简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam Alert: Stay Away from Unlicensed FX Broker Monfex

Abstract:Successful forex trading begins with selecting a trustworthy broker. While finding a legitimate broker is already challenging, the rising number of brokers makes things even more difficult.

This article explains how scam brokers like “Monfex” deceive clients using false information, lure them into profit-making deals, take their money then run away.

Monfex - A Quick Overview

Monfex (https://www.monfex.com/) is an offshore broker providing online trading services across various financial markets. Founded in 2018, the broker claims to offer 200+ tradable assets. Its supported markets include forex, commodities, stocks, indices, and cryptocurrencies. Clients have a web-based trading interface at their disposal, which is also accessible using mobile devices. The broker's educational library consisting of blogs, cocktails, and how-to guides, also make part of the offerings. Clients can reach the company's customer support via telephone or email. But the broker doesn't offer a live chat service.

Is Monfex Regulated?

No, the broker is not regulated anywhere in the world.

It previously claimed to be a part of SWISS-SVG HOLDING LTD, having “regulations” from Financial Services Authority Saint Vincent and the Grenadines (SVG FSA). The company seems to have removed the information from its website after being exposed by various independent reviewers.

Notably, SVGFSA does not license forex traders or brokers, nor control, monitor, oversee or provide licenses to foreign entities participating in forex trading or brokerage. Therefore, even if it hadn't taken down the information about SVG FSA, it was still an unregulated broker.

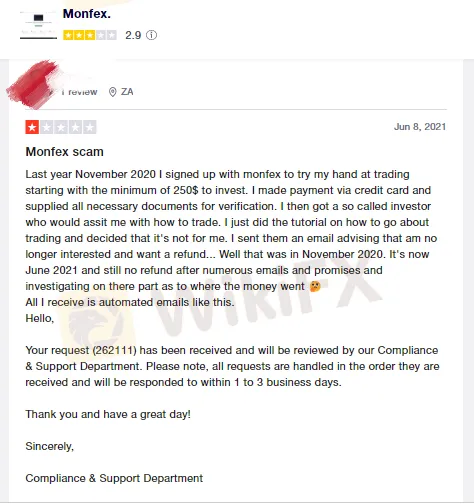

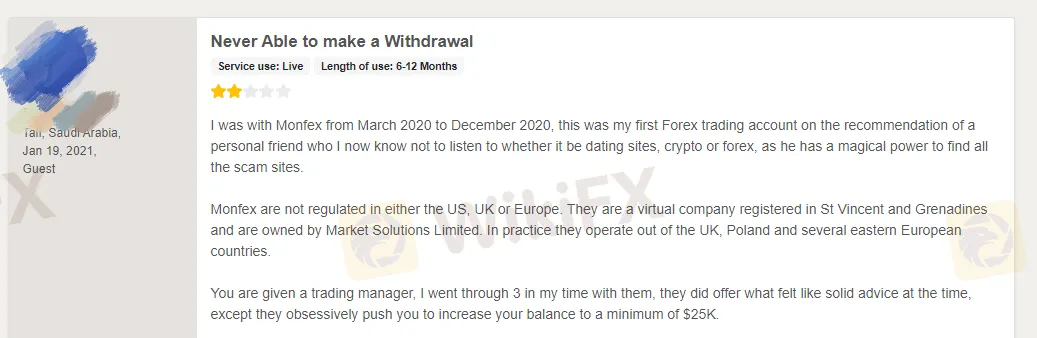

Clientele Feeback

Monfex has a terrible reputation among its customer base, much like many other scam brokers. Funds withdrawal delays, sluggish trade executions, slippage problems, and poor customer service are some complaints against the company. What's more, most clients reported that the company doesn't release your funds in any case.

Here are some reviews from several third-party websites.

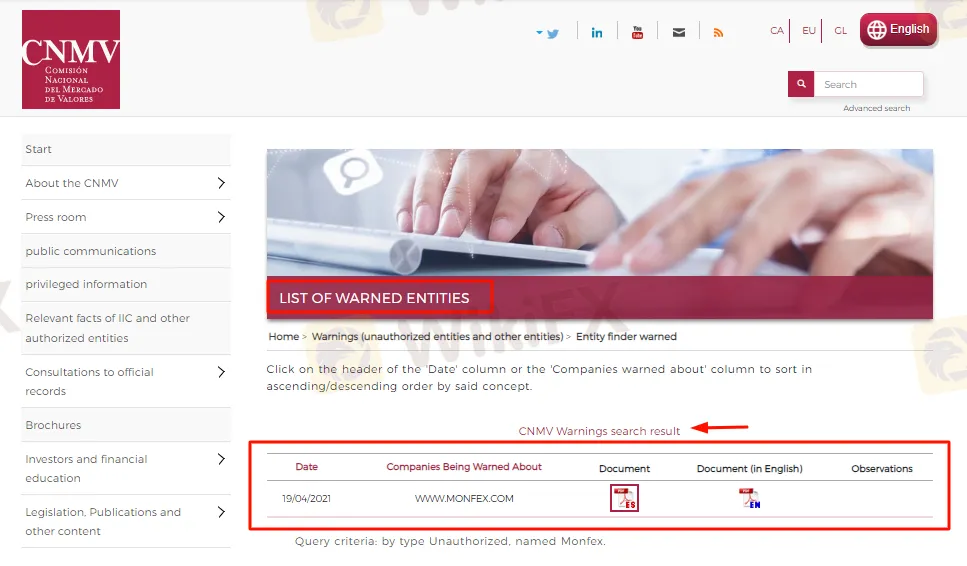

What Makes Monfex a Scam?

Monfex appears as a scam due to various reasons.

First of all, the company has been warned by the Spanish National Securities Market Commission (CNMV) amid its unauthorized operations in the country.

Second, the broker doesn't provide access to any reputable third-party trading platforms like MetaTrader or cTrader. Instead, it makes clients use its custom-built web terminal to access the markets, which carries a certain level of risk.

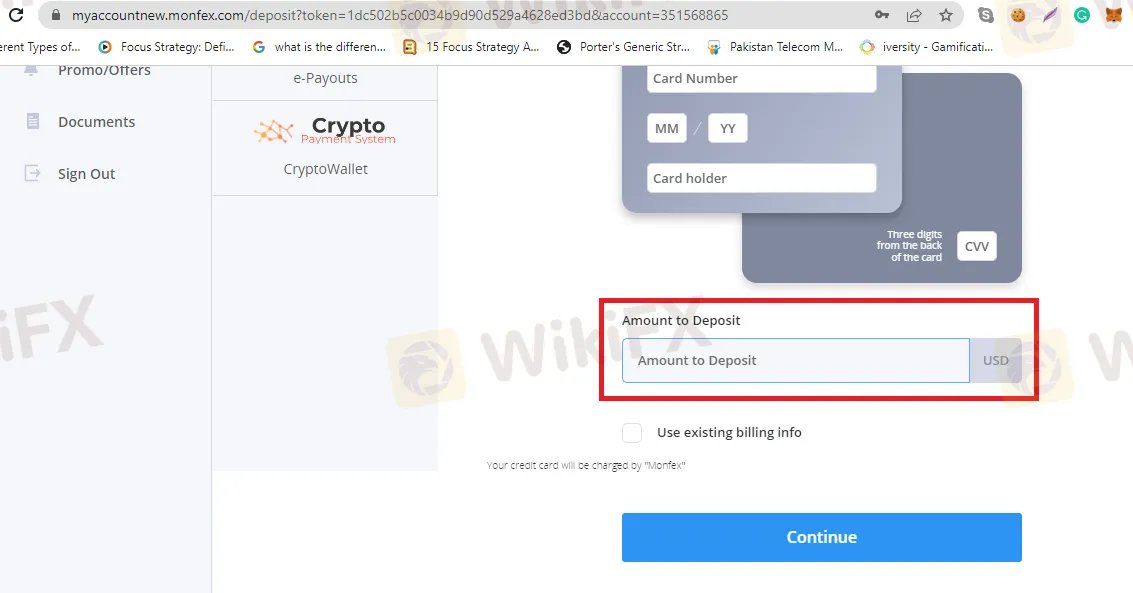

Third, the company doesn't ask for KYC documents before allowing you to deposit funds into your account. Legitimate brokers don't allow clients to use the platform until they submit relevant documents and verify their accounts. However, that's not the case with Monfex. You can deposit as many funds in your account as possible because the broker knows it won't return a single penny out of it.

Fourth, it's an unregulated entity based in an unknown location. There is no detail available on the physical address of the company.

Lastly, poor clientele feedback speaks for the company's lousy code of conduct.

How does Monfex Scam Clients?

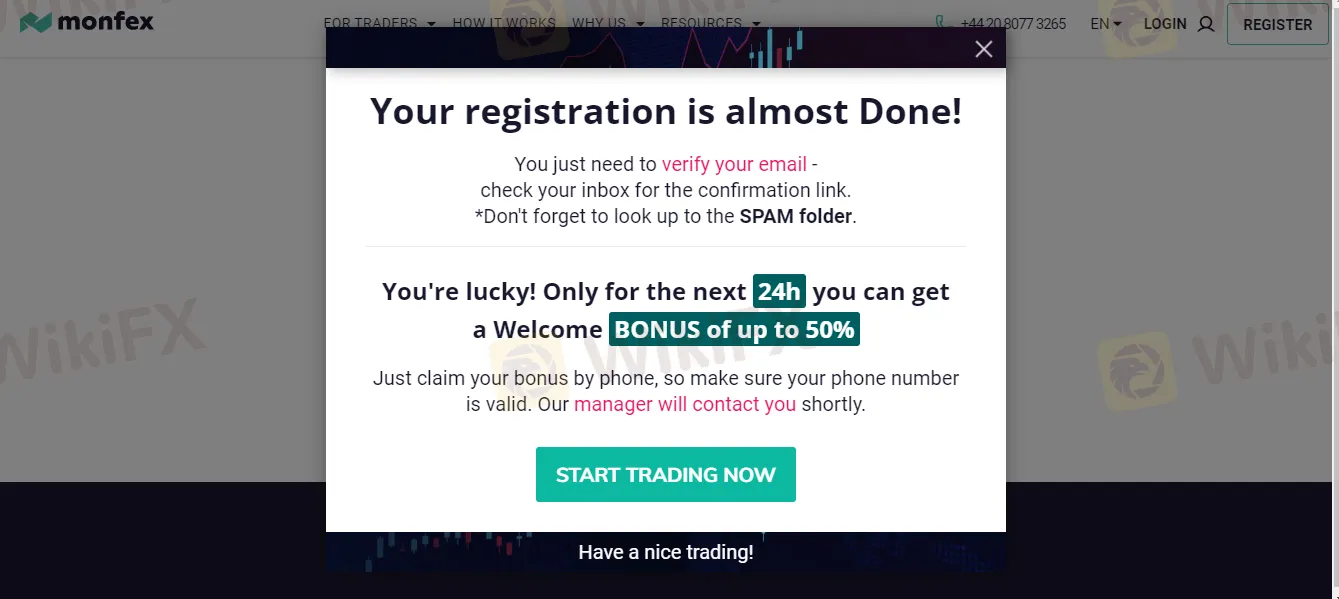

When you sign up with the company, a flash screen pops up showing that you are one of the luckiest customers who can avail of a bonus of up to 50%. The same message gets delivered to every person who registers with the broker.

Then someone from the broker's marketing team follows you via email or telephone. Pretending to be your account manager asks you for deposits. Fraudster pushes you to add a specific amount to claim the bonus offer. However, once you have funded your account, your money is gone forever since the scammer never turns the money back to you.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Starting from January 1, 2025, Russia will implement a comprehensive ban on cryptocurrency mining in 10 regions for a period of six years. The ban will remain in effect until March 15, 2031.

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Currency Calculator