简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

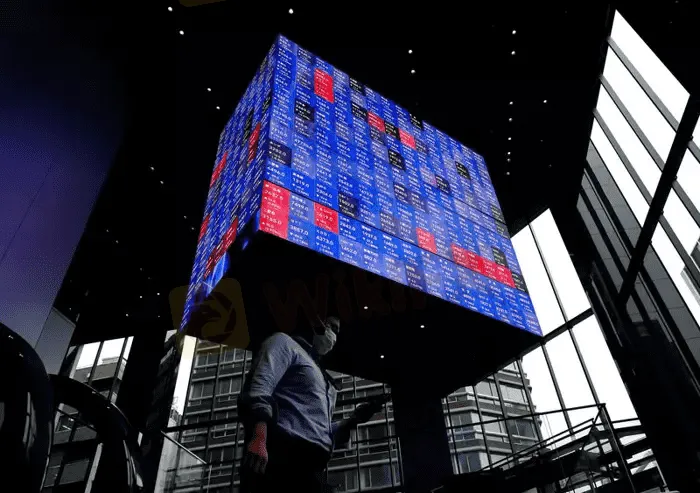

Asian stocks rise on upbeat data, Fed hawks lift dollar

Abstract:Asian stocks rose on Thursday, taking cues from a strong rally on Wall Street after robust economic data and upbeat corporate guidance boosted investor appetite.

The dollar hovered near its highest this week after Federal Reserve officials continued to stress that policy tightening is far from over. However, Treasury yields remained down from two-week highs as investors stayed sidelined ahead of employment data this week that will guide the path of interest rates.

Crude oil prices stabilised after sliding to an almost six-month low overnight as U.S. data showed an unexpected surge in stockpiles.

Japan‘s Nikkei rose 0.58%, while Chinese blue chips added 0.55% and Hong Kong’s Hang Seng jumped 1.24%, with an index of its tech stocks surging 2.29%.

MSCIs broadest index of Asia-Pacific shares gained 0.65%.

U.S. S&P 500 futures were about flat, after the underlying index jumped 1.56% overnight and the tech-heavy Nasdaq surged 2.73% to a three-month peak.

Strong financial results from PayPal lifted the mood, while data showed new orders for U.S.-manufactured goods increased solidly.

Meanwhile, more Fed officials joined the chorus saying more tightening is necessary to rein in inflation.

However, one – San Francisco Fed President Mary Daly – said in an interview with Reuters that a half point hike may be whats needed at the next meeting in September, rather than another 75 basis-point rise.

Fed Chair Jerome Powell said last week the central bank may consider another “unusually large” rate hike at its Sept. 20-21 gathering.

“The view that we have this pivot away from tightening (by the Fed) has been very heavily hammered over the last 48 hours by pretty much everyone and their dog, saying we are still going to be tightening rates pretty aggressively,” said Rob Carnell, Asia-Pacific head of research at ING in Singapore.

“That message hasnt properly percolated through to the equity market, which is looking at what has been a reasonably strong set of earnings numbers and some fairly decent economic data and going this is brilliant, instead of doing what they should be doing and saying this is quite concerning.”

Traders now price 58.5% odds of a 50 basis point increase versus 41.5% probability for the bigger bump, which would see the most aggressive tightening path in more than a generation.

Benchmark long-term U.S. Treasury yields held at around 2.71% in Tokyo trading on Thursday. They rose overnight to the highest since July 22 at 2.851% but then got knocked back to end lower following Dalys comments.

The dollar index, which measures the greenback against six major counterparts, eased 0.11% to 106.36 on Thursday after rising as high as 106.82 in the previous session for the first time in a week.

Against Japans currency, which is extremely sensitive to U.S. yields, the buck retreated 0.24% to 133.51 yen, after reaching 134.55 overnight.

The majority of analysts in a Reuters poll say the dollar has yet to peak.

Crude oil rose in early Asian trade, bouncing off the previous days multi-month lows following data that signalled weak U.S. fuel demand.

Brent crude futures rose 53 cents to $97.31 a barrel while West Texas Intermediate (WTI) crude futures rose 55 cents to $91.21. Both benchmark fell to their weakest closing levels since February on Wednesday, at $96.50 and $90.66, respectively.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

The Cyprus Securities and Exchange Commission (CySEC) has officially withdrawn the Cyprus Investment Firm (CIF) licence of Reliantco Investment Limited, the operator of UFX.com. This decision followed a six-month period during which the company failed to provide any investment services or perform investment activities.

Elon Musk Sparks Debate Over Presidential Power and Federal Reserve Independence

Elon Musk has voiced his support for the controversial idea that United States presidents should have a role in shaping Federal Reserve policies. This endorsement aligns with recent remarks from President-elect Donald Trump, who has hinted at revisiting the central bank's independence, a long-held tradition in the nation's financial governance.

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

Italy's financial regulator, Consob, has raised alarms over an increase in fraudulent schemes targeting investors through mobile messaging platforms such as WhatsApp and Telegram.

Crypto 101: Coins vs Tokens

For those new to the world of cryptocurrency, terms like "coin" and "token" may seem interchangeable. However, understanding the distinction between these two digital assets is crucial for navigating the crypto landscape. Both coins and tokens serve as integral components of blockchain ecosystems, yet they differ in their functionalities, use cases, and the technologies underpinning them.

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Peso Depreciation to 59:$1 Likely Amid Strong Dollar Surge

Currency Calculator