简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

SNB to Stand Firm After Intervention Frenzy to Tame Franc Gains

Abstract:LISTEN TO ARTICLE 2:10 SHARE THIS ARTICLE ShareTweetPostEmail Photographer: Stefan Wermuth/Bloombe

Swiss National Bank President Thomas Jordan has taken his foot off the pedal after the most aggressive currency intervention in five years early in the outbreak of the coronavirus pandemic.

Credit Suisse Group AG calculates Jordan and his colleagues spent more than 90 billion francs ($98 billion) on interventions in the first half of 2020 as the currency rose to a five-year high. But they won something of a reprieve over the summer thanks to the European Unions historic spending package and a rise in the euro. The recession is also proving less deep than initially feared.

“Switzerland is getting out of this crisis rather well,” said Nadia Gharbi, an economist at Pictet & Cie in Geneva. “But I think they will be quite prudent.”

Jordan has admitted the SNB intervened “more strongly” this year, and he has reason to keep the threat of action alive this week.

Britain‘s divorce from the EU single market, the Federal Reserve’s loose monetary policy stance, and the U.S. presidential election in November, all have the potential to stir up trouble for the SNB, whose monetary policy hinges on limiting fallout from an overvalued currency. Also hanging over Switzerland is a U.S. Treasury review that could see the country labeled a currency manipulator.

Along with salvos of interventions, a deposit rate of -0.75% is the SNBs main tool for fending off the threat of deflation caused by the rallying currency. Goldman Sachs Group Inc. and UBS Group AG are among those predicting no change to the rate on Thursday.

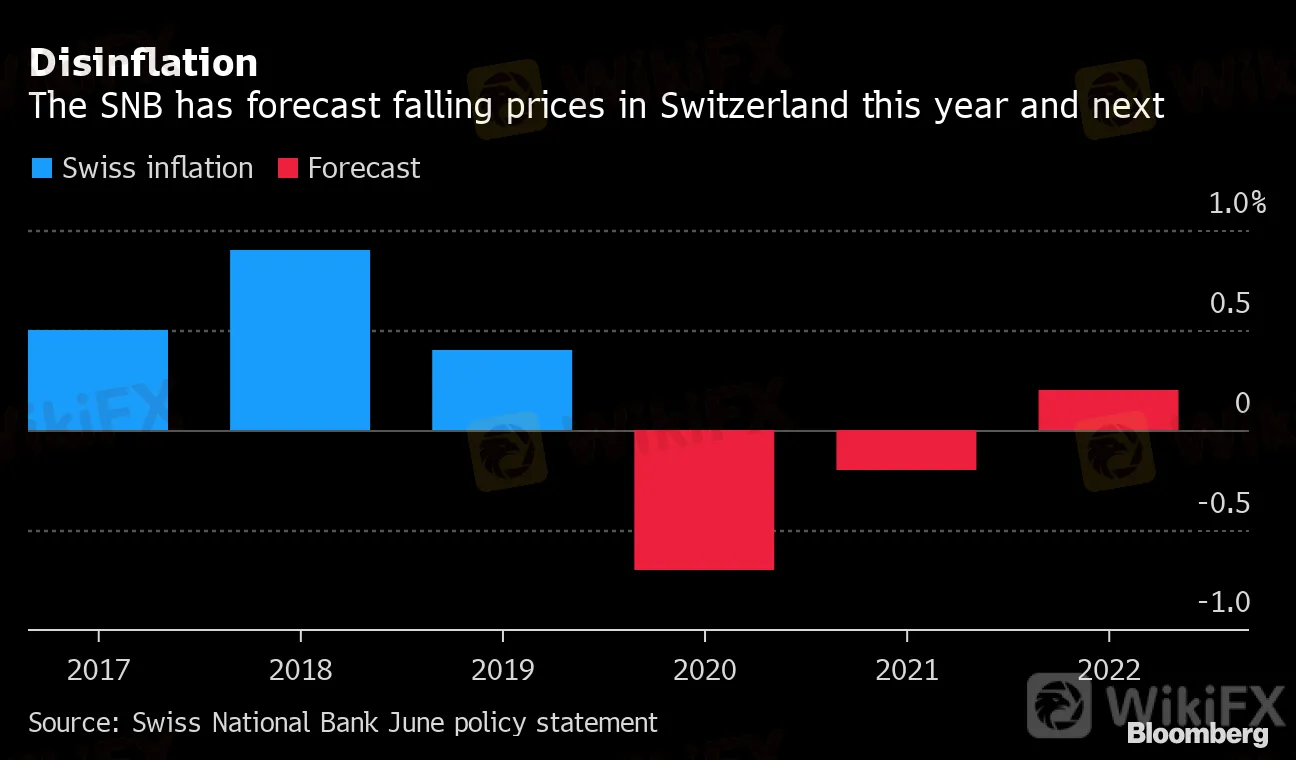

Disinflation

The SNB has forecast falling prices in Switzerland this year and next

Source: Swiss National Bank June policy statement

In June, the SNB predicted Switzerland‘s inflation rate will be negative this year and next, with only modest price growth in 2022. The central bank’s price-stability definition is positive rates of inflation below 2% over the medium term.

With inflation very weak, “the SNB will have to live with a reality that is not satisfactory,” said GianLuigi Mandruzzato, a strategist at EFG Bank in Switzerland. “At best they can try to limit the damage.”

— With assistance by Richard Jones, and Craig Stirling

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator