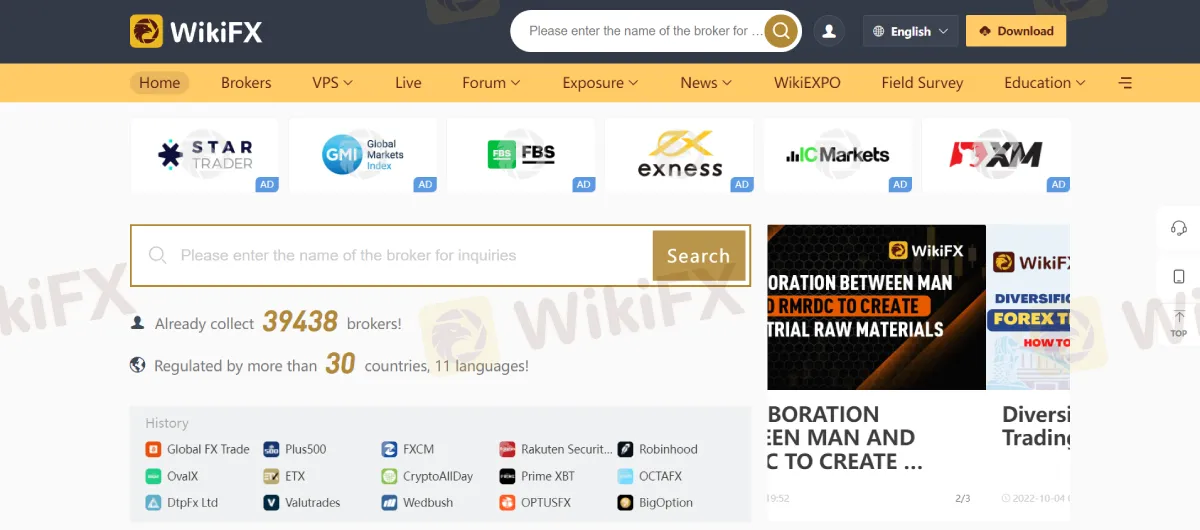

WikiFX is a search engine for worldwide corporate financial information. Its primary duty is to search for basic information, regulatory licenses, the credit assessment, platform identification, and other services for the participating foreign currency trading firms.

There are about 39,000 brokers listed on the marketplace, both licensed and unregistered. WikiFX's staff has been working hard with 30 financial regulators from across the world to guarantee that the information supplied is accurate and up-to-date.

Watch for more Broker News.

WikiFX App may be downloaded via the App Store or Google Play to access the latest news on the go.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator