简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Regulated by 4 Watchdogs? The FCA Warns Against 4XEmpires

Abstract:It is always a sign to be skeptical if a completely unknown FX broker claims to be authorized, regulated and registered by the key competent authorities and regulators.

And 4XEmpires belongs to this type of company. The entity is showing a totally regulated trading environment for traders by presenting its four licenses from financial watchdogs. But fact tells it is just a scam website.

Licenses & regulation info

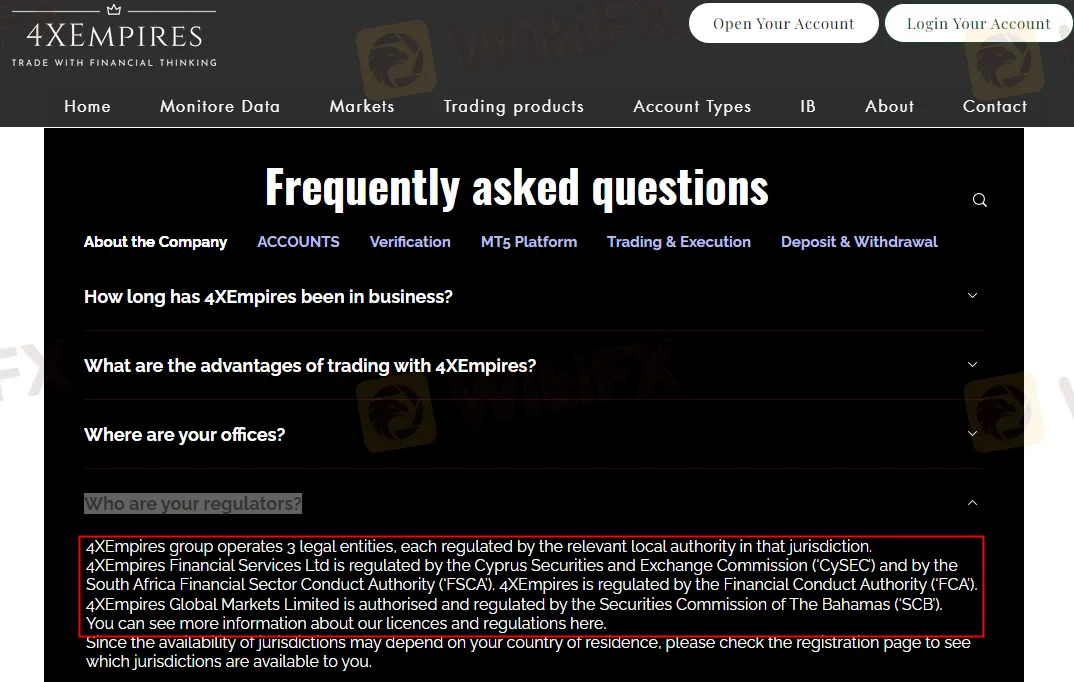

If we go by the information on its home page, then the company is showing that 4XEmpires group operates 3 legal entities, each regulated by the relevant local authority in that jurisdiction:

· 4XEmpires Financial Services Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) and by the South Africa Financial Sector Conduct Authority (FSCA);

· 4XEmpires is regulated by the Financial Conduct Authority (FCA);

· 4XEmpires Global Markets Limited is authorised and regulated by the Securities Commission of The Bahamas (SCB).

But no results matched with 4XEmpires can be found on the four mentioned regulators except an unauthorised record on the FCA. Moreover, UK FCA warned public that 4XEmpires is providing financial services or products in the UK without authorisation.

That means 4XEmpires is actually not regulated by any regulators.

The FCA added 4XEmpires into its Warnings

On June 29 2022, the FCA issued a warning that 4XEmpires has not been authorized to provide financial services or products in the UK.

Leverage up to 1:5000

4XEmpires has main offices in UK, Cyprus & Bahamas. As you can see, 4XEmpires offers four types of forex trading accounts, with leverage ranging between 1:500 and 1:5000. According to the laws and rules of global financial authorities in the three countries, it is impossible for a regulated broker to have such risky levels of leverage.

Based on the above information, we can conclude that 4XEmpires is a scam.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Good News Malaysia: Ready for 5% GDP Growth in 2025!

Malaysia's economy is on track to sustain its robust growth, with GDP expected to exceed 5% in 2025, according to key government officials. The nation's economic resilience is being driven by strong foreign investments and targeted government initiatives designed to mitigate global economic risks.

Oriental Kopi’s IPO: Worth the Buzz or Not?

Kopi Holdings Bhd, a café chain operator under the brand Oriental Kopi, is gearing up for its listing on the ACE Market of Bursa Malaysia. The company has garnered a positive valuation from Mercury Securities Sdn Bhd, which has assigned a fair value of 68 sen per share, citing strong earnings growth potential driven by outlet expansions and increasing contributions from fast-moving consumer goods (FMCG) sales.

Tradu Introduces Tax-Efficient Spread Betting for UK Traders

Tradu’s introduction of tax-efficient spread betting and groundbreaking tools like the Spread Tracker signals a new era of accessible, competitive, and innovative trading solutions for UK investors.

Trading Lessons Inspired by Squid Game

The popular series Squid Game captivated audiences worldwide with its gripping narrative of survival, desperation, and human nature. Beneath the drama lies a wealth of lessons that traders can apply to financial markets. By examining the motivations, behaviours, and strategies displayed in the series, traders can uncover valuable insights to enhance their own approach.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator