简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Which is More Profitable? Forex or Stock?

Abstract:The foreign exchange market has an endless number of major, minor, and exotic currency pairs to trade. Forex traders utilize pips to determine whether the market is moving up or down. EUR/USD, GBP/USD, and USD/JPY are prominent forex pairs.

The foreign exchange market is the world's biggest and most liquid financial market, with apparently an infinite number of major, minor, and exotic currency pairings to trade. Pips may be used by forex traders to watch price changes in order to assess whether the market is trending up or down. Among the most popular main currency pairings for forex trading are EUR/USD, GBP/USD, and USD/JPY.

Traders may bet on the value of blue-chip stocks and penny stocks, which are both popular assets with opposing initial valuations. Some of the most promising stocks to trade are those of well-known corporations with huge market capitalizations, such as Microsoft, Apple, and Amazon. If you are ready to take a chance on speculative investing, penny stocks may be profitable in the long run.

Market Trading Hours

The trading hours for forex and stocks differ. The currency market is active 24 hours a day, five days a week due to time zone overlap. Forex has this advantage over stocks. Stock-market trading hours differ depending on location and exchange.

The London Stock Exchange (LSE) is open from 8:30 a.m. to 3:30 p.m., and the core FX market overlaps the New York and Tokyo sessions. Asia-Pacific Exchanges are closed for lunch. Because forex trading hours are more flexible than stock market hours, traders have more time to invest. On weekends, these markets are closed.

Volume of assets

The quantity of cash assets is a big attraction. Forex trading is available on 330 currency pairs, including major, minor, and exotic pairings (see our forex trading website for more information). Forex traders consider major currencies such as EUR/USD and GBP/USD to be stable.

The stock market offers limitless opportunities, but it pales in comparison to the $5 billion in daily FX deals. Thousands of global shares in IT, medicine, and automobiles may be exchanged. This category includes both blue-chip and penny stocks. The Dow Jones Index and the S&P 500, two of the most prominent global indices, are traded on the stock exchange.

The number of shares on the stock market does not always provide an advantage over forex. Some traders prefer trading a small number of top currency pairings that have remained in the market over choosing between investing in existing, new, and emerging firms.

ETFs are a popular approach to trading stocks rather than currencies. Exchange-traded funds hold underlying assets and operate similarly to stocks. Spread bets and CFDs do not give the trader ownership of the underlying stock. ETFs are a useful offering since stock traders want long-term holdings.

On our instruments page, you may look through over 8,000 stocks and 1,000 ETFs.

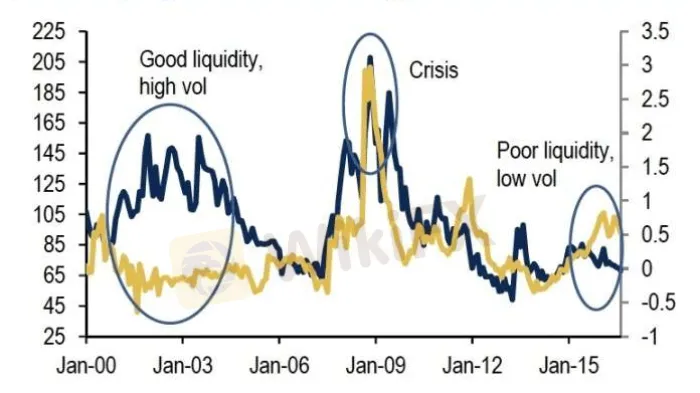

Volatility and liquidity

Volatility is a typical forex vs. stock comparison topic. This measures market price changes, which may help traders earn money if the transaction goes well or lose money if it doesn't. Forex traders need high market liquidity in order to purchase and sell assets swiftly without impacting their prices. Short-term traders gain from high market volatility. Many forex strategies commence and exit deals fast in order to profit from minor price changes in volatile markets. As a result, they can make exact bargains.

Long-term traders who prefer buy-and-hold strategies may feel uneasy in volatile markets. Traders in stocks are impacted. Because blue-chip corporations are more stable, traders are more likely to make long-term investments. A volatile market would not work for their trading strategy since they do not desire short-term price swings. Trading in volatility.

Rates of margin

Consider leverage, or margin trading, when comparing the FX and stock markets. A minimum deposit of the whole transaction value is required for spread betting or CFD trading accounts. This allows traders to quadruple their profits while trading equities and forex. This has the potential to exacerbate losses.

Forex margin rates begin at 3.3%, with leverage of 20:1. The stock market's 20% margin rate or 5:1 leverage ratio lowers the danger of capital loss. If a dealer's transaction fails, this should lessen their losses. This increased leverage ratio may help forex traders with more experience in volatile markets and who close positions quickly. If you are successful, the payout will be well worth the risk.

Trading strategies

Forex traders have significantly more tools and strategies at their disposal than stock traders. Short-term Forex trading strategies include day trading, swing trading, and scalping. In the stock market, day trading and swing trading may be employed. Stocks are often traded in long-term positions, while currency pairings are more valuable to short-term traders in volatile markets. Due to the abundance of resources and tips, forex trading may have an advantage over stocks.

Is one more profitable than the other when it comes to forex and stocks?

There is no simple answer to which market is more profitable. Consider your personality, risk tolerance, and trading goals before selecting a financial instrument or market to trade.

FX is more profitable than stocks if you desire small, consistent profits from market changes. The forex market is more volatile than the stock market, where adept traders may profit quickly. Forex involves enormous leverage, and few traders focus on risk management, making it a riskier investment with potentially negative consequences.

If you want to purchase and keep for the long term, the stock market is a safer and more regulated option that may result in larger returns if the stock performs well. Trading stocks and forex demands different strategies and patience. If a stock is successful, the stock market is a safer and more regulated choice that may result in higher gains over time. You may earn money trading stocks and FX by using various tactics and exercising patience.

Stay tuned for more Forex Educational articles.

Download the WikiFX App from the App Store or Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

5 Advantages of Choosing a Regulated Broker

Currency Calculator